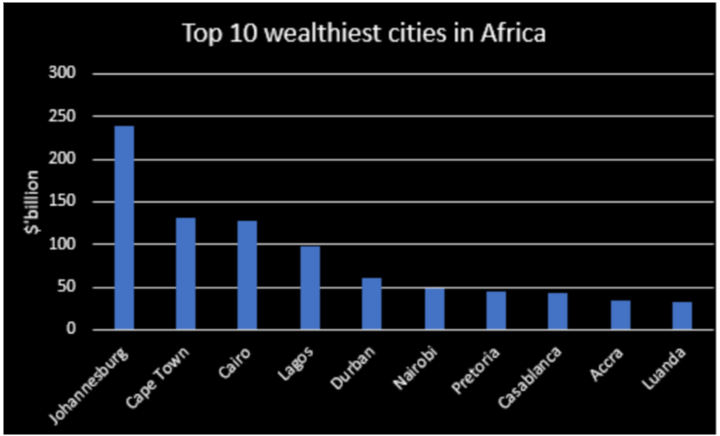

Nigeria’s economic hub, Lagos has been named the fourth wealthiest city on the African continent with a total private wealth of $97 billion. This is contained in the Africa Wealth Report 2022, released by Henley & Partners, in partnership with New World Wealth.

Lagos came fourth behind, Johannesburg in first position, Cape Town and Cairo in second and third positions respectively. Notably, the two wealthiest cities on the continent are in South Africa just as four South African cities make the top ten (Johannesburg, Cape Town, Durban, and Pretoria). Lagos is the most populated city in Africa and a major contributor to the Nigerian economy, with international seaports and airports.

However, Lagos comes behind the likes of South Africa’s Johannesburg and Cape Town, as well as Egypt’s Cairo, in terms of wealth controlled.

In the same vein, Nigeria despite being the largest economy in Africa ranks third behind South Africa and Egypt with a total private wealth of $228 billion, and 10,000 millionaires. Meanwhile, on a per capita basis, Nigeria ranked 11th on the list with $1,100, while Mauritius was top on the list with $34,500.

Highlights

- Africa’s total private wealth as of December 2021 stood at $2.1 trillion, with an estimate of 136,000 millionaires living in Africa, each with net assets of $1 million or more.

- Total private wealth in Africa increased by 5% compared to $2 trillion recorded in the previous year. Although, apart from the year 2020 which was marred by the covid-19 pandemic, 2021 has been the lowest since 2015.

- Approximately, there are 6,700 multi-millionaires living on the continent, each with net assets of $10 million or more in 2021.

- Also, the report noted that there were 305 individuals on the continent with net assets of $100 million or more, while the number of billionaires stood at 21.

- South Africa is home to over twice as many millionaires as any other African country, while Egypt has the most billionaires on the continent.

- Africa’s two wealthiest cities are in South Africa. Johannesburg is the wealthiest, with a total private wealth of US$239 billion, while Cape Town in second place has a total private wealth of US$131 billion.

Notably, South Africa is home to the largest luxury market in Africa by revenue, followed by Kenya and then Morocco. Major components of this include luxury hotels and lodges, cars, clothing and accessories, watches, private jets, and yachts.

Nairametrics reported in July 2022 that Nigerians got richer in 2021 based on income per capita, which rose to $5,250 from $5,000 recorded in the previous year, based on data from the World Bank. The increase was attributed to increased economic activities following the lockdown measures in the previous year to curb the spread of the covid-19 disease.

In 2021, Nigeria ranked as the largest economy in Africa with a total GDP of $440.78 billion, followed by South Africa and Egypt with GDP estimates of $419.9 billion and $404.1 billion respectively. Despite being the largest African economy, due to the huge population size of over 200 million, it ranked 17th in terms of per capita.

According to the report, it relied on wealth as a measure of financial health ahead of GDP because, in many developing countries, a large portion of the GDP flows to the government, hence having little impact on private wealth creation.

What you should know

- The total wealth held in Africa has fallen by 7% over the past decade (2011 to 2021) The performance was constrained by poor returns in the three largest African markets, namely South Africa, Egypt, and Nigeria.

- In the 10-year review period, Mauritius was the fastest growing market in Africa, followed by Rwanda and Ethiopia.

Nigerian banks are actually doing great now compared to years back when the started

This report seems flawed at an exact 10000 individuals. It would shock you