Nigeria’s Insurance market earned a combined gross premium income of about N326 billion, according to the 2016 Insurance data compiled by the National Insurance Commission of Nigeria.

The dual report, breaks down the Insurance Sector into Life and Non-Life and includes about 43 Insurance companies public and privately held in the non-Life Segment.

Nigeria’s Insurance Sector is largely under capitalized and has attracted some investments in the last two years. Investors see huge opportunities in this sector and consider it an easy path into Nigerian financial services business, that potentially serves over 180 million people.

Below, is a summary of some of the key highlights in the data.

Gross Premium

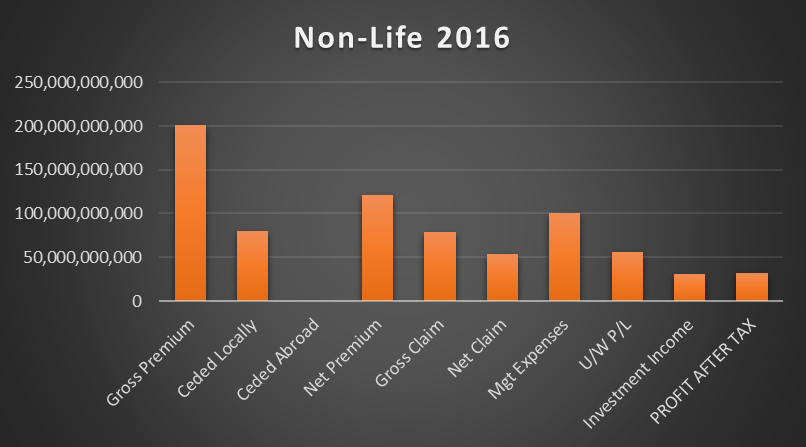

- The Insurance sector collected a total of about N201 billion in Gross Premium Income on non-Life Insurance for the financial year ended December 2017.

- This sector comprises of Motor Insurance, Fire and Burglary, General Business, Marine Insurance, Oil and Gas Insurance etc.

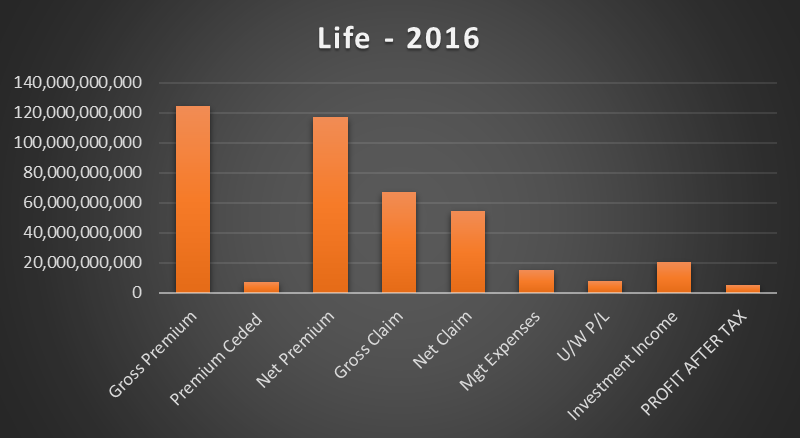

- The report also places the Life Segment of Insurance Business at N124.5 billion in Gross Premium Income for 2016. In total, Nigeria’s Insurance Market is valued at N326 billion.

- In terms of market share, Leadway Assurance led the market share with about 10.69% or N21.59 billion. Continental Re-Insurance was next with 8.10% or N16.3 billion.

- Custodian and Allied came third with 8.05% or N16.2 billion and Axa Mansard and NEM in 4th and 5th with 7% and 5.2% respectively.

- In terms of what makes up the revenue, we observe that Motor Insurance accounted for N154 billion of total gross premium income.

- This perhaps indicates where Nigerians are inclined to buy insurance. Motor Insurance is mandatory in Nigeria forcing every car owner to be insured.

- Oil and Gas is next with about N25.4 billion, perhaps relying on regulatory requirements.

Non-Life Insurance

In terms of non-Life, Leadway Assurance again led with N31.5 billion or 25.3% followed by AIICO Insurance with N22.1 billion or 17.8%. African Alliance, Custodian and FBN life, came 3rd 4th and 5th with 10.7%, 9.7% and 7.9% respectively.

On Claims

The Insurance Sector appears to be big on spending. According to the data, Gross claims made on non-Life Business amounted to about N78.5 billion while those of Life was N67.2 billion.

On Management Expenses

Management expenses for non-life, however gulped about N100 billion and life N15.1 billion.

You can download the data below;