The oil and gas industry plays a critical role in Nigeria’s economy. For the government, it is a key source of revenue. For individuals and businesses, petrol prices affect their daily spending and profit margins.

While the crude oil prices can be volatile, investors in this space have reaped billions in terms of dividends and capital appreciation.

This is Nairametrics’ profile of billionaire investors in oil and gas firms listed on the Nigeria Stock Exchange.

Austin Avuru

Ojunekwu Augustine Avuru (also called Austin Avuru) holds a Geology degree from the University of Nigeria, Nsukka (1980), and a postgraduate diploma in Petroleum Engineering from the University of Ibadan, Nigeria (1992).

Avuru spent twelve years at NNPC beginning in 1980, where he held various positions including well site geologist, production seismologist, and reservoir engineer. In 1992, he joined Allied Energy Resources in Nigeria, where he worked for the next ten years as exploration manager and technical manager.

In 2002, Avuru established Platform Petroleum Limited and held the role of Managing Director until 2010, when his company merged with A.B.C Orjiako’s Shebah Petroleum Development Company to become Seplat Petroleum Development Company Plc.

He has served as Managing Director, Chief Executive Officer, and Executive Director of Seplat Petroleum Development Company Plc since May 1, 2010.

Avuru holds 74,546,740 shares in the company. This amounts to N49.5 billion, as at our *cut-off date.

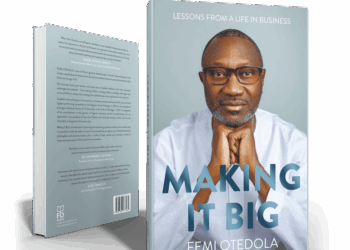

Femi Otedola

Femi Otedola is the controlling shareholder of Forte Oil, an oil marketing and power generation company. Originally a Nigerian subsidiary of British Petroleum (BP), Forte Oil has more than 500 petrol stations across the country.

The company owns oil storage depots and manufactures its own line of engine oils.

Femi Otedola holds 1,024,732,798 shares in the firm, in his personal capacity, and through several investment vehicles.

Going by the company’s valuation as at April 6, 2018, this gives him a net worth of N40.9 billion.

Dr. Ambrosie Bryant Chukwueloka Orjiako

ABC Orjiako, as he is commonly known, obtained an M.B.B.Ch. degree in 1985 from the College of Medical Sciences, University of Calabar, Nigeria, then trained as a General Surgeon at the Lagos University Teaching Hospital. He later sub-specialized in trauma surgery and became a fellow of the West African College of Surgeons in 1996.

He went into full-time business in 1996 after eleven years of active medical practice. He co-founded Seplat in 2009 and became the Chairman, spearheading new business developments and fundraising, as well as providing leadership on strategy and stakeholder relationships.

He has served as a Non-Executive Chairman of Seplat Petroleum Development Company Plc since March 3, 2010. He is also the Chairman of Neimeth Pharmaceutical International Plc, which is also listed on the NSE.

ABC Orjiako has 47,251,325 shares in the company which are valued at N31.4 billion going by his shareholding, as at the cut-off date.

Mike Adenuga

Adenuga got an MBA at Pace University in New York, supporting himself as a student by working as a taxi driver. Adenuga, Nigeria’s second richest man, built his fortune in telecom and oil production.

His mobile phone network, Globacom, is the second largest operator in Nigeria, with 37 million subscribers. His oil exploration outfit, Conoil Producing, operates 6 oil blocks in the Niger Delta.

Mike Adenuga has direct holdings of 103,259,720 shares and indirect holdings of 516,298,603 shares through Conpetro Limited in Conoil Plc. Conpetro Limited holds 74.40% of Conoil’s issued share capital.

At Conoil’s share price of N30.80 on our cut-off date, this gives him a net worth of N3.1 billion for his direct holdings. Indirect holdings have a value of N15.9 billion.

Wale Tinubu

Mr. Tinubu has a Bachelor of Laws Degree from the University of Liverpool, England and received his LLM from the London School of Economics, where he specialized in International Finance and Shipping.

He started his career with the family’s law firm, where he worked on corporate and petroleum law assignments.

He has been Chief Executive Officer and Managing Director of Oando Plc since July 2001.

Wale Tinubu has a total of 2,857,483,572 shares in Oando Plc through his personal holdings, as well as Ocean and Oil Investments (OOIL) and Ocean and Oil Development Partners (OODP) respectively.

Wale’s holdings in Oando Plc are thus valued at N17 billion.

Mofe Boyo

Boyo has a Bachelor of Laws Degree from King’s College, University of London, England. He is the Deputy Managing Director of Oando Plc.

Mofe Boyo has a total of 1,426,794,497 shares in Oando Plc held in his personal capacity, as well as Ocean and Oil Investments (OOIL) and Ocean and Oil Development Partners (OODP) respectively.

Mofe’s total holdings are valued at N8.5 billion.

Macaulay Agbada Ofurhie

Macaulay Agbada Ofurhie graduated with a B.Sc Honours in Geology from the University of Ibadan in 1971. He has been a Non-Executive Director of Seplat Petroleum Development Company Plc since December 2009.

Mr. Ofurhie had an outstanding career in the oil and gas industry at the Nigerian National Petroleum Corporation (NNPC) and the Directorate of Petroleum Resources (DPR) where he served at various executive positions.

During active service, he was Managing Director of NPDC and Nigeria Gas Company, both subsidiaries of NNPC.

Ofurhie has 4,901,611 shares in Seplat Plc. Going by our cut-off date, his shares in Seplat are worth N3.2 billion.

Sayyu Idris Dantata

Dantata studied Mechanical Engineering at the Morris Brown College Atlanta Georgia, USA.

Alhaji Dantata started his career as Director of the Engineering and Transport Division of Dangote Group.

Sayyu is a shareholder in MRS Holdings Limited. Corlay Global SA owns 100% of MRS Africa Holdings Limited. MRS Africa Holdings owns 60% of the shares in MRS Oil Nigeria Plc.

At our cut-off date, MRS Africa’s stake is worth N4,3 billion. Sayyu is believed to hold a significant stake in MRS Africa Holdings.

Notables

While these investors may not be billionaires, they are worth keeping an eye on.

Dr. Charles C. Okeahalam

Dr. Okeahalam has two Masters Degrees in Economics and Finance respectively, and a Ph.D. in Econometrics from the University of London. He also received a D.Sc. in Financial Economics and Banking and Finance from the University of Exeter.

Dr. Okeahalam is a Co-Founder of the AGH Capital Group where he oversees all investment decisions, portfolio management, capital raising and trading operations.

He has been an Independent Non-Executive Director of Seplat Petroleum Development Company Plc since March 01, 2013.

Okeahalam holds 597,238 shares in Seplat Plc. Going by our cut-off date, this amounts to N391 million.

Basil Efoise Omiyi

Mr. Omiyi graduated with a B.Sc. in Chemistry in 1969 and obtained a post-graduate diploma in Petroleum Technology in 1970 from the University of Ibadan. Most of his career was at Royal Dutch Shell, where he spent 40 years in various roles, both in Nigeria and Europe.

Mr. Omiyi is currently an Independent Non-Executive Director on the Board of Seplat Petroleum and he holds 495,238 shares in the firm. This amounts to N329 million.

Afolake Lawal

Mrs. Lawal Afolake has an Upper Second Class (Hons) in Law (LLB) from Anglia Ruskin University, Cambridge U.K.

She is an alumnus of Obafemi Awolowo University and holds a Masters Degree in International Law and Diplomacy from the University of Lagos. She also obtained a Master’s of Science degree in Corporate Governance and Finance from the Liverpool John Moores University in U.K.

She serves on the Board of International Breweries Plc and Eterna Plc (both companies are quoted on the Nigeria Stock Exchange).

Afolake Lawal is a co-founder of the GTI Group alongside her husband and she is currently the Group Executive Director with over 15 years’ wealth of experience in Investment Banking, Corporate Governance, and Business Strategy.

She is a certified pension practitioner and an associate member of the National Institute of Marketing of Nigeria (NIMN).

Afolake Lawal is a Non-Executive Director of Eterna Oil and Gas Plc. She has a total of 49,902,892 shares in the company through her personal holdings, GTI Capital Limited and GTI Securities Limited. At the stock’s price of N6.29 on our cut-off date, this amounts to N313 million.

*Cut off date used for shareholding valuation is April 6, 2018.

Hello, Onome. Can you enlighten me a bit here? ’cause I’m getting confused.

“Sayyu is a shareholder in MRS Holdings Limited. Corlay Global SA owns 100% of MRS Africa Holdings Limited. MRS Africa Holdings owns 60% of the shares in MRS Oil Nigeria Plc.

At our cut-off date, MRS Africa’s stake is worth N4,3 billion. Sayyu is believed to hold a significant stake in MRS Africa Holdings.”

Is MRS Holdings Ltd different from MRS Africa Holdings Ltd? Or does Mr. Dantata own a significant share in MRS Africa Holdings by virtue of his stake in Corlay Global SA? Or perhaps he just happen to have some stake in MRS Oil Nigeria Plc?

Yes. They are different entities. MRS Africa Holdings is a major shareholder in MRS Oil Plc. Sayyu holds his take in MRS Oil through MRS Africa Holdings.

Thanks for the clarification.

Pls what is the share holding structure of eterna oil plc. Any major shareholders?

This is a beautiful article, Onome. Inspiring, encouraging and motivating. I just felt I must go and start something immediately. More of them.

This is a pure challenging clarification. I feel a fire in my bones, so what do think should do with these info? thanks