There is a saying: the first generation builds, the second generation manages, the third generation destroys.

So far, the founders and key investors of some listed companies have been able to pass the reins to the next generation, and in the process, retained their fortunes.

Time will tell though if they can successfully pass the baton to the third generation.

Here is a list of some dynasties on the Exchange and how they are faring succession-wise.

Dangote Family: The Dangote Group

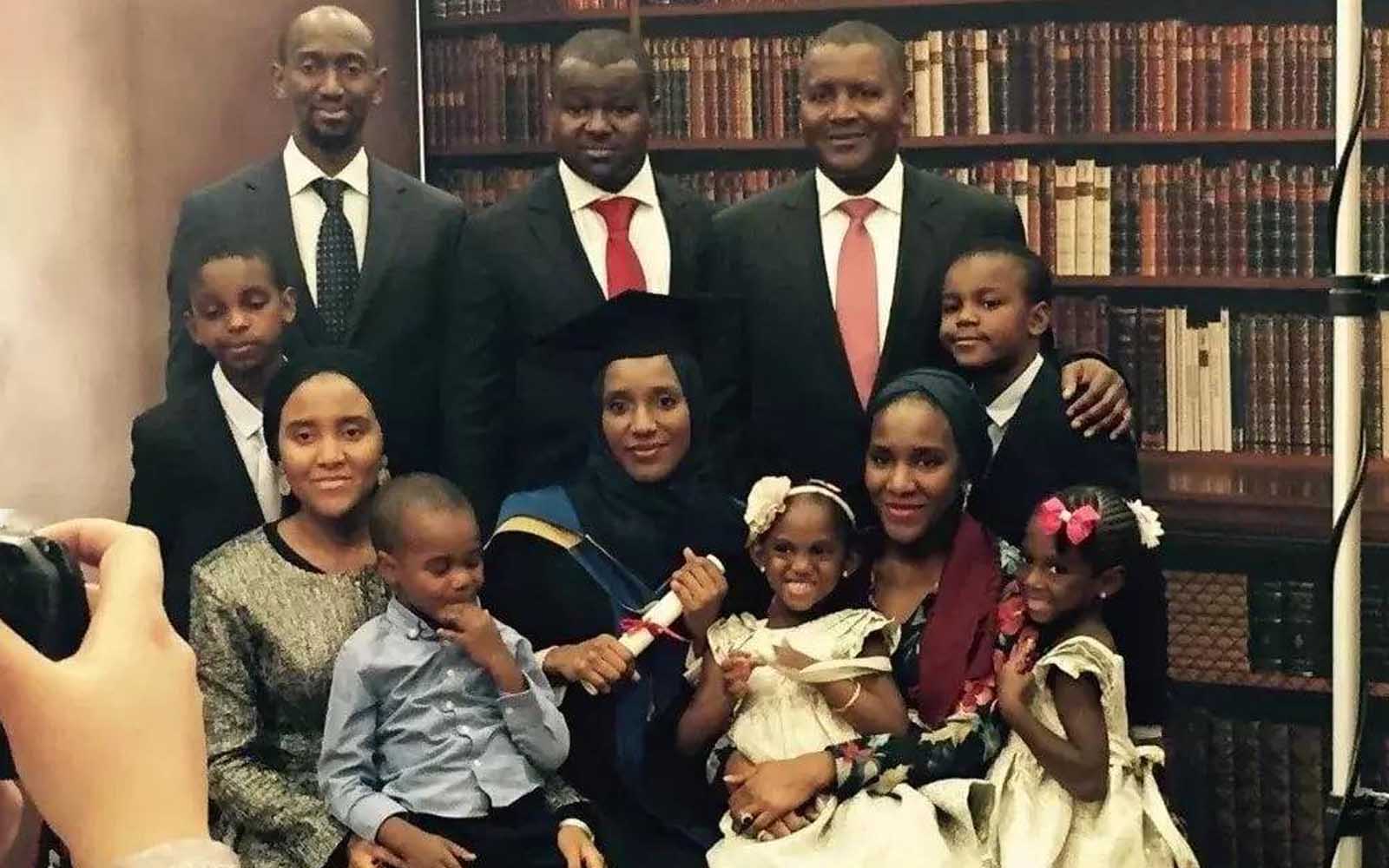

A billionaire list in Nigeria would be incomplete without of Aliko Dangote. Nigeria and Africa’s richest man, Dangote has often expressed his belief in handing over the reins to the next generation.

Dangote’s stake in Dangote Cement Plc is worth over N2.8 trillion, as he holds 85% through Dangote Industries Limited (DIL). DIL also holds stakes in Dangote Sugar, Dangote Flour Mills and NASCON Allied Industries Plc.

Daughters, Halima and Fatima, play key parts in the group. Halima is an Executive Director at Dangote Flour Mills, while Fatima is an Executive Director at NASCON Allied Industries.

The Balogun family: FCMB Group Plc

FCMB was established in 1982 as a merchant bank but began operations in August 1983. The bank was given a universal banking licence in 2000 and changed its name from First City Merchant Bank to First City Monument Bank. In 2004, the bank was converted to a public limited liability company and listed on the Nigerian Stock Exchange (NSE) in December that year.

The group currently consists of FCMB Capital Markets Limited, CSL Trustees Limited, FCMB Microfinance Bank Limited, CSL Stockbrokers Limited (including its subsidiary First City Asset Management Ltd), First City Monument Bank Limited (including its subsidiaries: Credit Direct Limited, FCMB (UK) Limited and FCMB Financing SPV Plc) and 88.22% of Legacy Pension Managers Limited.

FCMB was founded by Subomi Balogun, who had to resign from the company in 2004. Ladi, his son is currently the Group Chief Executive Officer. Gboyega Balogun, another son, is the Managing Director of CSL Stockbrokers Limited.

The Dozie family: Diamond Bank Plc

Diamond Bank was founded in 1990 by Pascal Dozie, the patriarch who has since handed over the reins to his son, Uzoma. The Dozie family has a 14% stake in the bank, valued at N2.7 billion as at today’s market price.

While the bank has been in the news in the last few weeks due to rumours of an acquisition, it has been one of the few family-owned banks still standing.

The Makanjuola family: Caverton Offshore Support Group Plc

Caverton Offshore Support Group Plc was incorporated in Nigeria as a private limited liability company on June 2, 2008, and became a public limited liability company on July 4, 2008.

The principal activity of the Group is the provision of offshore services to the oil and gas industry. It commenced business on July 1, 2008.

While the group was founded by Aderemi Makanjuola, his son, Bode, has since expanded it to include Caverton Helicopters. However, the family continues to maintain a key stake (over 50%) through Makanjuola’s personal holdings and a holding vehicle, Tasmania Investments Limited.

Dele Fajemirokun and family: AIICO Insurance Plc

AIICO commenced operations in Nigeria in 1963 as an Agency office of American Life Insurance Company (“ALICO”) – at the time, a subsidiary of American International Group (“AIG”).

The company was incorporated, registered and licensed in Nigeria as American Life Insurance Company Limited, as a wholly owned subsidiary of ALICO/AIG in 1970 to offer Life and Pension products and insurance services.

It was renamed American International Insurance Company Limited (“AIICO”) upon the acquisition of a 60% stake by the Federal Government of Nigeria and later listed on the Nigerian Stock Exchange in 1990, after which both shareholders – the Federal Government of Nigeria and AIG–divested.

The company has a market capitalization of N4.5 billion, with the family holding over 50% of the company’s issued shares, through several investment vehicles.

The Fajemirokun family, in some ways, represents one of the closest examples of wealth that could potentially move through three generations successfully.

Henry Stephen Fajemirokun, the founding patriarch, died suddenly, leaving the reins in the hands of his son, Dele Fajemirokun. Dele then chaired AIICO for several years before resigning.

He, however, continues to retain a key stake in the company through his investment vehicle, DF Holdings. Babatunde, his son, is currently an Executive Director. Adenike, his daughter, is a Group Executive Director at the Dangote Group.

The Ibru family: Ikeja Hotels Plc

While the Ibru family may be popularly associated with the defunct Ocean bank, (and for the older generation, fish and jetty importation) several branches of the family also hold shares in Ikeja Hotel Plc, largely run by Goodie Minabo Ibru for over two decades.

The Ibru family through their various investment vehicles own at least 30% of the company valued at N2.4 billion at current market price.

A tussle between himself and other factions in the company (including the other branches of the Ibru family) led to several court cases.

Goodie eventually stepped down in February last year citing the need for the new generation of Ibrus to take over.

That new generation comprises his son Ufuoma Ibru and Toke Alex-Ibru, son of Maiden Ibru and late Guardian publisher Alex Ibru.

Ikeja Hotels remains thriving, an indication the company and the Ibrus will be key players for a while.

The Otudeko family: FBN Holdings & Honeywell Group

Another former President of the Nigerian Stock Exchange, Otudeko is a billionaire by virtue of his stake in FBN Holdings, as well as Honeywell Flour Mills (part of the Honeywell Group which he founded).

Otudeko’s (directly and indirectly) owns about 67% of Honeywell Flour, valued at over N5.5 billion.

Otudeko’s son and namesake, Obafemi Ademola Otudeko, is also following in his footstep. Otudeko junior is the Executive Director at Honeywell Group and a director of First Bank of Nigeria Plc.

Ademola was also a billionaire, prior to the stock market dip which led to a fall in the company’s share price.