Money Market: The money market rate decreased last week as the Overnight rate (OVN) and Open Buy Back (OBB) fell to 5.29% and 4.57% from 10.00% and 9.14% respectively. As a result, the average money market rate decreased by 4.64% to settle at 4.93% due to the absence of CBN liquidity mopping activity (OMO) last week. The System Liquidity is estimated to have increased to close at cN290bn.

Major Inflow for the week included: OMO Maturity of cN117bn, DANGCEM and FSDH Commercial Paper Maturity of cN45bn while major outflow for the week included: Weekly Wholesale, Invisible and SME FX auction of $210mn.

We expect the rate to trend upward this week as CBN is expected to renew its mopping activity and as Bond auction is expected to hold during the week.

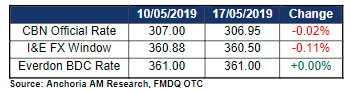

Forex: The CBN Official rate rose marginally by 0.02% last week to close at N306.95/$ while the rate in the Investors and Exporters’ FX Window fell slightly down by 0.11% to close at N360.50/$ despite an increase of 48% in average market turnover to close at $1.44 billion during the week. However, Naira at the parallel market remained unchanged to close at N361.00/$ (using the Everdon BDC Rate).

We expect rates in the parallel market to remain constant as the apex bank continues to supply FX into the market, coupled with its frequent Wholesale and Retail SMIS programme.

Commodities: Brent Crude Oil and WTI Crude Oil rose by 2.25% and 1.78% to close at $72.21 and $62.76 per barrel respectively even as geopolitical tensions between the United States and Iran continues. According to Reuters, Saudi Arabian Energy Minister Khalid al-Falih said there was a consensus among the Organization of the Petroleum Exporting Countries (OPEC) and other oil producers to slowly reduce crude inventories slowly.

Fixed Income Bond: The Bond Market closed on a bullish note last week as average yields fell by 11bps to close the week at 13.95% due to the continuous reduction seen on short term securities (T-bills) during the week. The yield fell across most maturities, including 2020 (-54bps) and 2021 (-44bps).

The following activities are expected to shape market activities during the week:

• Decision at the CBN Bi-monthly Monetary Policy Committee Meeting is set to hold between Monday and Tuesday, 20–21 May 2019.

• Q1 2019 GDP Report

• Bond Auction, which is expected to hold on Wednesday, 22 May 2019 We expect market participants to remain cautious in the early part of the week.

Treasury Bills: Due to relatively buoyant liquidity coupled with an absence of OMO auction, secondary treasury bills market closed on a bullish note last week. The average yield fell by 78 bps to close at 12.14% from 12.14% in the previous week.