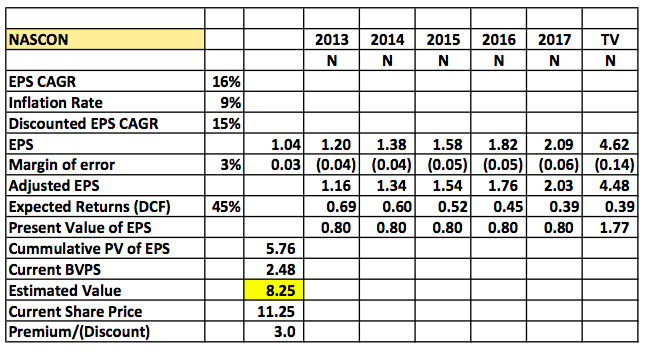

My recent valuation for Nascon drew some comments on a popular Stock Market forum. The comments drew my attention to the difference in “valuation” now compared to what I envisaged a few months back when I had NASCON as a stock on my radar. I tried to explain the concept and difference between valuation and price. Valuation is basically what you think something is worth and price what you are willing to pay for something. Despite their relationship they quite represent different things.

It is also important to check assumptions used during valuations, rather than just looking at the value arrived at. Since equity valuations are basically a guessing game (no matter the level of sophistication in technique used) it is very very important to look at the assumptions used at all times. To demonstrate how assumptions can drastically influence valuations I have done a remake of my valuation for Nascon Plc changing some of my assumptions.

Assumptions

- I used a CAGR of 16% to match the current Growth rate of the company for the last 5 years instead of the 8% I used earlier

- I also discounted the EPS of the company with a factor of 45% matching the company’s trailing ROE.

- I maintained the same current share price I used before

Valuation Result

Compare to prior Valuation

Also find attached the NASCON Valuation Spreadsheet I used so you can input your own assumptions accordingly.