Nairametrics| It’s not every Nigerian company that gets to claim a tax benefit from a Scheme that’s currently under suspension, but that’s exactly what Dangote Cement (Nigeria’s largest listed firm) seems to have done.

Going through the firm’s 2016 Annual report, Nairametrics was struck by a key audit matter flagged by its Auditors Akintola Williams Deloitte on Dangote Cements approach to ‘Assumption of tax holiday in determining tax liability.’

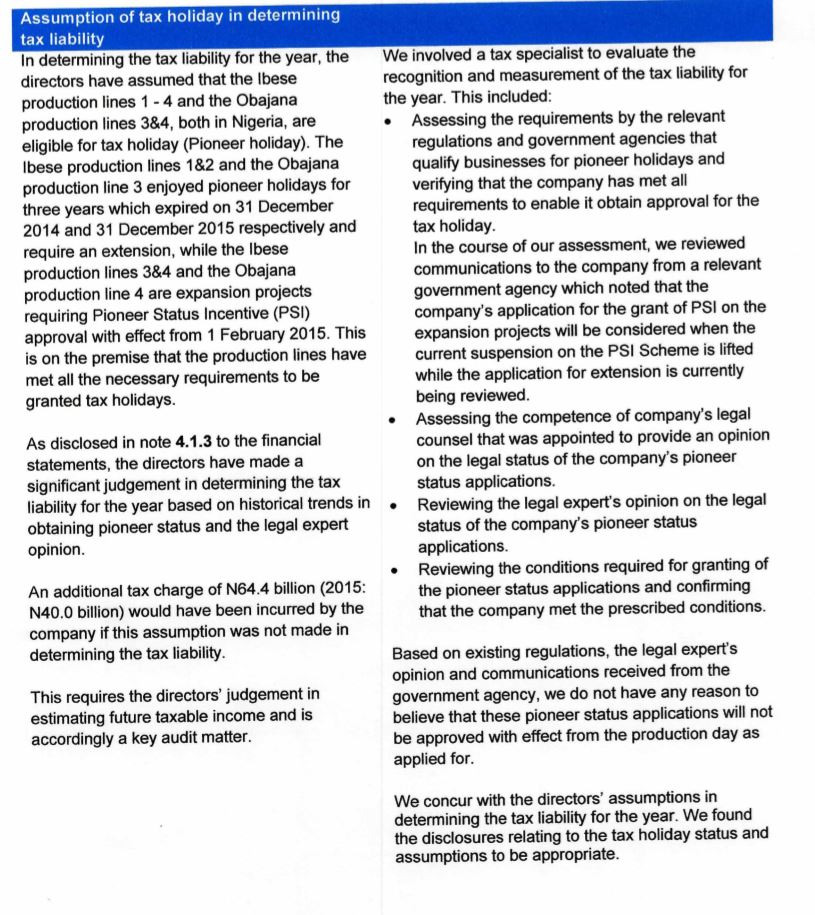

The Auditors noted in their statement that:

In determining the tax liability for the year, the directors at Dangote Cement have assumed that the Ibese production lines 1 – 4 and the Obajana production lines 3&4, both in Nigeria, are eligible for tax holiday (Pioneer holiday).

The Ibese production lines 1&2 and the Obajana production line 3 enjoyed pioneer holidays for three years which expired on 31 December 2014 and 31 December 2015 respectively and require an extension, while the Ibese production lines 3&4 and the Obajana production line 4 are expansion projects requiring Pioneer Status Incentive (PSI) approval with effect from 1 February 2015. This is on the premise that the production lines have met all the necessary requirements to be granted tax holidays.

The Auditors concluded that “An additional tax charge of N64.4 billion (2015: N40.0 billion) would have been incurred by the company if this assumption was not made in determining the tax liability.”

A key concern for us at Nairametrics however was the following statement by Akintola Williams Deloitte:

“In the course of our assessment, we reviewed communications to the company from a relevant government agency which noted that the company’s application for the grant of PSI on the expansion projects will be considered when the current suspension on the PSI Scheme is lifted while the application for extension is currently being reviewed.”

In other words Dangote Cement chose to book the tax credits even though the PSI has been suspended by the current government of Nigeria. Of course, after the auditors allowed it to, themselves relying on the opinion of an unmentioned tax specialist, legal expert and relevant government agency.

The Auditors further went on to make what are presumptuous statements to us saying :

“We do not have any reason to believe that these pioneer status applications will not be approved with effect from the production day as applied for.”

We believe this is material information to shareholders as the Government of President Muhammadu Buhari has made known its intention to close most tax loopholes and grow non-oil taxes.

An additional tax bill of N64.4 billion would have reduced Dangote Cements reported net income to N122.2 billion from N186.624 billion for Full year 2016.

The N64.4 billion amount if paid as taxes could have also helped the FG pay for various infrastructure projects currently ongoing all across Nigeria that would have positively impacted millions of citizens.

It is important to note however that Dangote Cement may not have broken any tax laws going by the auditors opinion. However, the materiality of the amount involved should be factored in when projecting the future value of the company, particularly from a retail investor stand point.

Here is a screenshot of the relevant portion of the audit opinion.