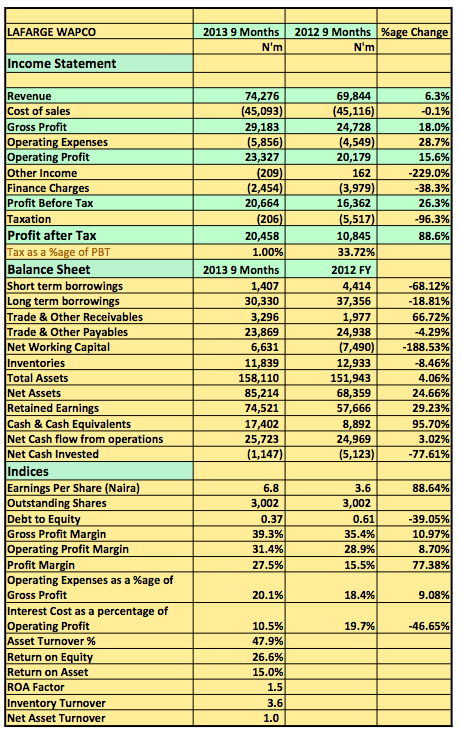

9 Months Result Snapshot→

Lafarge Wapco released its 2013 Earnings report for the first 9 months of the financial year showing a 6% rise in revenues to N74.2billion (2012 9 Months: 70billion). Gross profit rose YoY to N29billion as the company was able to keep cost of sale steady while growing revenue. Pr-tax profits at the end of the period was N20.6billion a 26% increase compared to the prior period.

QoQ[upme_private]

Key Highlights

- The revenue rise of 6% this period compared to the last follows a similar trend for H1 and Q1. The company must be feeling the angst of competition

- Margins did fair better this period compared to the prior year helping reduce the effect of tepid revenue growth.

- It is important to note though that deducing from the Gross Profit Margins, Wapco increased its Markup by 10% this year compared to last. Markup on cost of sale was 64% this period compared to 54% in the prior year (Dangote Cement did have a markup of about 200% for H1 2013)

- Digging further, the largest increase in markup was in Q1 (75%) this year followed by a slight drop in Q2 (55%) and a further increase in Q3 (65%) respectively. Indicating an unsteady pricing of their products during the period

- Lafarge continued to reduce its external loans this quarter as well shedding a further N5billion this quarter. It has now repaid about N10billion in external loans this year alone.

- This has off-course brought down interest cost as a percentage of operational profit from 19.7% to about 10.5%

- It is important to also not a huge reduction in taxes compared to the prior year. The company obtained N1.9billion and N985million in tax reduction during the 1st and 3rd quarter respectively. This may be as a result of some tax breaks or usage of deferred tax assets.

- Wapco was priced at N98.5 (25/10) and has a P.E ratio of about 20x. Its Price to book ratio is about 4.3x.

Lafarge Wapco released its 2013 9 Months results in the website of the NSE[/upme_private]