The Central Bank of Nigeria has for years been trying to bridge the gap between lending and deposit rates. In Nigeria the gap can at times be between 10-14% depending on the bank that you approach. This basically sees depositors been short changed for their hard earned cash. Recently though, Banking in Nigeria has been turned in the head since the Central Bank curtailed Bank’s dependence on public sector funds. This has inadvertently now increased deposit rates as banks are now faced with the pressure of seeking private sector deposits.

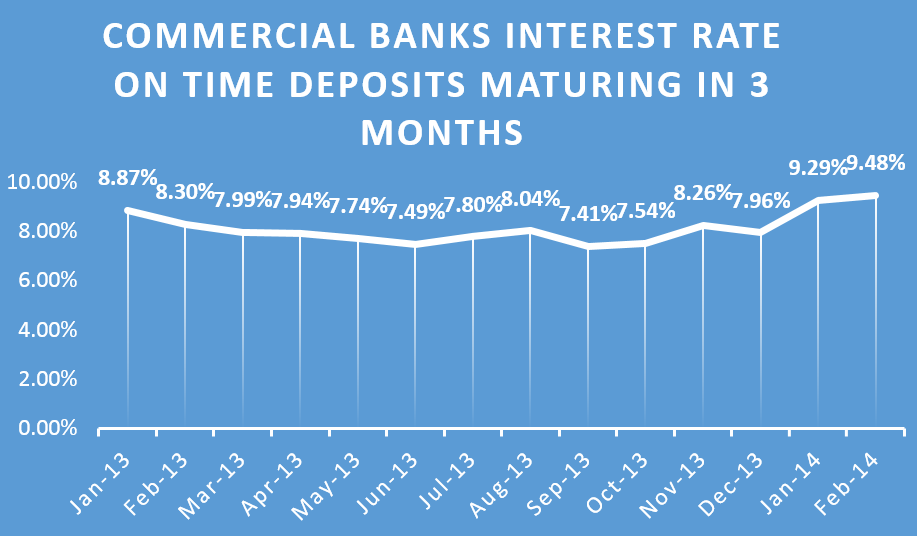

Despite this, they will only pay interest commensurate with the times if you are aware of it. If you have money in the bank and don’t ask for higher interest rates the bank will not feel compelled to increase your rate. So what has interest rate looked like over the last one year. The charts with data from the CBN below tells the story

Savings deposit which is probably the most common was 3.2% as at February 2014. It was 1.7% a year ago, so it has almost double in the last one year alone

Time deposits for 3 months has hovered from 8.8% to 9.48% in February this year (the highest so far)

Time deposits for 6 months was 9.6% for February 2014

Average time deposits for 1 year was abut 9.3% in February 2014

Time deposits over one year was 9.68% in February 2014.

So, where do you stand? Have you been short changed? Remember you can also invest in Treasury Bills should you not like to invest in banks. But if you are the type who require free floats and quick access to your money, it is not a bad idea taking advantage of these yields.

Note: ...all rates are per annum and are averages for the banking sector