The Nigerian pension fund industry hit another milestone in September as its total asset value hit and surpassed the N13 trillion mark for the first time. This is according to the unaudited report on the pension fund industry for September 2021, published by PENCOM.

As pension and retirement funds all over the world continue to grow, Nigeria is also not being left out. This is evident by the 5.6% year-to-date increase recorded in the net assets of the industry. According to data from the National Pension Commission, total pension fund assets in Nigeria grew to N13.001 trillion ($31.69 billion) as of September 2021.

Similarly, the number of RSA registrations also increased to 9.46 million in September from 9.43 million as of the previous month. Also, between January and September 2021, a total of 245,385 new RSA registrations was recorded.

Highlights

- As of 30th September 2021, a sum of N8.22 trillion has been invested in FGN securities, representing 63.2% of the total net assets.

- On the other hand, 17.6% of the funds were invested into local money market instruments at N2.29 trillion.

- A total of N968.26 billion was invested in corporate debt securities as of the review period, which accounts for 7.4% of the total fund. Investments in corporate debt securities also increased by N131.93 billion on a year-to-date basis.

- Investments in mutual funds dropped by 27.6% year-to-date to stand at N116.84 billion, whilst accounting for the least quota in their investment portfolio.

Compared with the previous month, pension fund assets increased by N100.57 billion from N12.9 trillion. The increase is attributable to increased contributions from retirement savings account holders, better investment performance and an increase in the number of people that registered into various retirement savings accounts.

The increase could also be attributed to the creativity of the Pension Commission, whose effort to come up with a Sharia-compliant pension fund, Fund VI, added N7.8 billion to the total assets of pension funds in Nigeria. The growth of pension fund assets has been in the ascendency in Nigeria as indicated in the chart below.

RSA Fund II drives industry growth

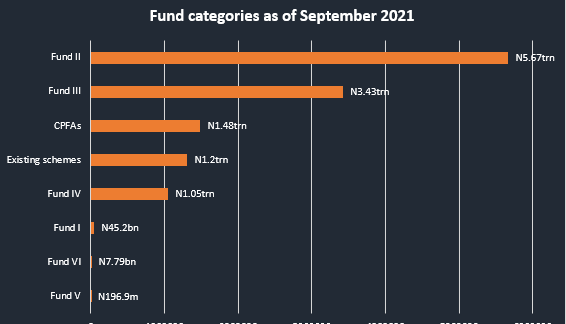

The RSA fund II category increased by N315.12 billion between January and September 2021, representing a 5.88% increase from N5.36 trillion recorded as of December 2020 to N5.67 trillion as of the end of September 2021.

RSA fund II, which is the default fund for active contributors who are 49 years and below accounted for the lion share of the fund, which is 43.6% of the total net assets.

RSA fund III followed with N3.43 trillion, representing 26.4% of the total, while CPFAs accounted for 11.5% of the total net assets at N1.49 trillion.

It is worth noting that RSA fund II is a balanced fund with the intention of capital preservation while pursuing fair returns in the long term. About 10% to 55% of the pension funds can be invested in variable income instruments. Although it is typically a default fund for contributors aged 49 and below, they can also opt to switch to Fund I based on their request.

Notably, assets in Fund I totalled N45.14 billion, Fund II assets were N5.67 trillion, Fund III assets stood at N3.4 trillion while the assets in Fund IV totalled N1.05 trillion. Newcomers, Funds V or micro pension fund and Fund VI, Sharia Compliant pension fund had asset totals of N196.9 million and N7.8 billion respectively.

Nigeria Vs USA

Though the growth in pension assets is a giant stride in Nigeria, it is a far cry from what obtains in the United States of America. As at the end of the second quarter of 2021, Retirement Assets in the US totalled $37.2 trillion, according to data from the Investment Company Institute. That represents a 4.8% increase when compared with the ending balance as at the first quarter of 2021.

The huge disparity in the retirement assets in Nigeria and the US is not surprising given the level of financial literacy in the US versus Nigeria, and the high level of awareness being created in the United States on the importance of retirement savings.

In addition to all that, the US has a series of tax policies aimed at incentivizing the citizenry to save for their retirement. According to the same data, retirement assets account for 33% of all household financial assets in the US as at the end of June 2021.

Bottom line

The Nigerian pension industry continues to wax stronger with improved competition amongst the 22 players in the industry. However, due to the conservative investments of the PFAs they often post only single-digit returns.

A recent analysis carried out by Nairalytics showed that the best performing PFAs in the country between January and September 2021, printed single-digit ROI in the period. Specifically, ARM Stanbic IBTC, Veritas Glavills and ARM Pension topped the list with 6.79%, 6.29%, and 6.02% year-to-date ROI respectively.

.gif)