The market capitalization of the top five banks referred to as the Tier-1 banks grew to N2.51 trillion at the close of business on July 23, 2021, as investors in these banks gained N25.56 billion during the trading week.

According to data from the Nigerian Exchange (NGX), the market capitalization of the top five banks grew to N2.51 trillion to appreciate by 1.0% during the week.

The gain can be attributed to the buy-interests witnessed in the share prices of the banks, during the three trading days.

A summary of performance for each bank is captured below.

FBNH PLC

First Bank Holdings Nig. Plc gained a total of N7.18 billion after its market capitalization grew from N262.04 billion to N269.21 billion at the close of business on Friday.

The growth is due to the appreciation in its share price which closed at N7.50, gaining about 2.7% at the end of the week.

During the week, investors traded about 16,175,833 units of the bank’s shares valued at N119.56 million. The volume of shares traded depreciated immensely by 13.15%, when compared to 18.63 million units traded the previous week.

Earlier in the month, First Bank of Nigeria Limited announced a webinar event designed for SMEs, to enlighten entrepreneurs on how to access finance for their businesses.

The bank is yet to release its second quarter results.

UBA PLC

United Bank for Nigeria Plc gained N1.71 billion as its market capitalization appreciated from N265.05 billion to N266.76 billion, due to the increase in its share price from N7.75 to N7.80, reflecting a growth of 0.6%.

UBA Plc, during the week, traded a total of 24,142,909 units valued at N187.10 million. In comparison, the bank’s share volume depreciated by 66.11%, from 71.22 million traded last week.

UBA Plc is yet to release its second-quarter financial statements for Q2 2021.

GTB Holding Company Plc

GTCO Plc gained a total of N5.89 billion after market capitalization appreciated to N871.16 billion at the end of yesterday’s trading session.

The growth can be attributed to the increase in the company’s share price, from N29.40 traded at the end of last week, to N29.60 at the close of business, reflecting a growth of 0.70%.

During the trading week, Investors traded a total of 24,138,737 units of the bank’s shares valued at N712.00 million, making the bank the second-most traded stock amongst the FUGAZ during the week.

In contrast with the volume traded last week, share volume for this week decreased by 80.03% from 120.90 million.

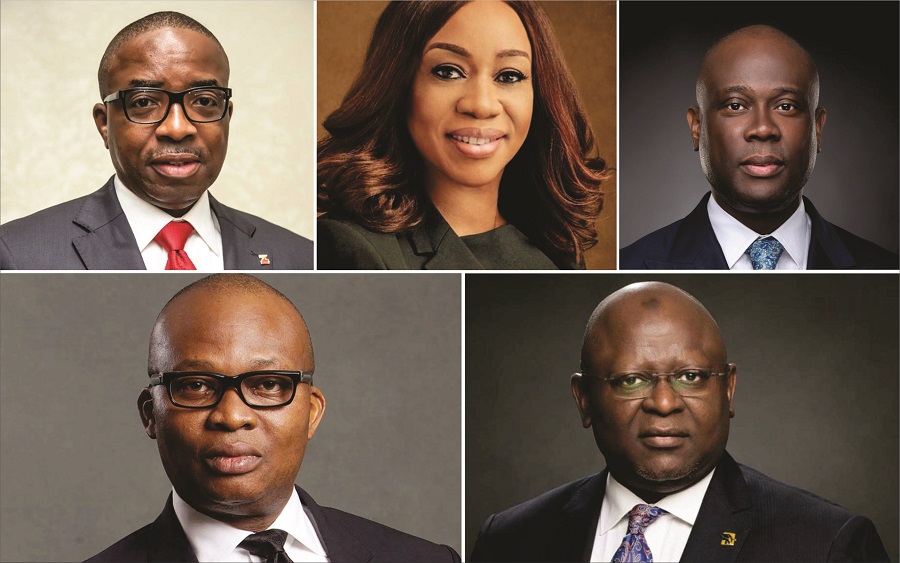

Recall that the bank recently announced the appointment of Mrs Miriam Olusanya as the new MD of Guaranty Trust Bank, following the end of Segun Agbaje’s tenure.

Access Bank Plc

Access Bank Plc depreciated by N1.78 billion as its market capitalization decreased to N325.24 billion at the end of the trading week. The loss was due to a 0.5% decrease in its share price from N9.20 traded earlier to N9.15.

At the end of the week, investors had traded a total of 19,610,801 units of the bank’s shares valued at N179.33 million. The total volume traded for the week declined by 63.98%, from a total of 54.44 million traded in the previous week.

Earlier this month, Fitch Ratings revised the outlook on Access Bank Plc’s Long-Term Issuer Default Rating (IDR) from Negative to Stable and also confirmed the rating at ‘B.’

Access Bank Plc is yet to release its Q2 financial result for the year.

Zenith Bank Plc

Zenith Bank Plc gained N12.56 billion after its market capitalization advanced to N780.20 billion from N767.64 billion at the end of the trading week. This growth can be attributed to the 1.60% increase in its share price from N24.45 traded at the end of last week, to N24.85 at the end of this week.

Hence, a total of 37,941,068 units of the bank’s shares were traded during the week, valued at N939.22 million, making the firm’s stock the most traded stock amongst the FUGAZ during the week and trading the highest number of shares on Friday at 24.29 million units, valued at N604.08 million at the end of the trading day.

The total volume, in comparison with the previous week, depreciated by 45.66%, from 69.82 million units traded last week.

During the week, the Board of Directors of Zenith Bank Plc at its meeting of Friday, July 23, 2021, considered and approved the 2021 Half Year Audited Results of the Group, however, still subject to approval by the central bank of Nigeria.

What you should know

- The Nigerian Exchange Limited (NGX) closed positive week-on-week as ASI appreciated by 1.89% to close at 38,667.90.

- The FUGAZ banks make up over 70% of the NSE Banking sector index, hence, they strongly influence the growth or otherwise of the index.

- The NGX banking Index closed positive to increase by 0.44% and closed at 384.99.

The rest of this content is for our Premium Newsletter Subscribers SSN. Subscribe here to receive this newsletter every week via your email.