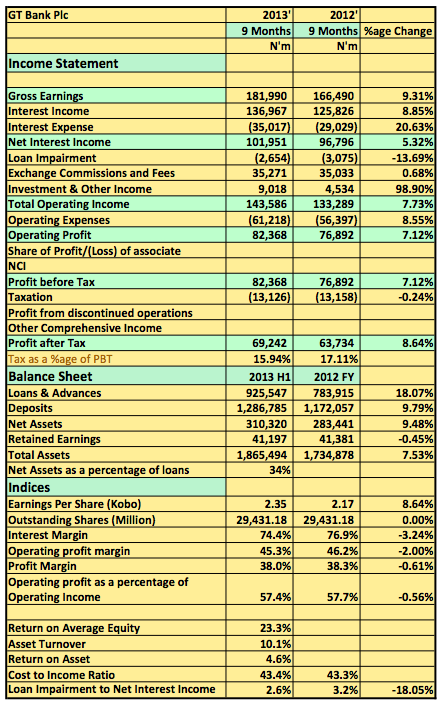

GTB released its 2013 9 months results showing Net Interest Income grew 8% YoY to N136.9billion (2012 9 Months: N125.8billion). Net Interest Income also rose 5.32% to N101.9billion. Pre-tax profits rose 7.12% to N82.3billion (2012 9months: N76.8billion).

Quarter on Quarter [upme_private]

Key Highlights

- The 3rd quarter reveals a very challenging period for the company. Interest income, commission on fees all dropped in comparison with the prior quarters.

- The lower revenues may not be unconnected with the new CBN guidelines restricting bank deposits as well as reduction in commissions on deposits

- Cost to Income Ratio this quarter also rose 45%, the highest this financial year

- The Bank still remains strong and a sure bet for increased profitability in the coming years.

GT Bank released its 2013 9 Months result in the website of the NSE[/upme_private]