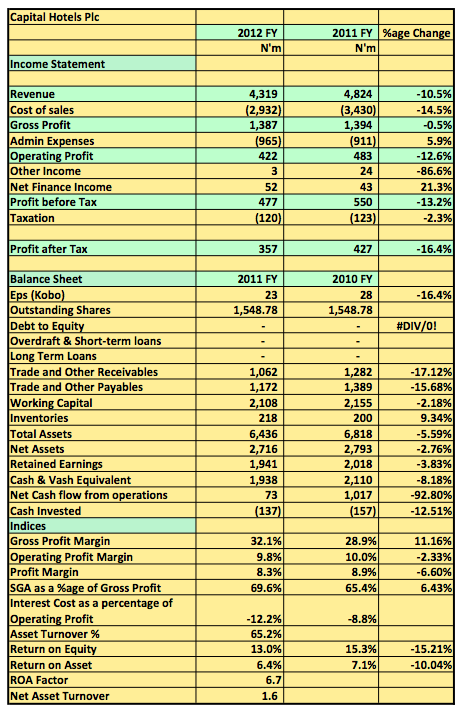

Capital Hotel Plc released its 2013 Earnings with Revenues dropping 10.5% to N4.3billion (2012 FY: N4.8billion). Gross Profit was N1.38billion during the period not much different from the N1.39billion posted a year earlier. The company posted a pre-tax profit of N477million 13% drop from the N483million posted a year earlier. Profit after tax at the end of the period was N357million (2012 FY: N527million).

Key Highlights

- Capital Hotels is a member of the Ikeja Hotel Group and has Sheraton Hotel Abuja as its main operating asset.

- The 10.5% drop in revenue is probably a reflection of the January 2012 strikes as well as the flurry of holidays that marked 2012.

- The drop in cost of sales in my opinion is a reflection of a drop in food & beverages as well as other office and general surprises. About N3.3billion was added as purchases in 2012 compared to about N3.8billion (or even more) in 2011.

- The interesting aspect of this result is the break down of the revenue. Rooms revenue was N2,289 (53%) out of the N4.3billion total revenues. Gross Profit margin for revenues was 80% (cost of sale N466.3million). Contrast this to F&B and other revenues of N2.02billion with Gross Profit margin negative 21.4% (cost of sales N2.46billion). 2011 was 81.5% Room Revenue margin and F&B revenue margin negative 31.6%.

- Operating expenses was just 6% higher at N965million.

- The company has no debt. However, of worry is the N2billion it owes in Employee Compensation. Whilst that is not due now it is still payments that will be made someday.

- Their benefit plans is also quite interesting. Employees who have worked below 15 yrs get to leave with 300weeks of their Gross annual earnings whilst those that have worked for over 15 years leave with 357 weeks of annual gross earnings.

- I agree they have N1.9billion in cash which is by all mens an impressive pile. In fact its Net Assets Per Share is about N1.7 and Net Cash per share about N1.2 not too far off. The company keeps N1.7billion of its cash in time deposits (2011: N1billion)

- The company has intercompany receivables of N1.1billion from Ikeja Hotels Plc (Sheraton Ikeja). It in fact is funding the operations of the moribund hotel.

- The company also has a management agreement with CH Hospitality and Tourism Ltd. They currently pay CH 5% of Revenue as management fee. This is typical in Hotel industry and is often called Asset Management Fees. The managers typically need an asset management company to handle secretarial and other support services for the operators.This can include treasury, public sector, project financing, procurement, corporate affairs etc. But at 5% of Revenue?? This cost them N220.3million in 2012 (2011: N245.2million). This also doesn’t add up if you calculate based on 5% of Gross Annual Revenues.

- They also have operating contract with Sheraton which is about 2.5% of “Gross operating Revenue” and an incentive fee of “Adjusted Gross Operating Profit” of 2.5%. This cost N27.4million and N35.1million in 2012 and 2011 respectively. This figure hardly adds up to though leaving me to doubt its accuracy.

- Despite an impressive balance sheet shareholders should be worried about the paltry profit margin the company is declaring. I don’t understand how a hotel can be making a loss in it’s F&B division. Its 575 rooms provides a revenue per available room (rev par) of just N10.9k (2011: N12.3k) which by all means is terribly low for a hotel of this calibre. It ought to be selling its rooms at a better rate. And if competition is the problem it had better then reduce cost of sales by at least 50% boosting Gross Profit Margin to about 65%. In fact operating profit margin had to be around 35% at least.

- Share price remained at N4.59 as it has been since April 2013

- Dividend proposed was about 7kobo per share.

Capital Hotels Plc released its 2012 FY results in the website of the NSE