- MBO Capital Management has invested over $6 million in 35 film and television projects since 2017, leveraging Nigeria’s creative economy growth of 1,244% between 2012 and 2023, driven by a youthful population and rising global influence of African culture.

- Despite Nollywood’s scale, challenges such as limited cinema infrastructure, high ticket prices, and distribution gaps persist, creating investment opportunities in modern cinemas, digital platforms, post-production facilities, and technology-driven distribution solutions.

- MBO aims to unlock Africa’s creative potential through flexible financing and strategic investments across six verticals—Film, TV and Digital Content, Music, Theatre Arts, Food, Fashion, and Fine Arts—mobilizing capital to strengthen the continent’s soft power globally.

MBO Capital Management Limited (“MBO”) began investing in Nigeria’s creative economy soon after the country rebased its GDP in 2014. According to the National Bureau of Statistics (NBS), this rebasing exercise expanded the GDP basket to include activities such as Information and Communication Services, as well as Arts and Entertainment (A&E).

In 2012, A&E contributed just 0.08% to Nigeria’s GDP.

Following President Buhari’s 2015 election, the country experienced two economic recessions (2016 and 2020).

During these contractions, traditionally dominant sectors i.e Agriculture, Oil & Gas, Trade, and Financial Services, shrank, while the A&E sector grew nearly four-fold, rising to 0.3% of GDP. Between 2012 and 2023, the A&E sector grew by 1,244%, in stark contrast to the Oil & Gas sector’s 20% contraction and the overall GDP decline of 22%.

Nigeria’s demographics further reinforce the sector’s potential. The country’s estimated population exceeds 230 million, with a median age of 18.1 years, far below Africa’s median age of 19.7 and the global median of 30.4.

The World Bank estimates that the A&E sector employs more 15–29-year-olds than any other sector globally, creating nearly 50 million jobs worldwide. In Nigeria, individuals aged 15–35 made up approximately 45.46% of the country’s population in 2021.

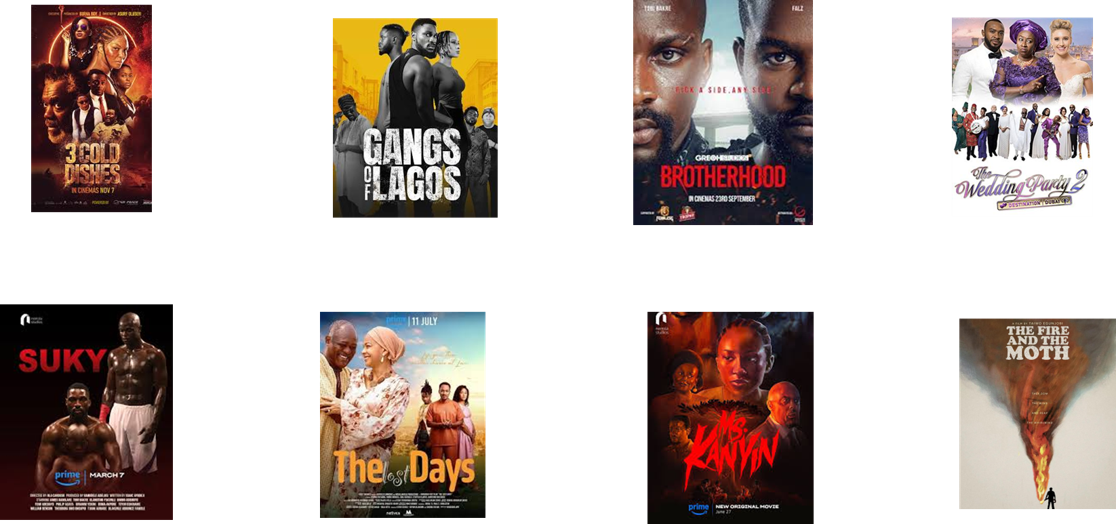

Across Africa, the creative industry is valued at an estimated $58–59 billion, influencing global culture through music, film, fashion, and digital content. This combination of rapid sector growth and a young population informed MBO’s first creative investment in 2017, a slate of three films by Inkblot Productions. As of Q3, 2025, we have invested over $6 million in 35 film and television projects, 26 of which have been released in cinemas and on international streaming platforms.

Despite abundant potential, Africa’s creative ecosystem still faces significant challenges, particularly around scale and funding. Our early film investments revealed both opportunities and barriers within the sector. Building on this experience, we analyzed the creative economy through an African lens and identified six core verticals: Film, TV & Digital Content; Music; Theatre Arts; Food; Fashion; and Fine Arts

Film, TV & Digital Content

Africa’s film, TV, and digital content landscape is one of its fastest-growing creative drivers. The growth is fuelled by rising consumer demand, new-age storytellers, and expanding digital distribution. This segment includes:

- Film and television production

- Streaming and on-demand services

- Animation and short-form storytelling

- Video gaming and e-sports

- Social-media-driven digital creators

With increasing mobile penetration, a youthful population, and expanding digital infrastructure, Africa (especially Nigeria) has a fast-evolving interactive entertainment ecosystem.

Film as an FMCG Product

Film behaves similarly to a fast-moving consumer good (FMCG): success depends not only on quality but also on marketing and distribution. As with any consumer product, awareness must precede demand. From our experience, approximately 30% of a film’s budget is often required for marketing. Critically acclaimed films have underperformed due to inadequate promotional investment.

Distribution is another bottleneck. Nigeria has only 333 cinema screens across 102 locations, serving over 230 million people, one of the lowest screen-per-capita ratios globally.

| Country | Population (M) | Screens | Screens per Capita |

| US | 347 | 38,000 | 1 : 9,139 |

| UK | 69 | 4,587 | 1 : 150,425 |

| China | 1,416 | 90,928 | 1 : 15,574 |

| India | 1,464 | 9,927 | 1 : 147,467 |

| South Africa | 63 | 785 | 1 : 80,255 |

| Nigeria | 238 | 333 | 1 : 713,213 |

Nigeria’s limited cinema infrastructure makes it difficult for Nollywood productions to profit solely from theatrical runs. Most producers aim merely to break even in cinemas to strengthen their negotiating leverage with streaming platforms, where they retain more of the revenue.

Affordability Challenges

Cinema ticket prices, ranging from N7,500 (~$5) to N10,000 (~$6.70) in Lagos and Abuja, place the cinema experience beyond the reach of large segments of the population. Community cinemas, using churches or viewing centres have been proposed as more accessible alternatives.

Distribution Gaps and Investment Opportunities

Nigeria’s distribution challenges present notable investment opportunities, including:

- Modern cinema infrastructure

- Digital distribution platforms

- National-level distribution hubs

- Technology-driven distribution innovations

Streaming has absorbed some of the demand, but challenges persist. Many Nigerians consume streaming content on mobile devices, with YouTube dominating due to affordability. Netflix and Amazon Prime maintain global quality standards that local productions sometimes struggle to meet, creating a gap for locally driven streaming platforms.

Emerging home-grown platforms like EbonyLife ON Plus, Kàva, Circuits TV, EnfiTV, Gree-Oh are seeking to address this gap. Many are raising capital for content acquisition and original production, often backed by established production studios entering the distribution space.

Post-Production and Infrastructure

Nigeria produces over 2,000 films annually, yet many filmmakers outsource key post-production services, increasing overall costs. Investments in:

- high-quality post-production facilities,

- sound stages,

- equipment rentals, and

- technical training

would raise standards and localize more of the film value chain.

Looking Ahead

While Film, TV & Digital Content dominate discussions around Africa’s creative economy, they represent only one part of a larger, vibrant ecosystem. In the second part of this series, we shift focus to other major verticals, Music, Fine Arts, Theatre Arts, Fashion, and Food, each rich in cultural and economic potential.

At MBO, we remain committed to unlocking the creative sector’s full promise through flexible, risk-sharing financing tailored to the unique realities of creative enterprises. As Africa’s creative influence continues to grow globally, we aim to bridge the gap between creatives and investors, mobilizing capital to drive sustainable growth and strengthen the continent’s soft power.

By Adekunle Adebiyi, Folajimi Alli-Balogun, Irewole Akomolafe, and Makuochukwu Nwagbo

This is good. Well done, MBO Capital.

Are you thinking of launching an Entertainment Fund to provide long-term capital for movies and series?

What’s the place of the government in providing a more suitable industrial environment for the A&E sector to grow?

Thanks.