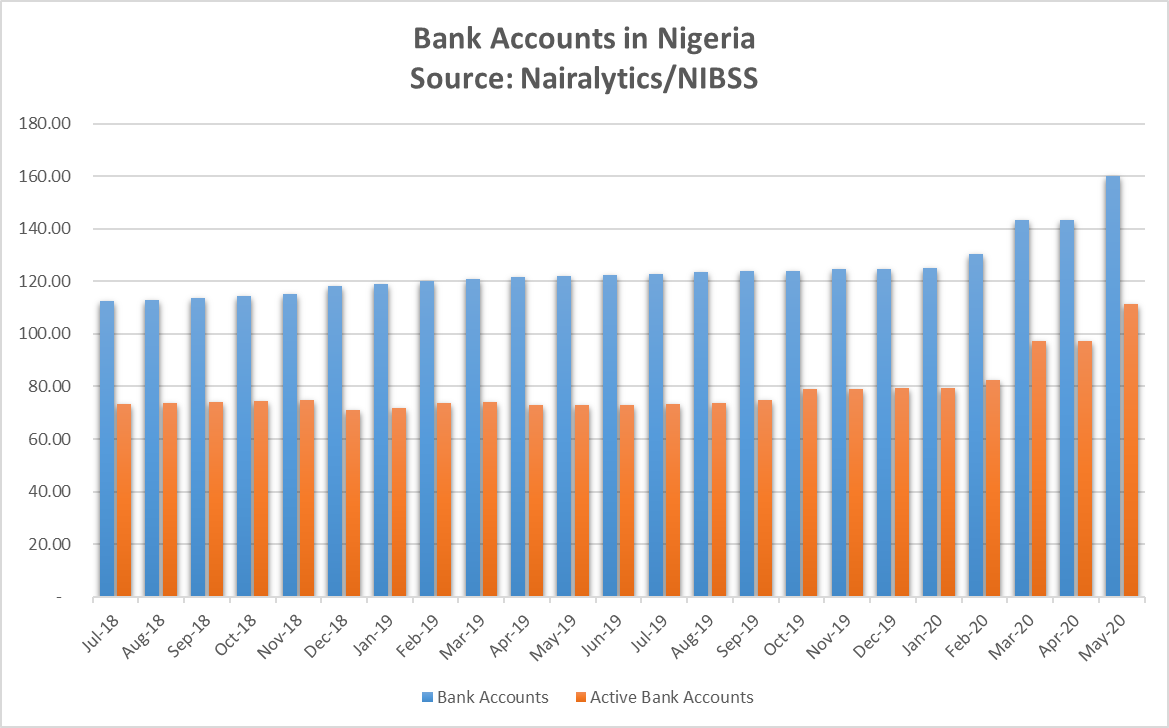

Nigeria’s active bank account increased by 14.41% from 97.485 million active accounts to 111.54 million, data from the Nigerian Inter-Bank Settlement System Plc (NIBSS) reveals.

The increase is a big boost to achieving the National Financial Inclusion Strategy (now revised) goal aimed at reducing the financial exclusion rate from the baseline figures of 46.3% in 2010 to 20% in 2020.

READ: How to protect your bank accounts from hackers and fraudsters

Key metrics

- Nigeria recorded a total of 160, 038 bank accounts for the period under review, 30.31% of the accounts translating to 48.5 million accounts were dormant. However, the percentage of dormant accounts reduced within the period under review when compared to the April 2020 figures, while the absolute number increased.

- As of April 2020, approximately 45. 90 million accounts were dormant which is about 32% of the total bank account obtainable, while in May 2020, the absolute number increased to 48.5 million, however it was only 30.31% of the total bank accounts which is 1.69% down.

- Total savings account increased by 13.8% from 114.13 million accounts recorded in April 2019 to 129.91million accounts in May 2020. Also, Current accounts increased by 3.59% from 24.3 million accounts to 25.17 million accounts.

- The financial Inclusion rate as of 2018 was 63.2% which is a 4.4% increase in the 2016 figures of 56.8%. The figures are bound to improve in 2020. To achieve the 70% benchmark in 2020, it is pertinent to leverage on technology to provide affordable financial services.

READ: Value of shares traded by top 10 stockbrokers up 133% despite COVID-19

The licensing of Payment Service Banks and digitization of most of the Deposit Money Banks services have in a long way contributed to the continued improved performance of the financial inclusion figures.

Why the surge?

Nairametrics had reported the impact and opportunities available for financial service agents in Nigeria during COVID-19. The report highlighted that the Central Bank of Nigeria excluded super-agents from the list of financial institutions exempted from government lockdown restrictions and the positive multiplier effect of this announcement.

The lock-down period reinforced the position of agent banking as an important part of the financial ecosystem. They are close, convenient, and cost-effective. On an operational basis, most agents had to rebalance through ATM to meet liquidity needs.

READ: Twitter freezes password reset to address cyberattack

On why the total active, savings, and current accounts increased during the period under review irrespective of the gloomy economic situation, Mr. Samuel Olaniyan, a banking expert informed Nairametrics that “the increase is partly due to the lack of better investment alternatives and also due to the lockdown”.

For example, fixed deposit rates and treasury bills rate within those periods were around 1-2% and most people with maturing investments would rather keep their money in their savings (3.5%) and some would rather not invest at all.

Secondly, due to the pandemic, there wasn’t a lot of money moving around and a lot of people had to make sure their savings is safe and secure (of course in their bank accounts).

READ: CBN grants licenses to 3 Payment Service Banks

Why this matters

As one of the National Financial Inclusion targets, by 2020, an excerpt from the Revised Nation Financial Inclusion Strategy reads thus; ‘‘It is expected that 60% of the total adult population which translates to 6.3 million people should have been financially included. The 2020 revised strategy target for Agents pegs it at 476 Agents per 100,000 adults. The justification for this new figure is based on recent developments in the financial sector aimed at taking financial services to the unserved and under-served using branchless platforms such as Agent banking and digital platforms. It is estimated that at least 500,000 Agents should be available to serve about 105 million adults population in Nigeria by the year 2020. This gives about 476 Agents per 100,000 adults”.

From the above set targets, it is not out of place to state that despite the remarkable progress made in the number of active bank accounts and savings which are important metrics in the financial inclusion drive, there is still a room for improvement as far as meeting the financial inclusion target is concerned.

READ: UBA reports profit of N30.1 billion for first quarter of 2020

To access the data in full, click HERESource: Computations from NIBSS data

An awesome narration.

Please could you provide an updated source for the raw data, the link doesn’t work