Mr. Abdul Rauf Aliyu, Senior Policy Advisor African Centre for Tax and Governance, has advised Nigerian business owners to take several steps to absorb the shocks associated with the petrol subsidy removal and currency floating policies of the federal government.

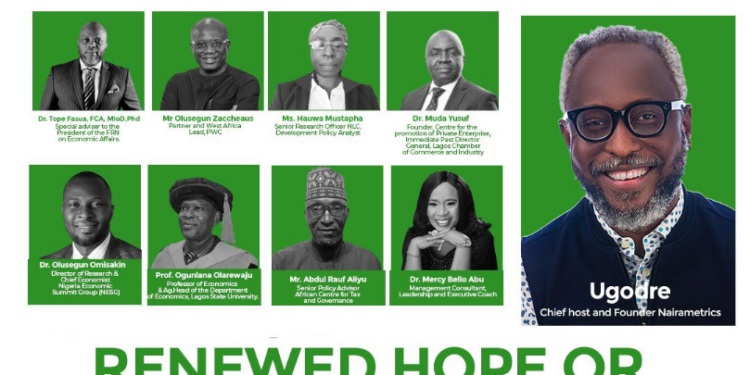

Aliyu suggested how businesses can thrive on Saturday during the Nairametrics Quarterly Macro-Economic Outlook webinar.

The event tagged “Renewed Hope or Reality Check? Identifying Opportunities in a Volatile Economy,” drew national stakeholders to review the performance of the President Bola Tinubu administration vis-a-vis Nigeria’s economic realities.

FG’s policy reforms

Aliyu said that from a political perspective, the reforms embarked upon by the federal government is having economic repercussions on Nigerians and businesses because fuel subsidy removal happened in the same season with the floating of the naira.

He said the economy had not absorbed the shock from the subsidy removal before the federal government floated the currency, adding that it would take a lot of time and government interventions for Nigerians to enjoy its benefits.

Economic strategies for businesses, individuals

Based on the development, he advised businesses to diversify by going into new products and services or consider moving to other countries.

“One other thing businesses must do is they must engage in diversification. Two types of diversification, either they diversify in more products or they do geographical diversification; trying to see if they can move into other countries so that it could edge against the risk of forex.

“We have seen one or two countries who have done that,” he said.

He also advised companies to explore price management by looking at the income or status of the people who are buying.

He said people now prioritize what they need to buy given inflation.

He also suggested that businesses should establish risk management strategies to safeguard against unforeseen shocks.

Lastly, he encouraged businesses to do a lot of engagements and advocacies around government.

What he said,

“A lot of engagement needs to happen around tax incentives, investment, favourable operative environment.

“Businesses should have that assurance from the government that they need to go through a lot of pain but there is hope on the horizon because businesses need to understand where they are heading.”

Aliyu advised the government to do a lot of cost optimization, prioritize operational efficiency by reviewing their processes, and renegotiate their contracts and supply chain issues if need be.

He also said there is a need to leverage technology as much as possible to bring down costs.

For individuals and households, the tax advisor explained they need to engage in financial planning and invest a lot in skills in other to enhance their employability.

“We need to have alternative incomes. Like businesses, individuals need to diversify, ” he added.

More insights

The removal of fuel subsidy has been a contentious issue for some months as crude oil prices increase and the exchange rate fluctuates.

But Nigeria’s President Bola Tinubu had said his administration removed petrol subsidy to put Nigeria on the path of economic growth.

He assured Nigerians of an impending economic recovery, expressing confidence in the country’s ability to overcome the adverse effects of the fuel subsidy removal.