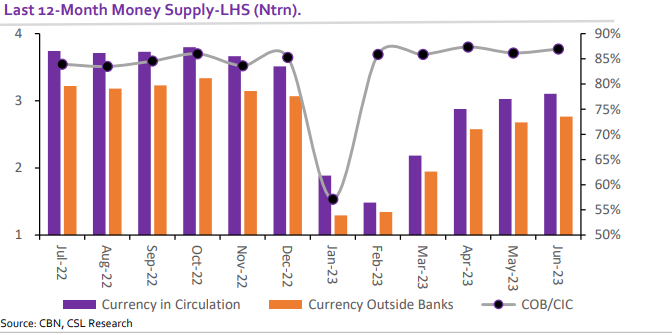

Money Supply statistics from the Central Bank of Nigeria (CBN) as of June 2023 showed that currency in circulation increased month-on-month by 3.03% in June to N2.6trn from N2.53trn as of May 2023.

Also, currency outside banks rose month-on-month by 3.94% to N2.26trn (representing 86.93% of currency in circulation) as of June 2023 from N2.18trn (representing 86.17% of Currency in Circulation) in May 2023.

Between January and June 2023, currency in circulation has risen by 87.77% (N1.22trn) while currency outside banks surged by 185.67% (N1.47trn). This is however due to the reinjection of some old naira notes previously mopped up by the CBN into the banking system.

The challenge of having a high proportion of currency in circulation outside the banking system has remained since independence despite previous currency redesigns and printing.

However, the Ex-CBN Governor’s efforts at mopping Naira outside the banking system met with wide criticisms given the circumstances.

We reiterate however that the objectives of reducing the significant amount of cash outside the banking system to ensure monetary policy effectiveness, curtail criminal activities and promote financial inclusion amongst others are strongly desirable.

Also reducing the amount of cash outside the banking system also helps to curb money laundering activities if the implementation is done in conjunction with agencies like the EFCC and the banks.

Suspicious transactions can easily be flagged as cash comes in and out of the system. That said, we believe the timing and implementation process was flawed and may have been politically motivated.

From the numbers we have seen, we can conclude that the Naira redesign did not achieve its aim.

For context, the currency in circulation reduced by 48.97% between October 2022 (when the Naira redesign deadline was announced) and March 2023 i.e., from N3.3trn to N1.68trn.

However, the percentage of currency outside banks to currency in circulation in October 2022 and March 2023 were 86% and 85.86% respectively, a marginal reduction of 0.14%, which suggests the initiative did not achieve the expected objectives.

With the extension of validity of the old naira note as legal tender adjourned to 31 Dec 2023, we believe the currency outside banks will remain at current levels if actions are not taken to ensure they remain with the banks. For example, we expect the CBN to implement tighter rules around withdrawals to retain the money within the system once the old cash has been taken out of circulation.