Payment infrastructure company, Zone, has raised $8.5 million in an oversubscribed seed funding round led by VC firms Flourish Ventures and TLcom Capital.

According to a statement from the company, the new funding will enable Zone to further expand the coverage of its network domestically and connect more banks and financial services companies.

A significant portion of the proceeds will also be allocated to conducting a comprehensive pilot program to test the Company’s cross-border capabilities, scheduled for 2025.

The company added that another key priority is to ensure that it is well-prepared to extend its footprint across Africa to support intra-African and international payments which will bring the company closer to its vision of becoming a global payment network.

Other investors in this round include international blockchain-focused VC firms Digital Currency Group (DCG), VKAV (Verod-Kepple Africa Ventures), and Alter Global, each bringing niche sector expertise and credibility.

What they are saying

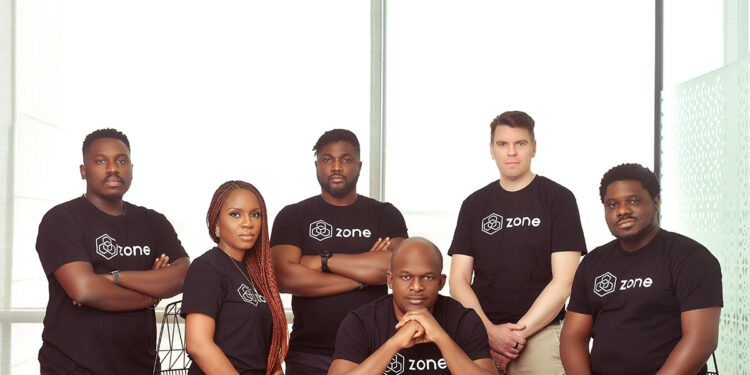

Commenting on the funding round, the CEO and co-founder of Zone, Obi Emetarom, said:

- “The participation of high-quality investors despite the funding drought and the fact that we had more interested investors than we needed, is a sign of trust in the Zone brand and investor excitement about the opportunity to redefine payment infrastructure in Africa.

- “As we step into this new phase at Zone, we are re-energized and our commitment to transforming Africa’s payment infrastructure is renewed. Our new investors and existing shareholders including CCA, Lateral Capital, Constant Ventures and V8 bring more than just financial backing as their global scope and deep expertise make them invaluable partners for us.

- “With their support, we are poised to accelerate our mission to connect every monetary store of value and enable real-time payments within and across geographical borders. Zone is committed to staying at the forefront of technological advancement and industry evolution in financial services.”

Also commenting on the investment in Zone, Partner at Flourish Ventures, Ameya Upadhyay, said Zone’s technology enables direct communication between participants in the payment ecosystem for the first time in Africa.

- “We believe this is a fundamental leap that will allow customers to experience a completely new standard of reliability, speed and cost efficiency at the ATM, at POS machines and online. We are excited by the potential for Zone’s technology to be replicated across borders to advance payment innovation globally.

- “The fact that Zone is led by Obi and Wale who are veterans of the banking industry reinforces our conviction that Zone can fulfil our shared goal of moving the entire sector forward”.

More insights into the deal

Flourish Ventures, an early-stage global fintech venture firm with purpose will provide Zone with a global perspective, networks of industry influencers, and extensive Africa fintech expertise, paving the way for expansion into new markets.

UK-based TLcom Capital provides essential local credibility and understanding of the African tech space while leveraging its existing relationships with key decision-makers In Nigeria to establish a strong foundation for Zone within its home market.

Additionally, the endorsement and investment from Endeavor Catalyst reinforces Zone’s status as a frontrunner in Africa’s fintech revolution, highlighting the company’s alignment with the entrepreneurial spirit that drives technological transformation and economic progress.

The deal marks a pivotal moment for Zone as the company continues on its journey to build a Blockchain-based decentralized payment infrastructure for financial services providers across the continent and beyond.