The monetary policy committee of Nigeria’s central bank voted on Tuesday to raise its benchmark interest rates to 15.5%.

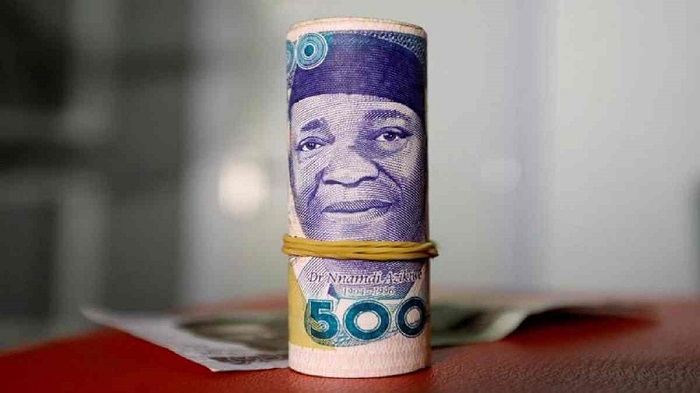

The decision is aimed at saving the naira from ravaging hyperinflation rates and a devastating exchange rate crisis both of which have pummeled the purchasing power of ordinary Nigerians.

But are its latest move enough to save the naira? We think not!

Just under a year ago, in a November 2021 article, Nairametrics forewarned that the Naira was under threat as the US Federal Reserve Bank (FED) had announced a turnaround in its monetary policy stance.

Specifically, the end of the Fed’s accommodative monetary policy stance meant that the US central bank would aim to deploy a combined action of reducing system liquidity, as well as a gradual increase in interest rates.

The anticipated result was that investors needed to brace up for the higher cost of using the Dollar in 2022 compared to prior years and more importantly large funds would rush out of Emerging/Frontier Markets and towards dollar-denominated assets.

To compound the situation, the US labour market has thus far continued to remain resilient and Energy prices have gone amok driven by the Russia-Ukraine conflict.

These additional events simply meant that the US Federal Reserve has had to increase its interest rates faster and higher than it previously wanted to create a vicious cycle of attracting more funds to the dollar and away from other currencies. DXY index is now at a 20-year high.

So what is the point of rising interest rates in the US and a strong dollar?

From an Emerging/Frontier Markets perspective, the ideal reaction was that as early as possible, EM and Frontier Central Banks needed to implement proactive monetary and fiscal policy actions to head off rapid currency depreciation.

These logical monetary and fiscal policy actions included (a) raising interest rates, (b) reducing the money supply, (c) clamping down on inflation differentials (d) supporting high-growth sectors of the economy among others.

Nairametrics readers would be familiar with the factors that influence exchange rates (see image below) or you can read more here and here.

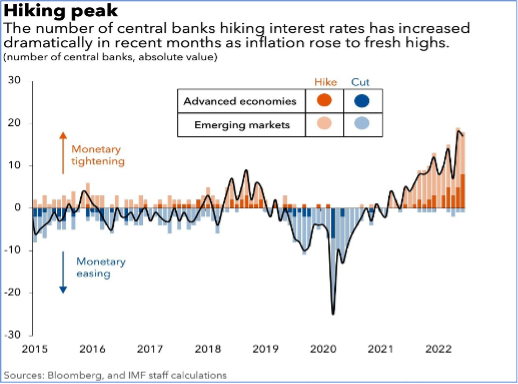

Notably many emerging market (EM) central banks started raising interest rates as early as 2021 whilst advanced economies followed suit in 2022. The key point here is that EM countries started raising interest rates early.

Nigeria’s Central Bank?

Since November 2021, Naira has depreciated in the parallel market from $1/N560 to $1/722 as of the time of writing this article.

This reflects almost a 29% worsening of the Naira and thus begs the question ”what actions have been done to stave off Naira’s currency depreciation”?

For Nigeria, despite the various headwinds on the horizon, none of the expected monetary and fiscal policy actions applicable to Frontier Markets have been taken by the CBN in a proactive manner.

As noted earlier, traditional monetary policy tools included (a) raising interest rates, (b) reducing the money supply, (c) clamping down on inflation differentials (d) supporting high-growth sectors of the economy. To save the naira, the apex bank will have to review its policies focussing on these five core issues.

1. On Interest rates: Remarkably the Central Bank only started raising interest rates in 2022. In actual fact the first increase was just recently in May-2022 to 13%, subsequent increases have resulted in a 15.5% interest rate benchmark.

- In line with our previous article on this low “anti-investor” interest rate, the latest MPR rate of 15.5% is still below current rates of inflation, thus investors are still being exposed to negative real rates of return.

- Even more surreal is that interest rates available to retail investors (savers) continue to be unattractive and there is no product available in Nigeria which offers an inflation-protected risk-free return such as TIPS in the US or Index-Linked Gilts in the UK.

- The monetary policy committee needs to be more aggressive when it meets again in the next committee meeting in November this year.

2. On Money Supply: Nigeria’s Central Bank keeps suggesting that it is concerned about excess liquidity, however the money supply (M2) keeps rising at an alarming rate. The latest print for August shows M2 levels of N49.3 trillion which is simply just stunning.

- Again as our previous article on excessive money supply noted, confusion between words and action simply suggests lip service to monetary policy responsibilities.

- A lot more needs to be done to roll back the money supply and a 15.5% interest rate hike is not enough to achieve this.

- Whilst intervention funds to the private sector (now over N4.5 trillion) have helped fuel economic growth, it has come at the expense of increased money supply.

- The CBN recently rolled back its regulatory forbearance on interest rates for intervention funds, the right decision to combat inflation. It will need to slow down further interventions until the inflation rate cools.

3. On combating Inflation: Nigeria’s central bank suggests it is driving a concerted effort to fight inflation (currently at 20.52%), however looking through the results of the Federal Government’s fiscal performance suggests that the Central Bank has given the Nigerian government over N20 trillion via the Ways and Means facility.

- It is unclear how effectively you can combat inflation whilst supporting an expansionary monetary policy. Unfortunately, most of the money ended up in unproductive recurrent expenditures.

- The CBN will need to reduce the spate of fiscal support it is giving to the federal government and consider clawing back some of the loans in a coordinated matter.

4. On supporting high-growth sectors of the economy: Given Nigeria’s underwhelming GDP growth rates and ultra-high unemployment numbers, some would question why the CBN continues to tout its efforts in the Agriculture sector whilst the Trade, Manufacturing, Education, and Health sectors continue to experience productivity challenges.

- Looking through global deal books, Nigerian-owned technology startups and Tech-enabled real sector solutions continue to dominate the league tables on completed deals.

- Thus arguably, the opportunities to enhance Nigeria’s GDP growth rate would be driven by paying more attention to other sectors of the economy.

5. On dollar Earnings: Nigeria still faces a major balance of payment headwinds even though exports have outpaced imports in the last two quarters.

- The country’s export earnings are still not robust enough to support the demand for forex.

- To make it worse, the apex bank continues to implement forex policies that have essentially dried up foreign portfolio dollars, a major source of forex liquidity in the past.

- The CBN needs to bring back confidence in the foreign currency market by dropping policies that have failed to save the naira.

- Rhetorics such as telling airlines it is their prerogative to source forex dampen investor confidence shutting out the very source of forex we need to save the naira.

In conclusion, over the past year, Nigeria’s Central Bank has been playing catch-up whilst the Naira has depreciated by 29% to $1/722 (compared to $1/560 same period last year).

- A further 29% depreciation over the next twelve months should mean by November 2023, Nigerians should expect the Naira to head towards an N900 – N1,000 range.

It is worth noting that this is NOT an inevitable scenario, however, it would require that both monetary and fiscal policy authorities need to become far more proactive and aggressive in addressing the aforementioned indicators.

- For the CBN to effectively utilize monetary policy tools available to it, monetary policy rates will have to rise fast enough to combat the inflation rate which is currently 20.52%.

- We do not see a 20% plus MPR as unreasonable in light of the challenges that lie ahead.

- Treasury bills and other short terms CBN securities will also need to rise fast enough if it wants Nigerians to hold more naira instead of dollars.

- No surprise, the one-year treasury bills rate rose to 12% a day after the apex bank increased interest rates to 15.5%.

Hopefully, as it is an election year there’ll be sufficient reasons for the appropriate authorities to take a more serious approach to results-driven policy making…or maybe not.