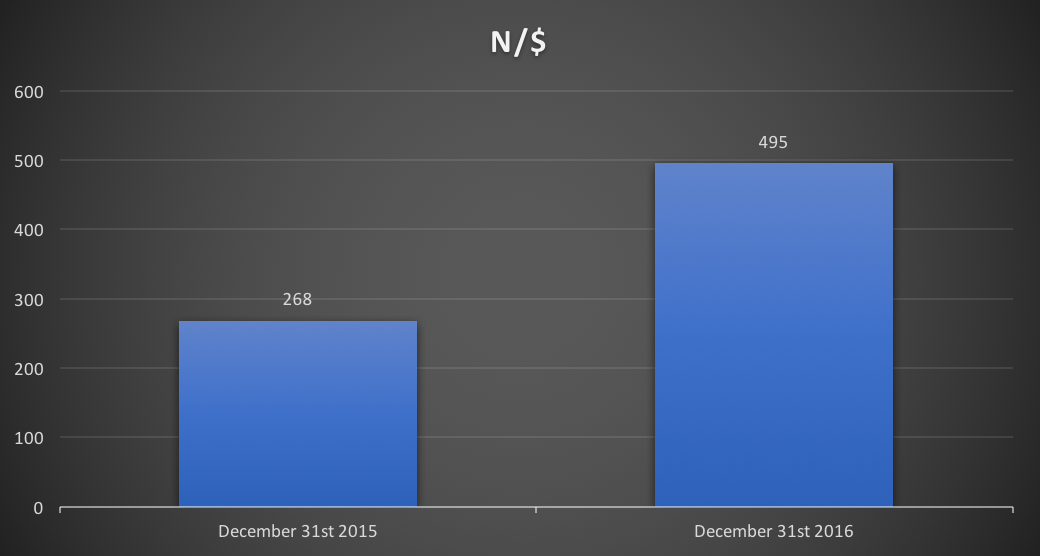

The exchange rate between the naira and the dollar closed a not to be remembered 2016 at an average price of N495 at the black market. This compares to an average price of about N268 when it closed on December 31, 2015 at the black market . This is a massive 85% gain of the dollar against the naira in one year, the highest ever on record for a single calendar year. In other words, if you held $100 at the start of the year it was worth N26,800. If you held the same amount till the end of the year it is now worth N49,500.

In December 2015 when the naira exchanged at N268 to the dollar, the CBN still held on tightly to a fixed exchange rate of N197. This was a 36% disparity between the official rate and the black market rate. At N495, the black market rate is at a 62% disparity to the CBN official rate of N305 even though the CBN claims the currency is floating.

The CBN in June 2016 launched its new Flexible Exchange Rate policy which many believed meant that the naira will be floating against major currencies around the world. Analysts believed this will usher in a new foreign currency trade regime that will see the exchange rate fall to the forces of demand and supply thus opening up the forex market to the world. It was believed that this would finally bring foreign investors back into Nigeria, paving the way for an economic rebound.

The reverse was unfortunately the case. The CBN did the exact opposite. The exchange rate was refused to float freely with commercial banks told clandestinely to limit their bid/offers rates and volumes. Prices were also said to be approved by the CBN before being sold in the market by third part sellers. Failure to do so attracted fine and reprimand from the CBN.

The effect was devastating for the naira. To the shock and consternation of many Nigerians, from having two rates, we had as much as 6 exchange rates in the market. There is the official CBN rate, black market rate, interbank rate, rate at which fx is sold to select segments of the economy, rates used by Travelex for PTA’s and BDC. The fragmentation of rates only created further scarcity in the market helping fuel the massive depreciation of the naira that we have seen in decades.

As Nigerians usher in 2017, one eye will remain at the exchange rate. Some already believe an exchange rate of N500/$1 is only days away. If this occurs, then the dollar would have gained over 200% against the naira since June 2014 when the exchange rate was still under N10.

Guys, check your maths, the Naira actually DEPRECIATED by 46% while the dollar APPRECIATED by 85%. Going by your analysis if the dollar rate was to be 600 then the Naira would have depreciated by 123%. It is not possible for a currency to depreciate by more than 100%. Hope you understand? You should, you are finance people.

Thanks for the education. We think its obvious that in this context, its the gain against the naira that is being highlighted. We will stick with the 85% depreciation.

Come on guys, its is not a 85% depreciation by the Naira, its a 85% appreciation by the dollar. Not the same thing. You cant even say 85% depreciation cause its just wrong! it is more mature to know when you are wrong and correct it than stick to a wrong position, and High School maths should tell you saying 85% depreciation is just wrong.

Well, its your blog..do with it as you please..but people that understand will definitely lose a bit of respect for your team.

Currencies depreciate by more than 100%. Google is ur friend.