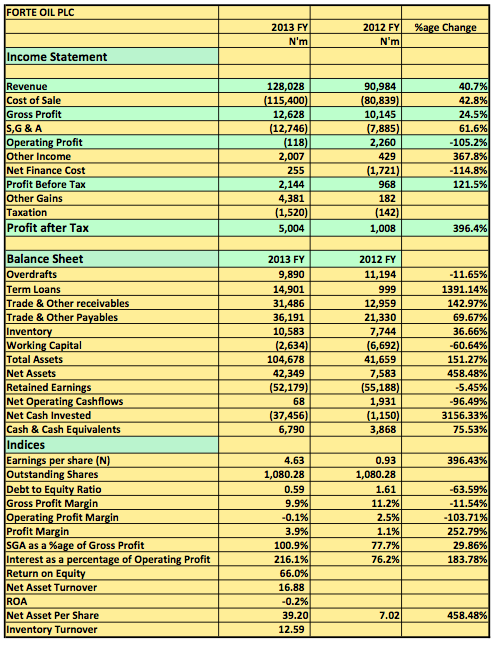

Forte Oil Plc released its 2013 FY results last week becoming the first to do so in 2014. The results showed a 41% rise in revenue from N98.9billion to N128billion. Gross Profit rose 24.5% from N10billion to N12.6billion year on year. Profit after tax at the end of the period was N5billion a 396% increase from the N1billion posted a year earlier. But does this mean the result was actually good or is there more to it than meets the eyes? Lets see.

Key Highlights & Talking points

- As mentioned revenue rose by about 41% which is fantastic by any standards. However, the rise will only be justified by the expenses incurred during the period.

- Forte Oil attributed the rise in revenues to “the significant increase recorded in the sales of its fuel products segment, comprising Premium Motor Spirit (PMS), Automotive Gas Oil (AGO), Aviation Turbine Kerosene (ATK); as well as Production Chemicals; Lubricants and Greases. The newly acquired Power Plant also contributed significantly to the revenue stream”.

- That surely is a vague statement and doesn’t really provide us any reliable detail

- Cost of sales rose 43% YoY eating deep into revenues. Gross Profit margin therefore dropped 11% YoY to 9.9%. This shows that despite the high revenue growth, the company spent N90 of every N100 it earned in revenue on direct cost. Last year it was about N88 for every N100.

- The oil industry is a low margin industry as such Gross Margins will typically average 11-12% annually.

- Operating expenses is perhaps the best way of measuring how efficient Forte Oil was during the year. It incurred expenses of N12.7billion during the period a 61% rise YoY.

- This basically ensured the company posted an adjusted operating loss of N118million during the period. Is this bad? I like to use adjusted operating profit most times as it demonstrates a company’s ability to generate organic earnings. Whilst other income and gains are also a good measure they are not as consistent as operating profit.

- Since Forte Oil posted N5billion in PAT despite posting an operating loss it is easy to notice the bulk of the profits were made from other sources. In this result, we observe Other Income, Net Finance Income and other Gains and losses all posted N2billion, N255million and N4.3billion respectively.

- In fact, the N4.3billion made from other gains was earned in the last three months of the year alone. Take that out and the profit after tax would have been just about N1billion.

- The company gave no precise explanation of what the N4.3billion was made of in its press release. However, it did mention that “the newly acquired Power Plant also contributed significantly to the revenue stream. The group’s profitability was enhanced by interest income earned on bank deposits, following the implementation of efficient cash management strategies”. I believe the annual report when released will give us a better insight.

- The operating loss further buttresses the need to continue to diversify its operations which is the basis for the branch out into power and possibly the upstream sector. They have started doing that but be rest assured that this may at the end of the day involve more debt as well as equity (thus diluting earnings further).

- It did fund the acquisition of the 414MW power station of worth $132million via debt and equity (with minority interest of N28.9billion) but expect the company to continue to raise more funds to fund more capes in the nearest future.

- Finally, Forte Oil closed 2013 as the best performing stock for the year in terms of Capital Appreciation after rising more than 900%. This is an abnormal rise as nothing in this result and even in future suggest it is justified. Agreed the company’s acquisition of Geregu Power plant does give it some impetus but I do not believe its enough to justified such price hike

- Forte Oil also comments that it is their ‘firm belief in our vision of being Nigeria’s integrated energy solutions provider can be seen in the strategic acquisition of retail assets to consolidate market position and grow profitably through increased revenue, enhanced superior customer delivery and cost leadership. This is our short-term focus. Our short-medium term focus of planned expansion into the Upstream Oil & Gas sectors through participation in Government bids rounds and acquisition of marginal fields from IOCs, remains on track”.

- Forte Oil is currently not included in Ugometrics Portfolio and we do not plan to for now.

Other Issues of note

- Cash flow from operations dropped 96% from N1.9billion to N68million an indication that the company may have funded much of its operations via debt or its cash reserves

- Net working capital was negative at N2.6billion

- The company’s capital reorganisation helped it wipe out its negative retained earning of about N55billion to N5.7billion setting it off against share premium. This ensures they can now pay dividend

- Return on Equity was 66% up from 16% the year earlier

Forte Oil released its 2013 FY Results in the website of the NSE