Sterling Bank Plc is reported to have turned down its planned talks to buy Keystone Bank Limited from the Asset Management Corporation of Nigeria (AMCON).

According to reports from Thisday, the Chief Financial Officer (CFO) of the bank Abubakar Suleiman explained that Keystone Bank was “an unsuitable fit”.

“We reviewed Keystone Bank and concluded the strategic fit was not strong enough. We will continue to evaluate all the options. As new candidates come into the market, we will also review them,”

Sterling Bank via this same CFO had earlier in the year announced to the world that the bank was looking to buy “one or two” mid-sized banks aided by the devaluation of the Naira. He believed a Naira devaluation will probably put a lot of banks under regulatory pressure making them vulnerable for an acquisition. According to Thisday, he says any move was likely to come after studying the impact of last month’s 30 per cent fall in the value of the naira. It appears that he has now moved from “wanting to buy” to “Studying to buy”.

Sterling Bank is currently valued at about N37 billion keeping them above Fidelity Bank (N33b), Wema Bank (N28b), Unity Bank (N11.3b) and Skye Bank (N9b). These are probably the only banks they can make a bid for based on market capitalization. Their current Net Assets of about N94billion also puts them in the lower Tier 2 segment of commercial banks, making them even vulnerable for an acquisition.

Deal or no deal?

Mr Suleiman (we wonder why we hardly hear from their CEO, Yemi Adeola) has been raving about an acquisition for about two years now with nothing to show for it. For all his tough talk, he should be more concerned about the bank’s vulnerability as a target for a takeover considering that the banking and economic landscape is gradually threatening the existence of Tier 2 banking. Time is also running out on the bank’s ability to raise funding. After the N19b it raised early last year (via a Silverlake Investments) they have not been able to raise any new significant capital. Silverlake Investments and Bank of India both own 25% and 8.8% of Sterling Bank respectively.

The article claimed that the bank “has completed book building for a N35 billion bond sale, its first tranche of a debt programme, Suleiman said, but added that the bank will raise only 20 per cent of that amount to gauge appetite once it receives regulatory approval. Bond yields in Nigeria are currently below inflation at 16.5 per cent in June. The most liquid 5-year government bond traded at a yield of 15.17 per cent on Tuesday.”

Why we are worried

Sterling Bank’s about face decision to ditch the Keystone Bank acquisition is commendable having seen the experience of Skye Bank. However, this raises the pressure on the bank to do a deal that can help strengthen its capital adequacy ratio following the floating of the naira and the disastrous economic data reeled in 2016 Q2.

Sterling Bank is dancing on the edges with a Capital Adequacy ratio of 16.1% (6.10%above the regulatory requirement for Tier 2 banks) and Liquidity ratio improved substantially to 46%. These appear great on paper but recent events give us concerns. Here are some other chilling stats from the bank;

- Downstream accounted for the highest sector impairment at 31.9%; two customers accounted for about 70% of the impaired assets

- A single customer accounted for about 67% of non-performing loans in the manufacturing sector; however, the loans were past due but not impaired

- NPL ratio remained flat at 4.8%, while cost of risk improved by 70 basis points to 1.6%

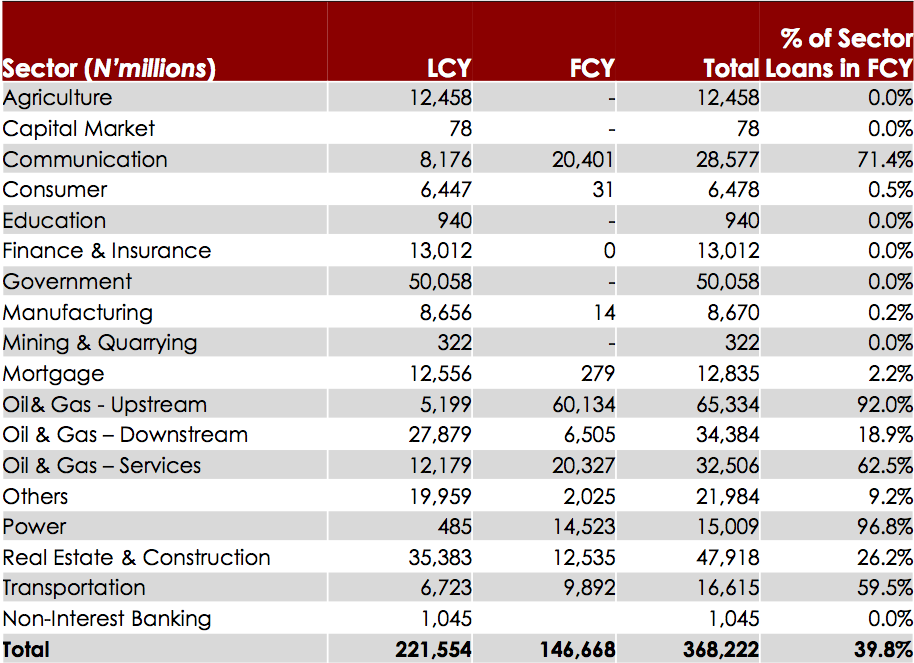

Sterling Bank has N99 billion in loans to the Oil and Gas Sector and another N15 billion exposure to the Power Sector. Both sectors are currently considered vulnerable following the dip in oil price and the recent struggles in the power sector. Another N48 billion is lent to the beleaguered Real Estate Sector. Out of Sterling Bank’s N338 billion loans N147 billion is denominated in foreign currency. Oil and Gas alone got about N86 billion in foreign currency denominated loans (see below).

Sterling Bank shares is down 29% year to date and trading at an earnings multiple of 4.2x. It is yet to release its 2016 Half Year results.