“Aig-Imoukhuede… gives us a frontline account of what it means to seize opportunities and weather risks in Africa’s banking industry. I recommend the book to all who want to get an inside view of what it takes to create and grow a successful business in Nigeria’s challenging but opportunity laden business environment.” Dr Ngozi Okonjo-Iweala, Director-General of the World Trade Organization and Nigerian Minister for Finance (2003-2006, 2011-2015)

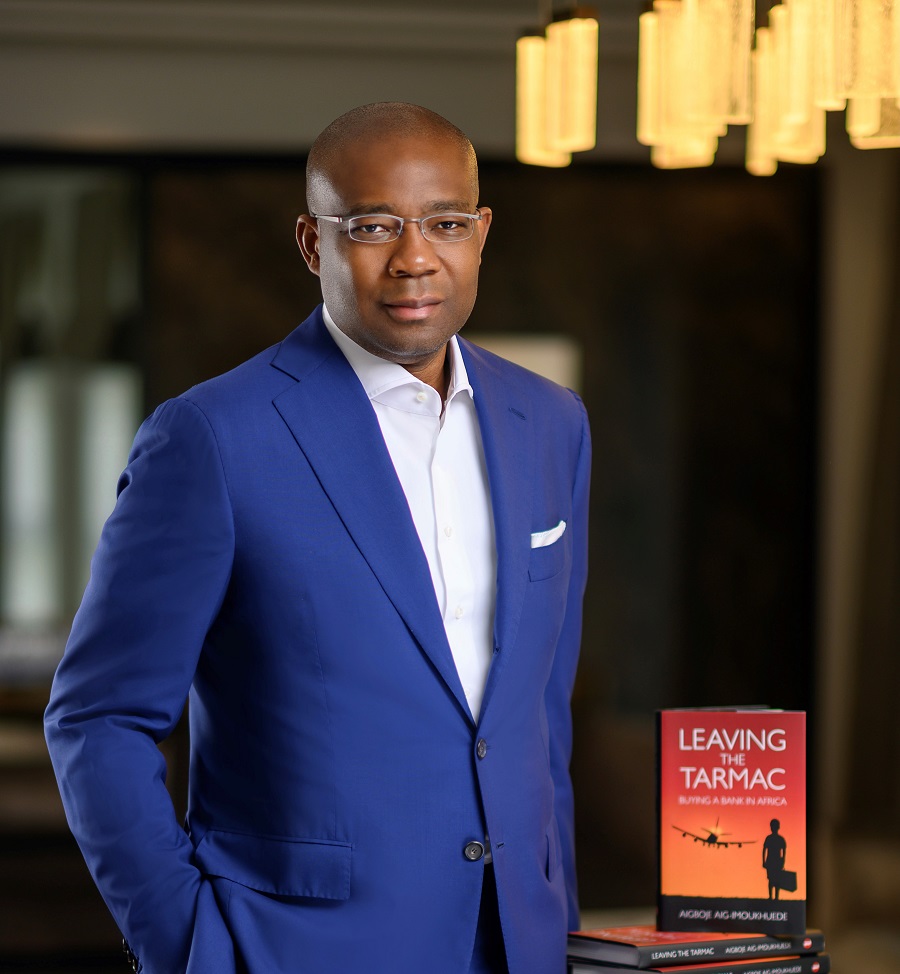

On 29th March 2021 Aigboje Aig-Imoukhuede, former CEO of Access Bank, one of the largest banks in Nigeria, will launch his new book Leaving the Tarmac: Buying a Bank in Africa. The book tells the story of how Aigboje Aig-Imoukhuede and Herbert Wigwe took a leap of faith and purchased an ailing bank in 2002, that they would go on to transform into an institution that has had a profound and long-lasting impact on the Nigerian banking and financial sector.

Containing never-before-revealed insights into the Nigerian banking and financial sector, the book reveals how the creation of Access Bank resulted in spreading prosperity for thousands, and in so doing established Aigboje Aig-Imoukhuede among the continent’s most inspiring and impactful entrepreneurs of the 21st century.

Aig-Imoukhuede commented: “My intention in penning the book was to motivate others to take up the challenge and unlock the power of our national economy and our people. I hope this book will inspire others as much as Nigeria and Africa inspire me. I’m inspired by the resourcefulness and resilience of the people; the richness of the land; and the heritage of those who came before us. This is a place of limitless potential, and opportunity.

“I want to show that nothing is impossible when you are part of a passionate, committed, hard-working team and when faith is the bedrock on which you build your life and your enterprises.

“However, this is not the end of the journey for me and those close to me both personally and professionally. We are moving on to other things and to being the change we want to see in Africa.

Aigboje Aig-Imoukhuede will make a number of significant announcements about his plans for the future at the launch of Leaving the Tarmac: Buying a Bank in Africa. These announcements include a significant multi-generational financial commitment focused on building Nigeria’s next generation of government leaders, helping transform public sector effectiveness, and improving access to quality primary healthcare. Profits from the sale of Leaving the Tarmac will be channeled to The Adopt-A-Health Facility Program (ADHFP) in Nigeria.

“This is a momentous occasion for me and for everyone who has been a part of this story. I look forward to sharing my Access Bank story with Nigeria, Africa and the world.”

To purchase a copy of the book or download an excerpt, please visit https://www.leavingthetarmac.com/

Praise for Leaving the Tarmac:

“Aig … gives meaning to grit and authenticity, taking us on a journey that closes the gap between harsh reality and one’s aspiration, giving young Nigerians, especially women in the finance sector the inspiration to dream, weather the storm and achieve greatness,” Amina J Mohammed, United Nations Deputy Secretary-General

“Aigboje has written a book that is a record of an important part of the history of Nigerian banking in a lucid and jargon-free manner, along the way telling a story about Nigerian economic history, about regulatory reforms, and about key actors in government, the central bank, the banking industry and big business with whom it was his lot to interact over the decades,” Muhammad Sanusi II, CON, 14th Emir of Kano & Governor, Central bank of Nigeria (2009-2014)

READ: Access Bank’s ex-CEO weighs in as post-merger fear creeps in

“Written with brutal honesty, lucidity and humility. The principles in this book are sound, practical and pragmatic, drawn out of the deep wells of personal experience, and inked with sincerity, honest rendition and transparency on what worked and did not work, to help others. One of the best business books I have ever read. Easy to read. Transformational. Memorable. Golden.” Dr Akinwumi Adesina, President Africa Development Bank and Nigerian Minister of Agriculture (2010-2015)

“It’s a powerful tale of leadership and institution-building amidst weak regulatory institutions and a changing cast of politicians, Central Bank governors and competitors.” Professor Ngaire Woods, Founding Dean, Blavatnik School of Government, University of Oxford, UK

“Everyone has a creation story, and Aig-Imoukhuede’s is compelling in the way that it seemed to be the primary driver of a young and successful banker’s towering ambitions: a prism through which we come to understand how he shaped his own career, and all the choices he would later make as he pushed towards what, now in hindsight, seemed all but inevitable,” Dele Olojede, International journalist, Publisher and Pulitzer Prize winner

“In his candid body of work, the writer thoroughly simplifies and brings into relatable context, timeless business know-how as building blocks for a sustainable enterprise. His undeniable footprints and giant strides in the African banking sector gives him the vantage position in this book to steer a growing breed of African leaders to success,” Aliko Dangote Founder & President of the Dangote Group.

“Leaving the Tarmac is an excellent compendium of some of the major challenges which investors with audacious goals must learn to overcome and some of the lessons enumerated via simple real life stories and situations can significantly shorten the learning curve for others trying to contemplate starting a new business or taking over and transforming an existing business that is not doing very well,” Atedo Peterside Founder of Stanbic IBTC and board member Standard Bank of South Africa

For further information, please contact:

Tosin Ibrahim oibrahim@tengenfamilyoffice.com +234 706 804 8190

and/or

Patience Salami patience.salami@aigafrica.org + 234 703 095 290