Thisday Reports;

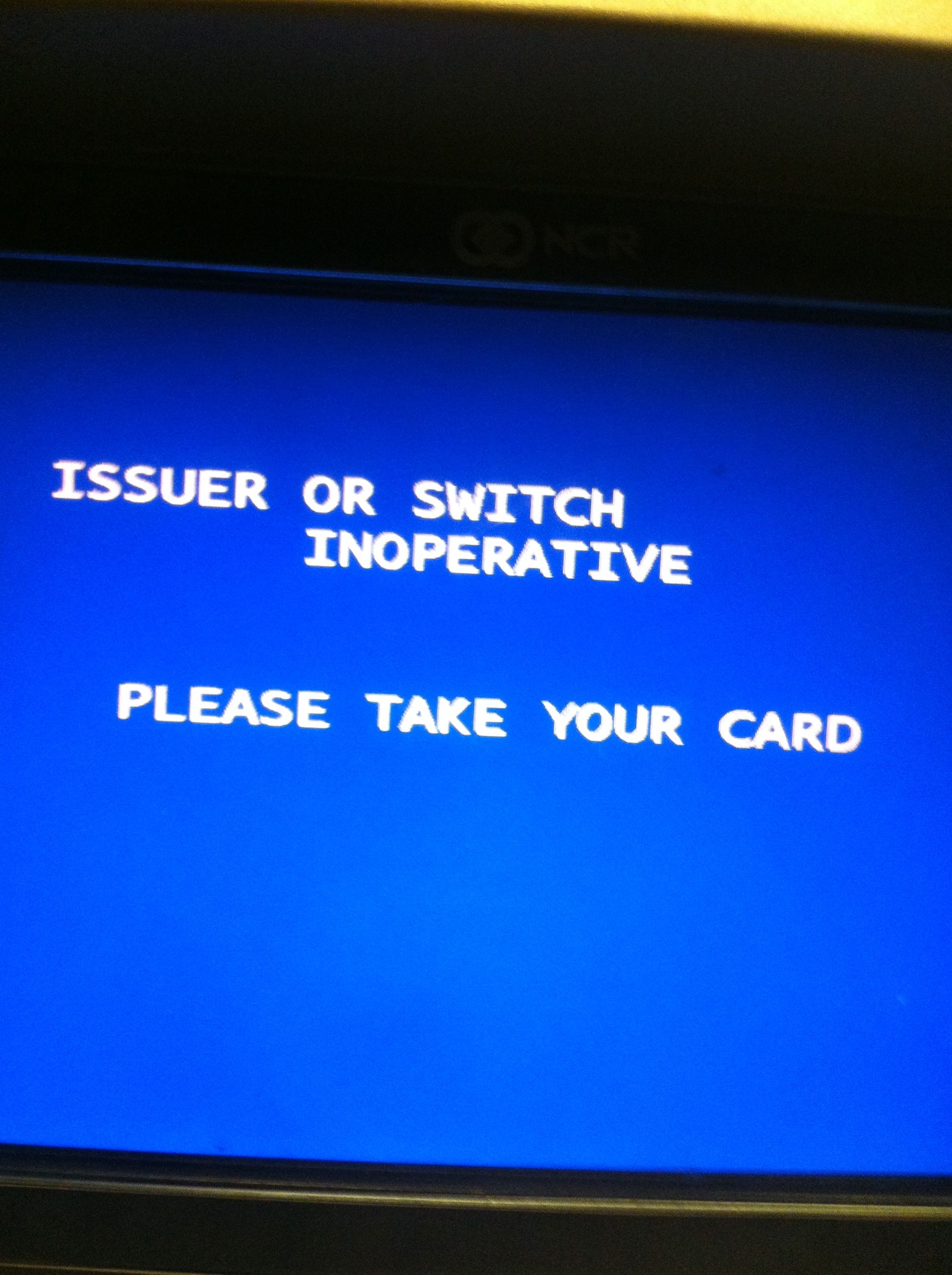

A recent system failure at the Nigerian Interbank Settlement System (NIBSS) is said to have disrupted the operations of Stanbic IBTC Plc’s Automated Teller Machines (ATMs), THISDAY has learnt.

Investigations revealed that the glitch occurred when its customers who had withdrawn money from the bank’s ATMS got credit notices or alerts instead of getting debit alerts.

When some of the customers noticed the defective credit notices, they took advantage of the system error and embarked on a withdrawal spree as word spread that Stanbic IBTC ATMs were dispensing cash without customers’ accounts being debited.

But by the time some honest customers, who also encountered the same problem informed the bank, the defective credit alerts had ramped up to the tune of N100 million.

“However, NIBSS would have to cover the losses for those customers whose account balances were insufficient to cover the illicit withdrawals they had made.”

He explained that what effectively happened was that those whose accounts have been debited simply spent their own money.

“They constituted the majority of those who tried to pull a fast one on the bank,” he said, adding, “While NIBSS would have to cough up the money for those with insufficient balances in their accounts.”

But the source revealed that it wasn’t only Stanbic IBTC that was affected by the system fault, saying Guaranty Trust Bank (GTBank) and one or two other banks had similar problems, but Stanbic IBTC was the worst hit.

The NIBSS operates the Nigeria Automated Clearing System (NACS), which facilitates the electronic clearing of cheques and other instruments, electronic funds transfer, automated direct credits and automated direct debits.

Source: Thisday