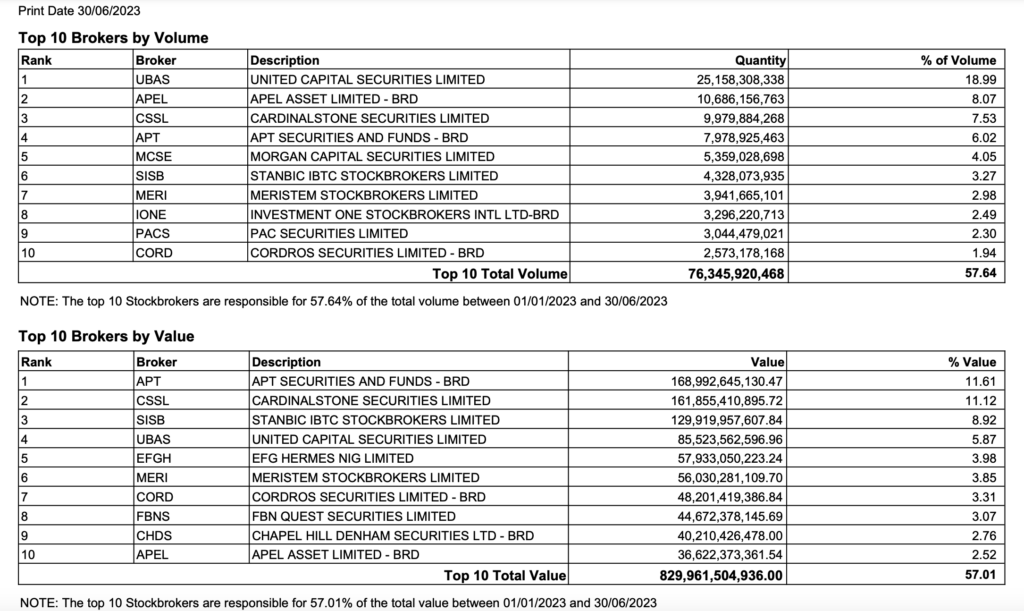

Leading stockbroking firms in the Nigerian stock market facilitated the exchange of 76.345 billion shares, with a total value of N829.961 billion, during the first half of 2023.

This figure represents 57.01% of the total value recorded between January 1, 2023, and June 30, 2023, according to findings by Nairametrics.

The aforementioned 76.345 billion shares accounted for 57.64% of the total volume transacted during the review period. These findings were published in the monthly broker performance report released by the Nigerian Exchange (NGX).

Among the stockbroking firms in Nigeria, Apt Securities, Cardinal Stone Securities, and Stanbic IBTC emerged as the top performers, collectively contributing to 55.52% of the total value of transactions conducted in the first half of the year.

- Apt Securities & Funds secured the highest position in the ranking, with a transaction value of N168.993 billion, which accounts for 11.61% of the overall transaction value.

- CardinalStone Securities followed closely with shares valued at N161.855 billion, representing 11.12% of the total transaction value. Additionally, Stanbic IBTC Stockbroker recorded an estimated value of N129.92 billion in trades.

- United Capital facilitated transactions worth N85.524 billion, while EFG Hermes transacted shares valued at N57.933 billion in six months.

- Others are; Meristem Stockbrokers, Cordros Securities, FBN Quest Securities, Chapel Hill Denham Securities, and Apel Asset facilitated deals valued at N56.030 billion, N48.201 billion, N44.672 billion, N40.210 billion, and N36.622 billion respectively.

Brokers to earn big from commissions

A cursory analysis of the value traded indicates the top 10 brokers may have earned about N8 billion in commissions collectively in the last 6 months under review.

- Brokers often charge as high as 1.35% in commissions on trades although some charge lower depending on the size of transactions.

- However, this is likely to be lower than the commissions earned in the first half of 2022 with values as high as N1.17 trillion

What you should know: Nairametrics recently reported that equity trading on the Nigerian Exchange Limited (NGX) concluded the first half of the year on a positive note, with the NGX All-Share Index gaining 18.9% and closing at 60,968.27 index points.

- This marks a significant milestone for the index, reaching its highest level in 15 years since March 5, 2008, when it stood at 66,381.20 points.

- The month of June saw the All-Share Index rise by 9.32%, breaking a four-year streak of losses for stocks during this month. It also represents the best monthly performance for the stock market in approximately two and a half years.

- The All-Share Index, which is the broad index that measures the performance of Nigerian stocks, opened the trading quarter at 51,251.06 index points at the beginning of trading in January 2023 and closed at 60,968.27 points at the end of the half-year on June 30, gaining 18.9%.

- The Nigerian Exchange Limited (NGX) which opened the trading year at N27.915 trillion in market capitalization at the beginning of trading, closed the quarter at N33,197 trillion, hence has earned a year-to-date gain of about N5.282 trillion or 18.9%.

Market analysts believed the renewed sentiment in the local bourse market had also grown following crave to increase capital gains on the back of low prices of stocks owing to upset in the financial market arising from unstable policies and build-up to the 2023 general elections.

Now I’m loving this news if they can do a trade of such level we can increase it more so I love you guys a lot keep on the good works

I hope you will use the same energy to report the losses of today. If you don’t have more work to do, start searching.

Stop sensationalizing the capital market with headlines that can cause disruptions all because you want traffic to your site. All the gains of July 1st wiped off as you won’t let the market breathe. Everyone must know people are making money. Don’t know how you think that is appropriate.