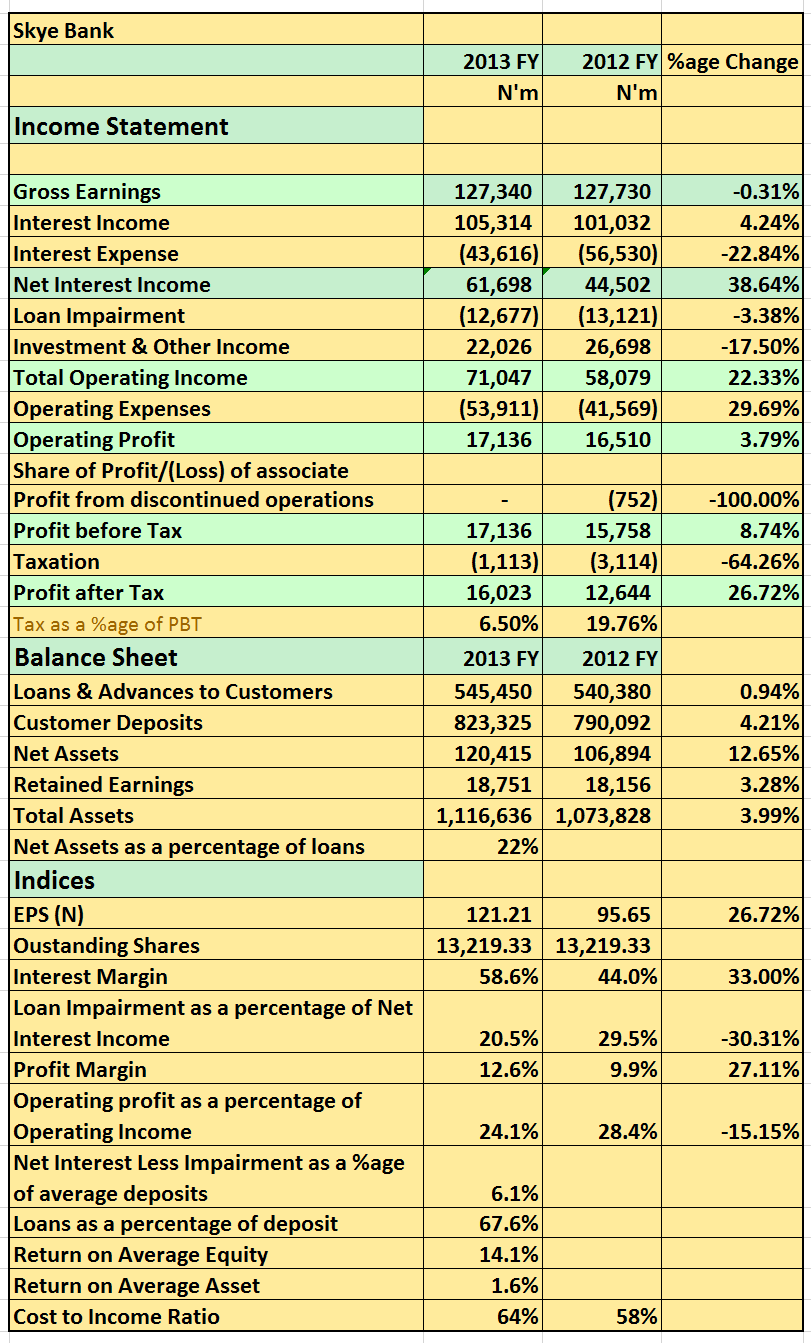

Skye Bank PCL released its 2013 FY results showing Gross Earnings of N127billion a 0.3% drop from the year before. Other details are as follows;

- Net Interest Income increased 38% to N61.6billion (2012: N44.5billion). This was helped by a 22% drop in Interest expense YoY

- Loan loss remained high at N12billion

- Operating income rose 22% to N71billion

- Operating profit rose 3.8% to N17billion (2012: N16.5billion

- Operating expenses remained high at N54billion and an estimated 64% in Cost to Income ratio.

- Profit after tax rose 26.7% to N16billion (2012: N12.6billion)

- Customer deposits increased 4% to N823billion

- Loans and advances was flat t N545billion(2012: N540billion) Loan to deposit ratio was 67.6%

- Return on Average Equity for the year was 14.1% compared to 12.2% a year earlier.

- They proposed a dividend of 30kobo per share

Very Good One.