The National Bureau of Statistics has released its 2016 FY Labour Force and Productivity data showing Nigerians labour productivity decreased to N684.4 for the year ended December 2016, compared to N718.13 in the year ended December 2015. Nigerians also clocked in a combined 148,282,982,466 hours in the whole of 2016, compared to 131,096.143,908 hours in 2015.

The Labour Productivity basically measures value created by a country’s labour force and the amount of reward generated per person for the efforts. It can also be defined as the quantity of labour input required to produce a unit of output. Labour Productivity is derived by dividing a country’s GDP per year by the labour input (Labour input is basically the total number of hours worked during the year).

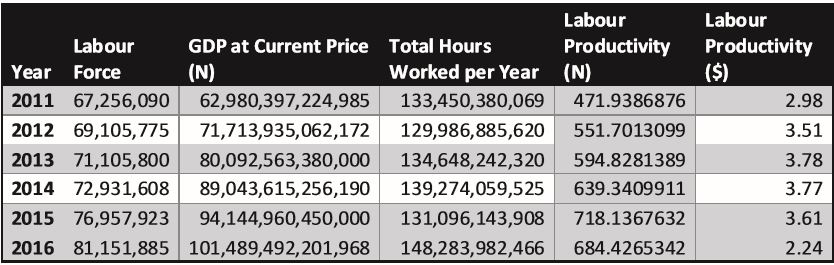

The table below displays the data for the past 6 years.

What this means

The table above indicates the following

- The number of Nigerians joining the labour force has risen from a about 67,256,090 in 2011 to 81,151,885 in 2016. The represents a 21% increase in the last 6 years. This means that the number of Nigerians that have joined the labour force has risen by 21% in just 6 years

- GDP has however risen from about 62,980,397,224,985 in 2011 to 101,489,492,201,968. This means that the value of output produced by Nigerians have increased by a whopping 61.1% between 2011 and 2016.

- It is important to add that this increase is also majorly a result of the devaluation of the naira. Despite this, the as at 2013, just before the devaluation, the GDP was 80,092,563,380,00 or 61% higher.

- Nigerians have also worked for a total of 148,283,982,466 in 2016 compared to 133,450,380,069 or 11% increase in the last six years. This suggest that Nigerians have put in more working hours in the last 6 years, which of course can also be attributed to the increase in workforce.

The result

- Nigeria’s labour productivity was N684.4 in 2016 compared to 471.9 in 2011. This represents a 45% increase. However, compared to 2015 which was N718, it was a 4.7% drop.

- Whilst, this may seem like a market improvement despite the economic recession of 2016, Nigeria’s labour productivity in dollar terms was disappointing.

- At $2.2 in 2016, Nigeria’s labour productivity in dollar terms dropped by a whopping 38.8% when compared to the $3.6 generated in 2015. It is also about 70 cents lower than the $2.9 generated in 2011.

The takeaways

Nigerians are increasingly facing a dire future. As they put in more work hours and increase their output, the amount of money generated in dollar terms have reduced considerably. Nigerians labour productivity is not growing at the same pace as labour force.