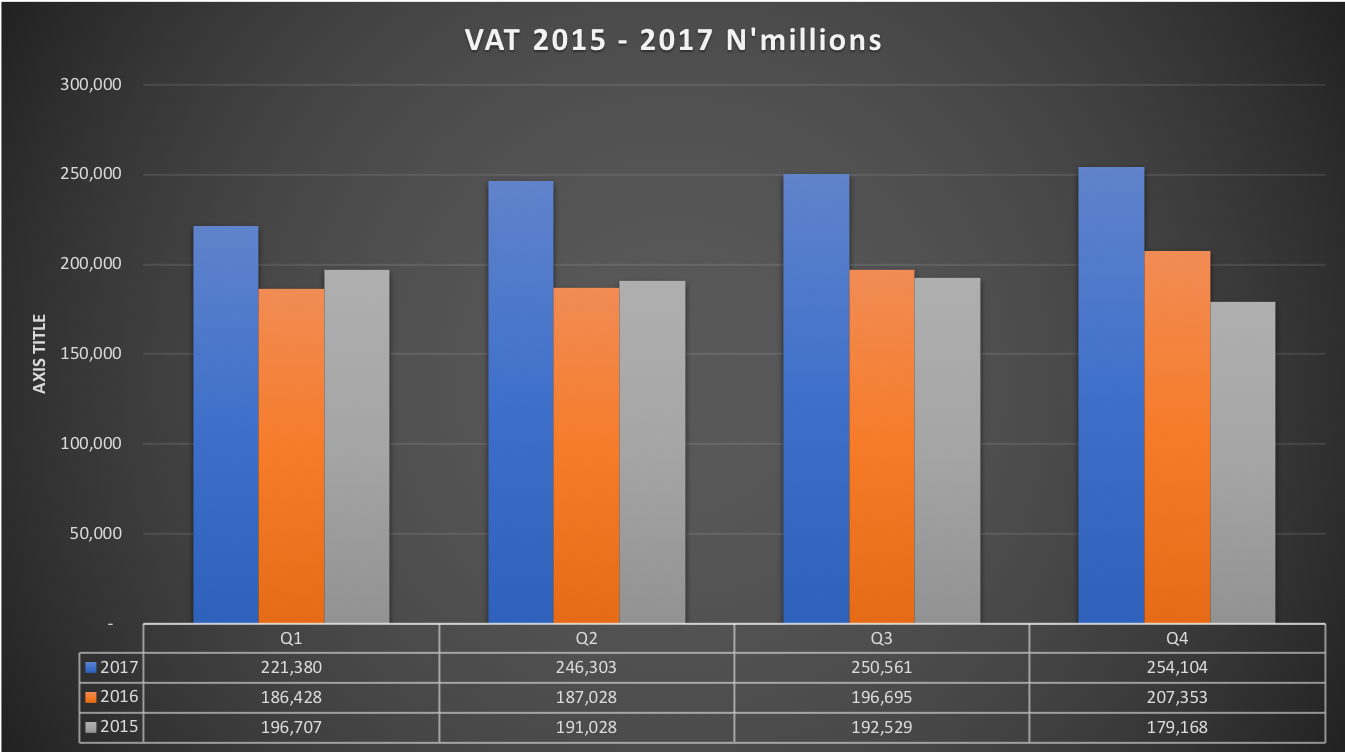

Data from the National Bureau of Statistics reveals that Nigeria collected a total of N972 billion in Value Added Tax for the year ended December 2017.

This is 25% higher than the N777.5 billion collected in 2016. Nigeria collected N759.4 billion in VAT in 2015.

The Federal Inland Revenue, headed by Babatunde Fowler, is the agency entrusted with collecting VAT in Nigeria.

Cursory Interpretation

- At N972 billion, this implies that total value of goods and services sold in Nigeria was at least N19.4 trillion. 5% of N19.4 trillion is about N972 billion.

- This is because VAT is a tax on total value of Vatable goods and services supplied in the country.

- VAT is basically a tax on the increase in value of a product or service at each stage of production or distribution.

- Whilst it does not represent the total value of goods and services sold in Nigeria, it provides a proxy to just how large the economy is.

- A N19.4 trillion value of goods sold is still a paltry 16.8% of Nigeria\’s N119 trillion GDP as at 2017.