The Securities and Exchange Commission (SEC) has announced plans to come out with regulations that will guide technology products in the capital market.

Acting Director-General of SEC, Mary Uduk, revealed this at the presentation of a lecture in Abuja.

According to her, the intention to issue new regulations for Fintech was aimed at transitioning towards a technology-driven capital market as well as protect investors. She further noted that SEC was interested in the investments that Nigerians were making, especially with the advent of digitalisation.

In her words:

“If we will regulate this market and understand what is happening, we need our staff to understand the rudiments of fintech. Very soon, the whole world will move to technology for regulation. Other jurisdictions have already gone far into it with some of them already amending their rules in that direction.

“The International Organisation of Securities Commissions is on it and there is a lot on it already all over the world, and we cannot be left behind. We are very much interested in some of the most active areas of fintech innovation like block chain technology, crypto currencies and how they affect investors.”

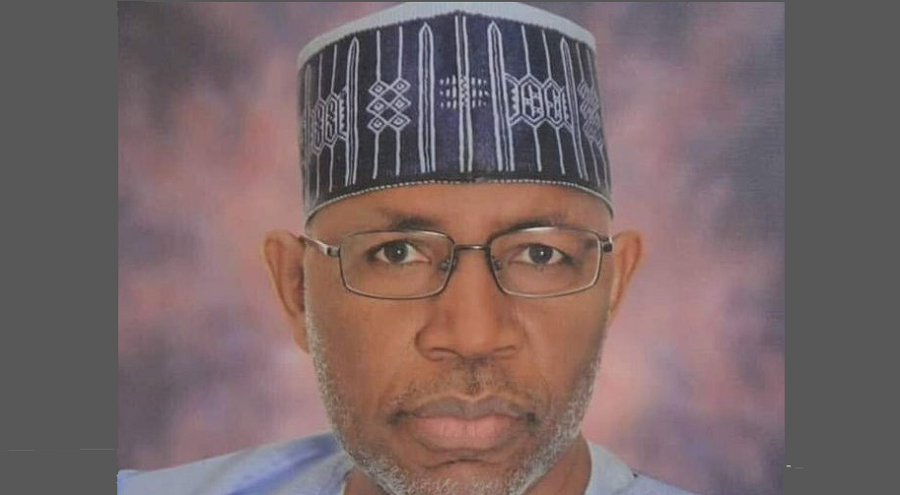

At the event, she announced Mr. Ade Bajomo as the chairman, Capital Market Committee on Fintech Roadmap for Capital Markets in Nigeria.

Recall that the Capital Market Committee (CMC) at its last meeting in Lagos, agreed to set up a committee to draw a fintech adoption road map for the capital market.

At the meeting, she reiterated the need for the capital market to take advantage of the fintech offerings going forward.

According to her, the capital market needs to create an enabling environment that is attractive enough for fintechs to innovate and engage actively with the new trend in technology.

The Securities and Exchange Commission (SEC) is the apex regulatory institution of the Nigerian capital market supervised by the Federal Ministry of Finance.