Financial Year 2013 is gradually coming to an end and investors will soon begin to take stock of what has become a truly remarkable year. The Nigerian Stock Market All Share Index is primed to close at above 38,000 at the very least with a projected gain of between 35%-37%.

According to the NSE a total of 83 companies paid dividends this year out of the 188 listed on the Main Board. And out of the 83 that paid dividends only 6 paid bonus shares to shareholders. Lets look at the 6 companies;

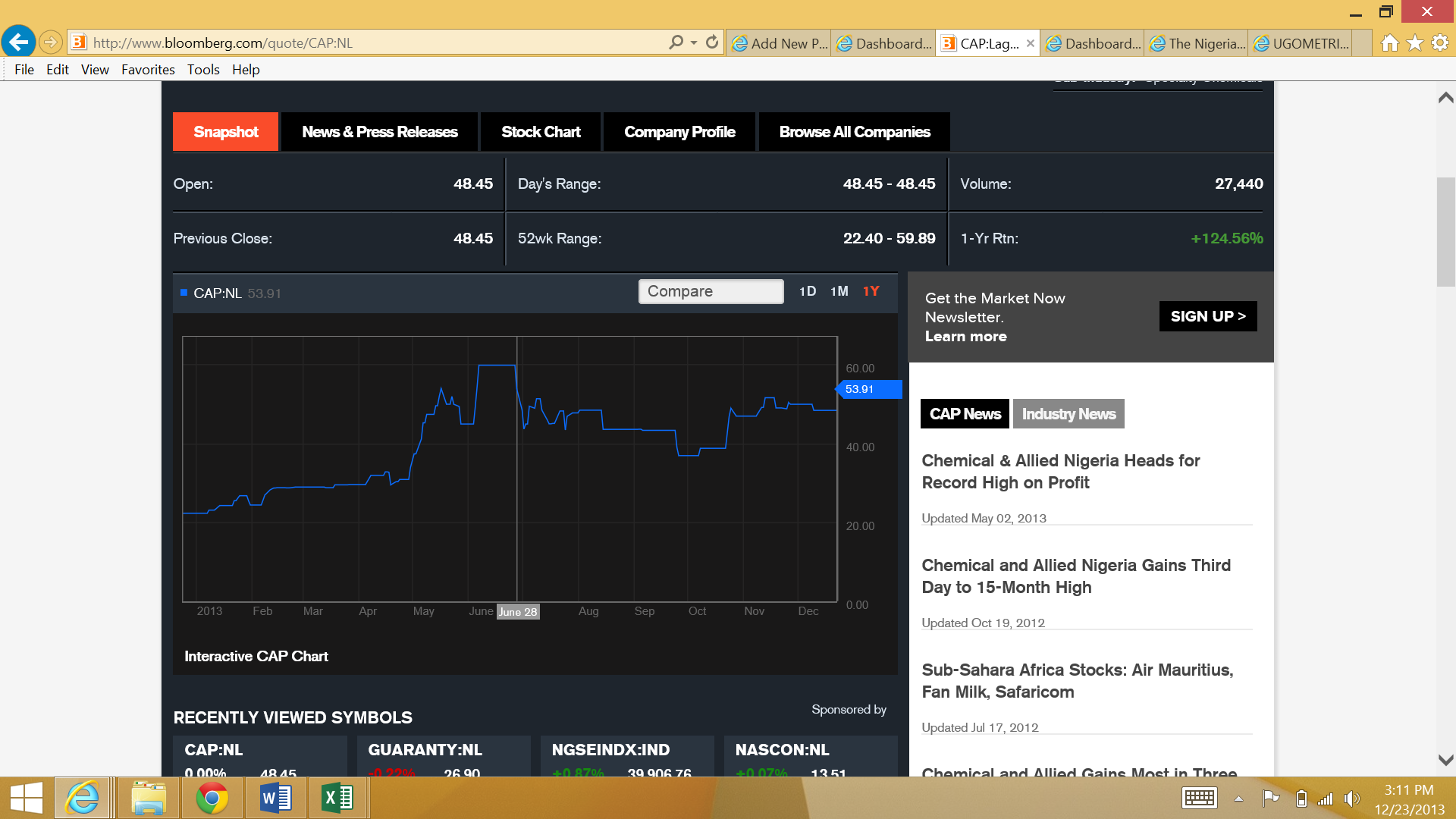

CAP PLC

CAP PLC is major paint provider and deals as the major franchise seller of the famous Dulux Paints. The company at the end of the December 2012 FY posted a Profit after Tax of N1.1billion. It went on to declare dividends of 70kobo per share and a bonus share of 1 for every 4 per share. The Company’s shares has also risen 124% per share year to date. It opened the year at N22.40 and is currently worth N48.45. It also reached a year high N59.89 this year coinciding with the closure date for Bonus shares of June 24 2013. CAP PLC is currently not in our Portfolio.

COURTEVILLE PLC

Courteville Plc is a business development solutions company. The Company provides financial management and advisory services, business solutions, e-commerce, and online marketing solutions. They are also the operators of the famous Auto Reg Car Registration Solution in Lagos. The company posted a profit after tax increase of 26% to N309million for the year ended December 2012. It consequently declared dividends of 5kobo per share and a bonus of 1 for every 5. The share price has risen 75% YTD having opened the year at 42kobo. It got to a year high of 90kobo back in August and just before the payment date. This year the company’s interim 9 months result showed a 13.6% increase to N268million. Courteville Plc is included in Ugometrics Portfolio.

FCMB

FCMB Plc is a leading commercial bank in Nigeria and at the end of 2012 concluded its restructuring and consolidation of its banking and financial services acquisitions. The company in its 2012 FY posted a Profit after Tax of N15billion after posting a loss of N9.2billion in the prior year. The company subsequently paid bonus shares of 1 for 25 but paid no dividends. This year, the company already reported a pre-tax profit of N12.7billion in its September 2013 Interim Results. FCMB share price has risen 2.75% this year which by the way is a reflection of banking stocks in general. Its year high was N5.12 but has since crashed to N3.30 as at the time of writing this article. FCMB is not in our Portfolio.

INTERNATIONAL BREWERIES

This company has had a stellar year and has basically lead the brewery sector in terms of performance and share price appreciation. It closed its financial year (15 months) to April 2013 with a profit of N2.5billion reversing losses of about N1.6billion recorded in the prior period. It then proceeded with a 25kobo per share and a bonus issue of 1 for every 85 shares held. The share price has risen sharply this year growing at a YTD 86%. It approached a year high of N31 just a few days ago and has hovered between N16.4 and N31 all year long. The company in its Interim Half year Months result posted a 21% increase in pre-tax profit of N1.6billion. International Breweries is currently not in our Portfolio.

OKOMU OIL PALM

Okomu Oil Palm is a leading Oil Palm producing company in Nigeria. It has had a rather uneven year. In the FY end result for 2012 released this year it posted a PAT of N3.5billion an 8.5% drop from what was posted a year earlier. This however did not stop the company from declaring a dividend of N7 per share in addition to a bonus issue of 1 share for every share held. The company’s share price has risen 140% this year and rose to a year high of N55.4 haven opened the year at N21.25. The company’s interim 9 months result indicates a pre-tax profit drop of 67% to N1.6billion. Its revenues has basically dropped in all three quarters this year compared to last year. Okomu Oil Palm is currently not in our portfolio.

UAC NIGERIA PLC

UACN Plc is a leading conglomerate and has been in existence for decades and counting. The company in its 2012 Annual result released this year posted a 109% increase in PAT to N7.1billion. The company subsequently proposed a dividend payout equal to N1.6 per share and a bonus issue of 1 for every 5 shares owned. This bumper payout helped its share price appreciate 93% YTD hitting a year high of N70 back in early November. The share price has a 52 week range of between N35 – N70. Looking forward the company in its 9 months interim results posted a 47% increase in pre-tax profits to N8.6billion already surpassing its 2012 Full year result.