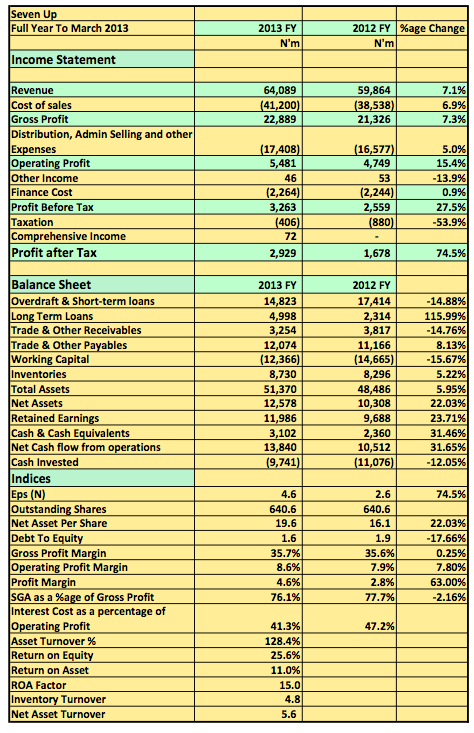

[upme_private]Seven Up Plc released its 2013 to March full year Audited results showing revenue rose 7% to N64billion (2012 FY: N59.8billion). Gross profit also rose 7.3% to N22.8billion in the period under review (2012 FY: N21.2billion). Operating profit also rose 15.4% to N5.4billion (2012 FY: N4.7billion) during the period. Profit after tax at the end of the period was N2.9billion, 75% higher than the N1.6billion it posted a year earlier. Earnings per share at the end of the period was N4.6

Key Highlights

- Revenue Growth of 7% this year is about the biggest drop since 2008 ( based on available Data) and also the first time it has post a single digit growth. 2012/2011 was a 17% growth whilst 2011/2010 was 24%.

- It appears the company is facing a huge decline in sales due to intense competition in the beverage sector. Their reliance on Footballers and Music stars for promotion of their Pepsi brand has also not yielded much impact based on this results.

- Revenue Growth for the first quarter of 2013/2014 Financial year was however 15%. Whether that growth will persist till the end of the year will depend on how they are able to improve market share

- In terms of efficiency 7up faired quite well considering its size. Gross profit margin rose slightly by 0.25% as the company spent N65.3 for every N100 of revenue it made on cost of sales. It was N65.4 in the prior year. The biggest gain was in operating expenses where it saved 2.1%. For example, S,G&A cost N76.1 for every N100 of Gross Profits compared to N77.7 in the prior year.

- The result is an improvement in profit margin compared the prior year. 2013 Profit margin was 4.6% (2012: 2.8%) even though a better indication of the impact on improved efficiency may be pre-tax profits.

- The company still operates with huge debts which is about 1.6x its Net Assets (2012: 1.9x). Its debt profile however remain unchanged from last year at about N19billion

- N6.8billion of its total Debt is owed to Zenith Bank with another N7.4billion owed to Standard Chartered. Zenith Bank carries a rate of 13-15% while Standard Chartered is 4% plus 90days Libor. Both buttress the average interest rate of 11% mentioned below.

- 7up posted about N13.8billion in operating cash flows during the period and N13.7billion in Ebitda. One then wonders why they refuse to reduce their current debt balances choosing instead to continue to acquire PP%E (N9.7billion in 2013 and N11billion in 2012). N5.4billion of additional PP&E is still under construction with N2.5billion in Plant and Machinery and N2.6billion in Land and Buildings.

- At an interest cost of N2.2billion the company pays an average interest rate of 11% during the year. Interest was also 41% of operating cost.

- 7up also has a negative working capital of N12.3billion mostly due to Trade payables of N12billion.

- 7up is also exposed to an Intercompany receivable of about N2.1billion out of the total Trade receivable of N3.2billion. N1.1billion of the intercompany receivable from its subsidiary Green Eagle Cork and Seal for the manufacture of Corks, Seal and Crates. The subsidiary is also expected to sell corks to other beverage making companies but relies heavily on 7up for working capital. N971million is also due from Sunglass its glass manufacturing subsidiary under similar circumstances as that of Green Eagle

- Despite all the challenges particularly with revenues 7up still post Return on Equity of 25.6% which ranks high amongst quoted companies. Net Asset per share was also N19.6

- 7up share price is N74.2 representing a 3.7x multiple on Book value per share. P.E ratio is about 16x. The current price hardly justify its value considering the inherent weakness the company has in terms of stifling competition. On a flip side one could make a case for an even higher valuation based on its Ebitda of N13.7billion. 5x that is about N68.5b N21billion higher than current market cap. Important to note the company incurred a whopping N7.2billion on depreciation in 2013Fy alone (2012: N5.8billion).

- The company recommended a N2.2 dividend per share which at this price represents a yield of about 2.9% much lower than industry average of 5%. However, share price is up 85% over the last on year.

- We hope to do a BSH on this company very soon

Seven Up Plc released its 2013 to March FY results in the website of the NSE[/upme_private]