Nairametrics| The Central Bank of Nigeria on Tuesday, issued a rash of new forex polices aimed at reducing dollar scarcity at the retail end of the market. We’ve analysed the effects severally on this blog and hope, with our fingers crossed, that it will work. However, as we look forward to the full implementation of the plan, we can’t help but look at the sharp drop in forex inflows into Nigeria in 2016 and what may have caused it.

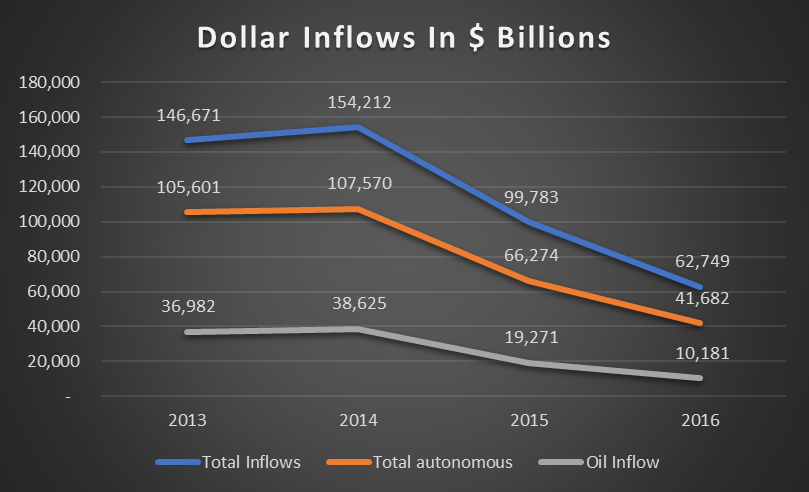

The chart above depicts just how bad things have been since the decline in oil prices and since the CBN started implementing its forex policies. As you can see from above, forex inflows started to dip just before the first set of devaluations in November 2014. It went downhill from there on. From about $146.6 billion, Nigeria’s forex inflows dipped to as low as $62.7 billion. That’s about $80 billion wiped out in two years. Oil inflows and non-oil inflows (autonomous inflows) all dropped massively, Autonomous inflows includes remittances, amount in domiciliary accounts, capital importation etc.

[visualizer id=”97768″]

Another look at the chart also reveal something interesting. The interactive chart above shows dollar inflows every month since 2013. From above, you can see that the drop was faster around August and September when the effects of the 41 banned items kicked in and when JP Morgan yanked Nigeria off its index. It’s been downhill since then and we never seem to have recovered till now. Whilst the drop in oil prices is a major reason for the sharp drop in supply, could CBN policies have contributed significantly?

Good luck to this present govt and the governor of cbn.today all financial in nairametric is the value of the naira vs other foreign currencies others is the usefulnesss of the naira and it.s worth vs other foreign currencies.

Do you have any plan to increases the value of the naira vs other foreign currencies.SO FAR NO GOVT HAVE NOT MADE ANY POLICY STATEMENT, THIS IS WHAT WE WANT TO DO WITH THE NAIRA, AND THIS IS OUR PLAN TO EHHANCES THE VALUE OF THE NAIRA.

tHE NEXT PROBLEM IS FOR THE GOVT TO IDENTIFIES THE PROBLEM,the cbn have identifies the problems,but is appling the wrong strategy for the work.now a sensible cbn official will ask himself. ” why is not working “.

any ordinary Nigerian with primary education would have identifies the causes or the difficulties that the naira is having.NOW THE CBN HAVE RELEASED SOME MILLIONS FOR THE BDC,which is temporary,because the cbn did it before.

This is how it is going to happened,whether the governor of cbn likes or not,or the governor of the bank of England,or the chairwoman of America reserve board.IT IS THE SUPPLY AND DEMAND OF FOREX.you can ban some product,but you will drive it underground.

unless there is a measure of increasing the supply of forex in Nigerian economy by any means,call it black market or private sector.nigerian economy and the cbn will always continue to have problem.i.e. to continue this present system of forex untilization,which are the hallmark of colonization