Note: This article contains some curse words and was published as is to relay the writers true reflections about the topic.

Nairametricsǀ Yesterday, I parked somewhere, received the hailing from the security guys who allowed me to park, and entered the building. Knowing security chappies in our environment, I knew I’d have to give them a small something upon exiting. Problem was, I had just ₦500 notes in my wallet, and I’d be damned if I just dashed some random guy ₦500 because of hailing. Upon finishing my business, I proceeded to ask around for change. ₦200 in two places, and ₦100. No one had any, so I was forced to buy “Burger” peanuts. First shock of the day — those things which used to cost ₦50 before the wife put me on diet, are now ₦70. Second shock — the girl selling, did not have ₦20 or ₦10 notes, so change was a problem. I ended up buying two “Burgers”, for ₦140. Change of ₦350 was given to me as three ₦100 notes, and one ₦50 note. I gave the security guy ₦100, and the customary hailing that would have happened upon driving out, did not happen.

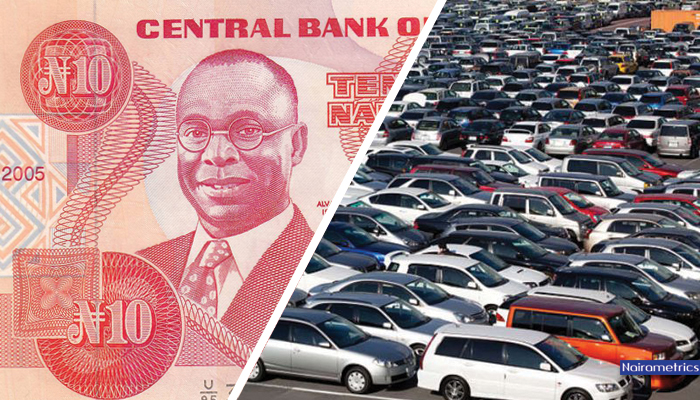

Two things I drew from this — first, the 18.48% headline inflation is real, and is touching everyone. This is seen in the fact that you can hardly get anything for ₦10 these days. That note has become redundant. Second, small notes, are disappearing from circulation. A fact confirmed by a recent newspaper report. It’s only a matter of time before traders begin to adjust their prices, upward, in order to avoid the trouble of having to find change for buyers. That will add to headline inflation.

One more thing, the recent list of “luxury” items taxed by our government, will make things worse. Again I ask — are we so adverse in using data to drive our decision making processes? Our biggest import is petrol. However, what is more important is that the list of “luxury” items being hit with more tax, includes used cars, anti-malarials, and antibiotics. In a region that is malaria endemic!

Let’s talk about the used cars, and I’ll use an illustration someone sent to me on WhatsApp:

Remember that cars are now imported only through the ports, so no more ‘Cotonou’ cars with fake duties. Also remember that a dollar now costs ₦500. So, a 4 year-old Honda or Toyota salon will still sell for $20,000 in the US as always, but that is now ₦10 million, not the ₦3.3 million of 3 years ago. Add 35% tariff (₦3.5 million) and shipping, and you are looking at ₦15 million for a 4-year old used Honda in Nigeria.

How many among the ‘middle class’ can afford that much for a car? Of course, we will see the usual defence — that the recession was not PMB’s fault and Nigerians have to tighten up. Agreed, but have public officials tightened up? They will still buy new SUVs with public funds and pay the 70% import duties with public funds. Four years later, the SUVs are theirs at give-away prices under current public service rules.

So, expect the National Assembly and government agencies to buy more “official vehicles” in 2017. Expect the customs service to “earn” more “revenues” from imported cars; revenues which, in fact, came from public funds. A classic case of robbing Peter to pay Paul. So, you don’t intend buying a car? Well, the Jettas, Siennas and Vectras you board at motor parks are also imported, which means more transport fares for you in 2017.

Worse is this — most of the drugs we “manufacture” here, source their raw materials from the abroad. Why do they?

Value chain. Despite all the noise, we have done nothing to encourage local manufacturing, so it is cheaper for them to source their materials from abroad. Let’s start with the basics — transporting products between Nigerian cities is a mess, because the roads are shit, and then various groups that spring up to demand various “taxes” read, rents. We haven’t sorted it, but we want goods to move from point A to point B cheaply? Then the big monster in the room. It costs 6 times as more to run an industry in Nigeria (Tom Burgis, 2015) than in the UK, because of the power issues. This means that whatever any industry in Nigeria will process will cost more than the foreign alternative. We’ve not solved power. We’ve not sorted cheap transport. We don’t use our waterways. We’ve not raised wages, yet we are banning?

Nigeria certainly has economic issues,it is unfortunate the government of the day is not engaging the best brains within and outside Nigeria to solve these problems.

I like to read your articles, but please could you stop using swear words like ‘shit’. They are unacceptable in articles of this nature. Thanks.

Noted! Thanks for your comments.

Chima, it’s best me focus on the message rather than the way it is written really just my candid opinion.

This tell so much truth, unlike 10 yrs ago, we have more data and information yet we go about solving problems the wrong way. I learnt a lot from this as always… ? if you want to stop a basket from leaking, close all holes…