Diamond Bank 2013 9 Months Snapshot ↑

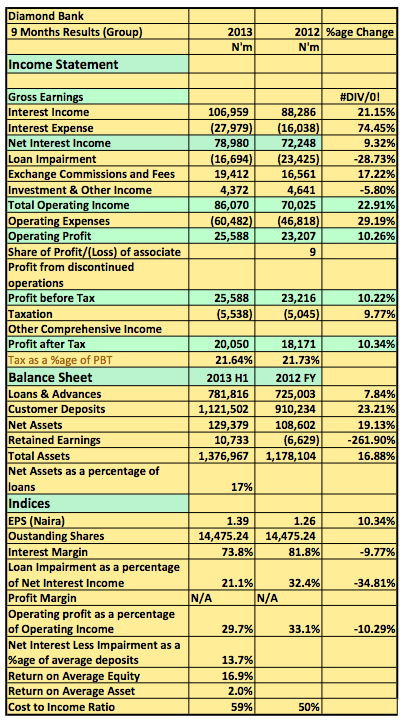

Diamond Bank Plc released its 2013 9 Months unaudited results showing a 9.3% rise in Net income to N78.9billion (2012 9 Months: N72.2billion). Income from commission on fees also rose YoY to N19.4billion whilst investment income also contributed another N4.3billion. The bank posted an operating income of N86billion 23% higher than the N70billion it posted a year earlier. Pre-tax profits also rose 10% YoY to N25.5billion despite a surge on operating expenses.[upme_private]

QoQ

Key Highlights

- Diamond Bank has clearly taken the lead in lending to Small Business as well as middle class individuals. This is a bold and risky model and it appears the aggressive move is beginning to hurt revenue.

- Interest Margin was indeed high at 73.8% and has basically been within that region all three quarters so far. That is a territory for the big 3 and as such is quite commendable. In fact, Net Interest Income less write offs as a percentage of loans of 14% is yield hard to beat in the industry. However that is not all;

- Adjust for write offs and the margins come down to earth. A loan loss of N16.6billion YTD is about 21% of Net Interest Income for the period. Compare that to GTB and Zenith at 2.6% and 4.3% respectively and you realise the price they pay for such yields. Diamond Bank is thus loosing N21 for every N100 of interest income it earns.

- Bad loans leading to write offs are a banks Achilles heel especially those looking at lending aggressively. At this rate I won’t be surprised if the bank beats last years write off by at least 20%. Last year it wrote of about N17billion and now with three months to go, N16billion has been written off.

- Despite these fears, so far the bank continues to churn in revenues some won’t mind. After all commission and fees has beaten last year’s performance at every periodic comparison. Keep that up and maybe, just maybe the bank will surprise shareholders.

- Deposits has also risen 23% YoY helping the bank cross the N1trillion mark this year.

- We have Diamond Bank in our Portfolio but quite frankly it isn’t one of our favourites. In hindsight a hold may have been a better option just as it is for now.

Diamond Bank Plc released its 2013 9 Months Unaudited results in the website of the NSE[/upme_private]