Shareholders of Mutual Benefits Assurance Plc finally have a reason to smile, as the company appears set to break its 9-year dividend drought.

In a recent notice sent to the Nigerian Stock Exchange informing it of board approval for its 2017 results, the company hinted at the possibility of dividend payment. Mutual Benefit last paid a dividend in 2008.

At its meeting held on the 22nd of February 2018, Mutual Benefit’s board of directors approved dividend payment. Details of the recommended dividend will be communicated to the Exchange (NSE) after the approval of the audited financial statements by the National Insurance Commission (NAICOM).

Insurance companies on the NSE, have a history of poor performance in terms of price appreciation and corporate governance. The recent shift in the minimum price floor to N0.01 left many insurance stocks hard hit.This may have been an impetus for the proposed dividend payment.

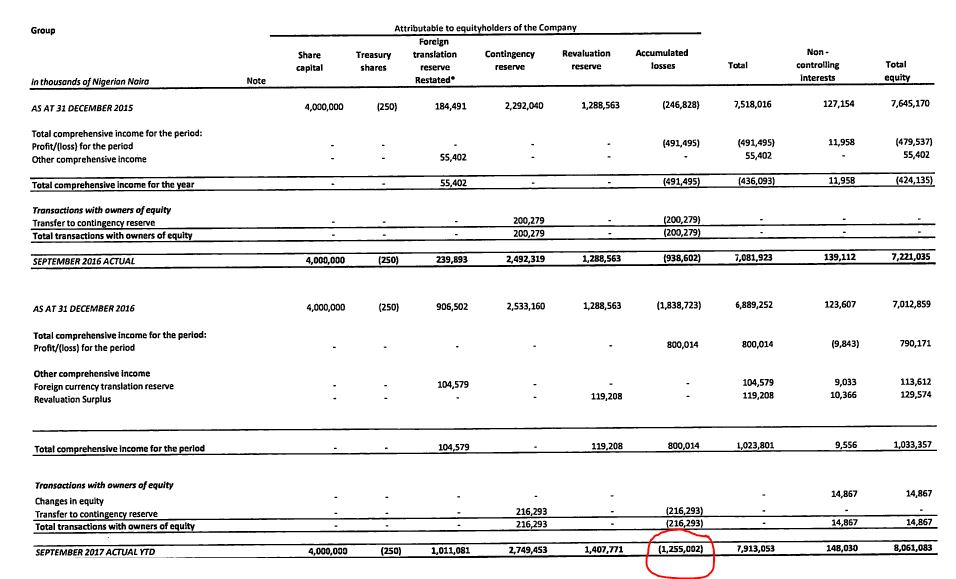

How were accumulated losses wiped?

As at when this article was written, Mutual Benefit was yet to publish its 2017 Full results. However, its most recent result was its 2017 9 Months results which showed that the company had accumulated losses (negative retained earnings) of ₦1.2 billion.

Companies are barred from paying dividends while they have negative retained earnings (This indicates Mutual Benefits now has positive retained earnings. The company does not also have a Share Premium account, which is typically how accumulated losses can be set-off against to allow for dividend payments.

Its recent rights issue which sold for 50 kobo did not have any Share Premium thus we do not know for sure how the company will fund dividend payment.

Mutual Benefits shares are currently trading at ₦0.33 in today’s trading session, down 2.94%. Year to date, the stock is down 34.94%.

Results for the 9 months ended September 2017 show gross premium written increased from N9.8 billion in 2016 to N10.5 billion in 2017. The company made a profit before tax of N1.1 billion in 2017 as against a loss before tax of N324 million in 2016.

It could pay dividends this year if its profits for the year is so good that it exceeds the accumulated losses and retains some profits where it can pay dividends from.