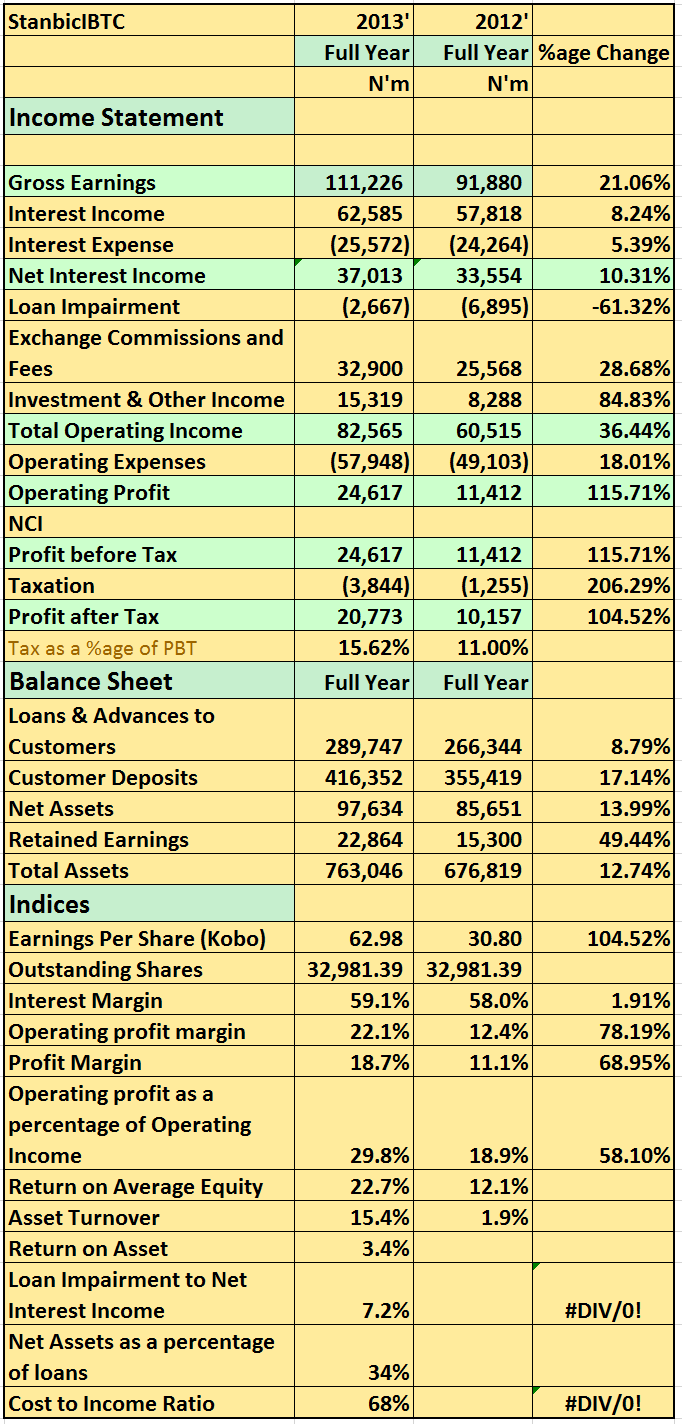

Stanbic IBTC released its 2013 FY results showing a Gross earnings of N111.2billion representing a 21% increase from the N91.8billion posted a year earlier. See highlights

- Net interest income increased 10.3% to N37billion (2012: N33billion)

- Operating income rose 36% to N82.5billion (2012: N60.5billion)

- Increase in operating income was helped by 38% increase in commission and fees to N33billion as well as an 84% increase in Other income to N15.3billion

- Operating profit rose 115% to N24.6billion (2012: N11.4billion).

- Increase in operating profit was helped by a moderation in operating expenses which grew by just 185 YoY. Operating profit as a percentage of operating income was 70% compared to 81% a year earlier.

- Profit after tax at the end of the period was N20.7billion a 104% increase from the N10billion posted in 2012.

- Return on average equity at the end of the period 22% compared to 12% in 2012

- They proposed a dividend of 10kobo per share with register closing 17 April 2014

- This is one of the highest increase in profit after tax this year