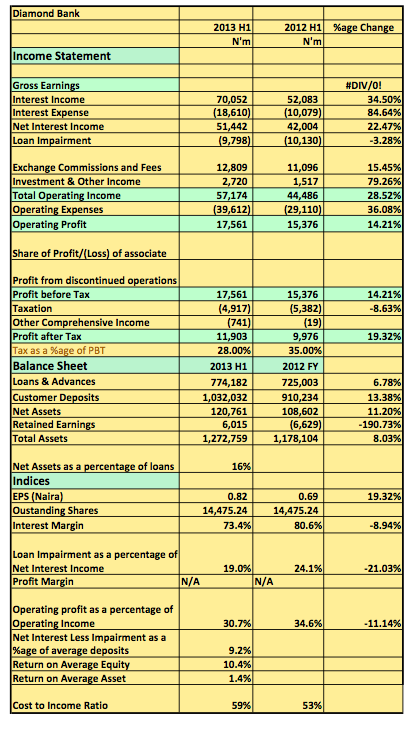

[upme_private]Diamond Bank Plc released its 2013 H1 results showing Net interest income rose a 22% to N51.4billion (2012: N42billion). The bank also post a higher operating of N57billion beating 2012 h1 results of N44.8billion. Pre-tax profits at the end of the period was N17.5billion compared to N15.3billion in H1 2012.

Key Highlights

- Diamond Bank continues to write off loans at an astronomical rate. It has now written of N9billion in the first half of this financial year and about N6.4billion this quarter alone.

- Another sour portion in the result is the 36% rise in operating expenses. It rose by over N10billion to N39.6billion. Cost to income ratio of 59% reflects this increase

- Employee cost increased by N5billion (2013 H1: N14.1billion) of that increase whilst marketing cost and contractor expenses also increased by N1billion each over the prior year.

- Diamond Bank projects a “thirty to thirty five billion naira” profit at the end of the year. That may be difficult if loan losses and operating expenses continue to rise.

- Diamond Bank remains a stock in our Portfolio

Diamond Bank Plc 2013 H1 results was released in the website of the NSE[/upme_private]