Nigeria’s biggest company by market capitalisation Dangote Cement (DANGCEM) is arguably in a growth spurt with its ground breaking African expansion programme.

Aliko Dangote, who is Africa’s richest man, has announced plans to double DANGCEMs capacity to 80 million metric tons a year.

DANGCEM, based in Lagos, currently has about 40 million tons of operational capacity in countries including South Africa and Senegal as well as Nigeria.

The company recently opened plants in Cameroon, Ethiopia and Zambia and plans to start up a new operation in Tanzania this year.

The company said July 31 that net income increased by 28 percent to N121.8 billion as revenues rose 15.8 percent to N242 billion.

Low rest of Africa margins takes shine off growth

While the headline numbers look impressive for DANGCEM at Naira-metrics we like to drill deeper for details that investors might have missed.

Looking at data from the recent period we find that while sales from rest of Africa contributed 22 percent of DANGCEMs total cement sales, they made up only 2.79 percent of profits or net income.

In other words of the N121.8 billion in profits DANGCEM made in the half year 2015 period, N118.4 billion came from Nigeria, N0.9 billion came from West and Central African operations, and N2.5 billion came from South and East African operations.

When Naira-metrics calculated profit margins for the rest of Africa it also looks pretty awful.

Nigerian operations had profit (EBIT) margins of 56.9 percent for the period (Nigeria revenues of N207.8 billion, EBIT of N118.4 billion).

The West and Central African operations had profit (EBIT) margins of 5.9 percent (regional revenue of N15.2 billion, EBIT of N0.9 billion).

The South and East African operations had profit (EBIT) margins of 13 percent (regional revenue of N19.2 billion, EBIT of N2.5 billion).

This should be troubling to investors since DANGCEMs lofty valuation is partly supported by assumptions that ex Nigeria sales and profitability will ramp up in the near future.

DANGCEM notes in its investor presentation that its strong Nigerian margins were:

“Protected by pricing action, improved gas supply more use of coal, and production at more profitable plants.”

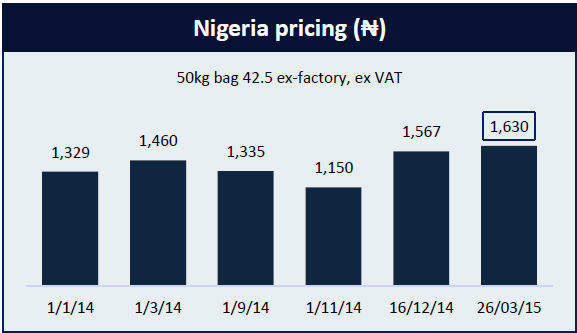

Average price per ton in Nigeria rose by 11 percent in the period.

Source: DANGCEM H1 2015 results Presentation

Since Dangote’s rest of Africa operations are mainly in saturated or slow growing markets like South Africa, Senegal or Ghana, it is difficult to see where margin expansion will come from for those markets since it will be difficult for the firm to raise prices.

Valuation

DANGCEM is currently valued at a trailing twelve months (TTM) price to sales (P.S) ratio of 6.9 xs, compared to 1.91 xs (TTM) for Lafarge Africa.

Seeing that 22 percent of DANGCEMs cement sales (1.797 million tons) came from the low margin rest of Africa region in the 6 months period to June 2015, we think that the firms P.S ratio (and overall valuation) may have to trend lower to match peers.

Their unusually high margins in Nigeria are supported by the monopolistic strategies & close relationship with the ruling cabal which Mr.D is known for. In other countries, however, he doesnt get this privilege thus more realistic margins there.