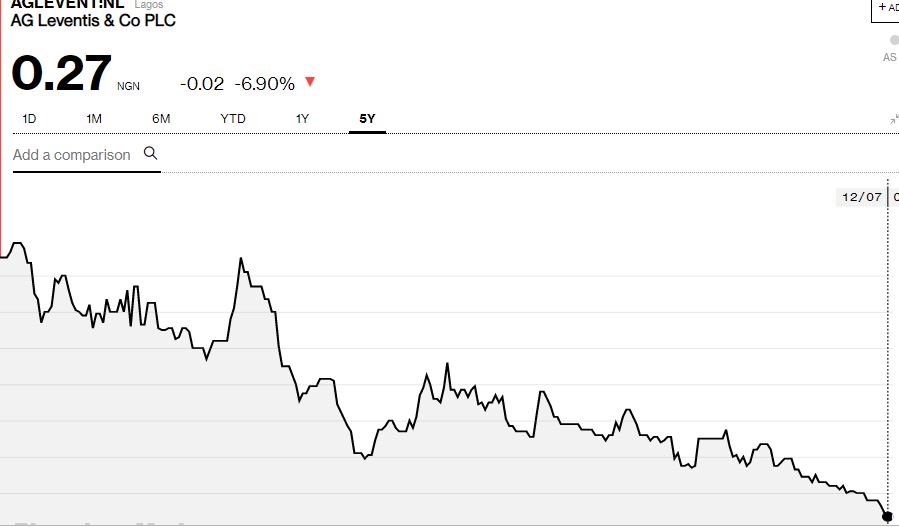

AG Leventis yesterday hit a 5 year low of N0.27 in yesterdays trading session on the Nigerian Stock Exchange (NSE). Year to date, the stock is down 61.43%, and is the worst performing conglomerate on the NSE.

For investors that have held the stock over the last 5 years, the capital losses are much worse. The company’s share price has dipped from N1.70 sometime in 2014, to its current price, a loss of 84.1%

Why has the company done so badly?

A combination of poor macroeconomic conditions and management’s slowness to pivot have led to mounting losses over the last three years.

In 2016, the group recorded a loss due to a spike in operating expenses. For the 2017 financial year, the firm also recorded a loss primarily due to its impairment of plant and machinery of Leventis Foods Limited by N1.6 billion.

Chairman of the company, Ahmed Kazama Mantey, in the company’s 2017 annual report, stated that Pikwik would roll out its first store this year. Pikwik Nigeria Limited is a joint venture partnership with South African retail giant, Pick n Pay. Not much has happened.

2018 is also dire

For the nine months ended September 2018, revenue continued to decline, even though loss before tax reduced from N1.5 billion in 2017 to N844 million in 2018. This was largely due to lower finance costs, sales, and administrative expenses.

No segmental breakdown was provided.

Another bleak year for shareholders

The continued losses by the firm means shareholders are unlikely to get any dividends. Companies are barred from paying dividends while having negative retained earnings. AG Leventis did not pay a dividend in 2017.

How low will it go?

A 20 kobo floor on the NSE means the stock could decline even further by the time it releases its full-year 2018 results sometime next year.

About A.G Leventis Plc

A.G Leventis was incorporated in Nigeria as a private limited liability company in 1952, and was converted to a public limited liability company in 1978. It was listed on the Nigerian Stock Exchange on the 29th of November 1978.

The principal activities of the Group and Company include the sale and servicing of passenger cars, commercial vehicles, agricultural and construction equipment, property letting and management.

The company (as well as its subsidiaries and associates) are also involved in the provision of food, hospitality services, manufacturing and sales of flexography and rotogravure inks for flexible packaging products and paints.