CutStruct Technology, a startup leveraging technology to cut costs in construction, has raised $600,000 in pre-seed funding. The company says the fund will be used to build its construction procurement product called LiveVend.

The pre-seed funding which was led by Zedcrest Capital, DFS Lab and Lofty Inc, also had participation from angel investors including Kola Aina.

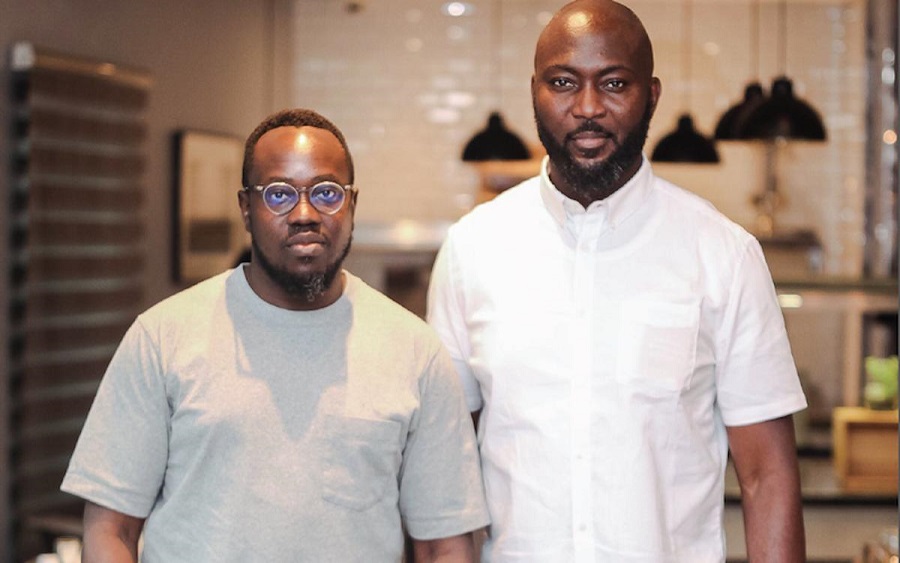

CutStruct is led by two second-time founders, John Oamen and Tayo Odunsi.

Why they invested: While commenting on the fundraising, a Partner at DFS Lab, Stephen Deng said:

- “We invested in John, Tayo and the Cutstruct team because we also believe in the untapped potential within the construction vertical in Nigeria and across Africa. We believe tech-enhanced, specialized B2B platforms like LiveVend have a chance to vastly improve buyer and seller experiences in otherwise traditional industries and unlock massive opportunities to digitize large value streams in the process. The team’s expertise within the industry and their vision to offer highly relevant services backed by their own on-the-ground experiences have been deeply impressive.”

Dayo Amzat – CEO of Zedcrest Capital also clarified why his company backed CutStruct:

- “Over the last decade, Africa, in general, has seen tremendous improvement in many sectors of the economy ranging from payments, e-Commerce, banking, telecoms etc. However, despite the biggest capital asset on the continent being real estate, every aspect of the real estate value chain from construction management to mortgages remains grossly underdeveloped, with very low net promoter scores. We, therefore, welcome the efforts of John and Tayo in helping organise the construction marketplace, bringing much-needed transparency and

- improvements to construction processes. This fits into our interest at Zedcrest, and is in line with a major market development initiative we are currently pursuing with an African-focused housing DFI”

About LiveVend: LiveVend is a construction procurement platform that allows buyers (real estate developers, contractors etc.) to engage vetted vendors on a simple and transparent platform while enjoying other services such as transportation, goods-in-transit insurance and trade credit which is offered by Sterling Banks’ buy-now, pay-later product – Specta for Business.

John Oamen, the CEO of CutStruct, described the platform as very simple. He said:

- “We connect construction vendors to buyers. All the complex work takes place in the background. The vendor vetting, sorting out the appropriate logistics, ensuring the goods are insured, guaranteeing fulfilment and securing financing – these are the complex things we do in the background, while our users engage with a simple platform”.