Escalating costs of drugs and hospital consumables are reshaping Nigeria’s healthcare financing landscape, forcing hospitals to raise service tariffs and compelling Health Maintenance Organisations (HMOs) to increase premiums significantly.

These adjustments, driven by inflationary pressures, surging import costs, and rising overheads, have shifted more financial burden to consumers, many of whom now struggle to afford quality healthcare.

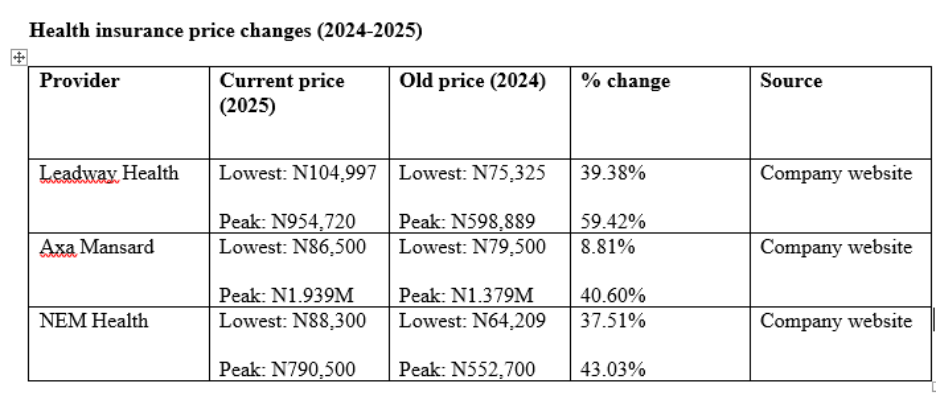

Between 2024 and 2025, health insurance premiums have risen sharply across nearly all categories, with increases ranging from 8% on the lower end to as high as 59% for top-tier plans.

Nigerians who previously paid between N79,500 and N1.379 million annually for coverage now face premiums between N86,500 and N1.939 million.

This steep adjustment reflects an industry-wide restructuring as healthcare providers and insurers adapt to a rapidly deteriorating cost environment.

Expanding HMO offerings amid rising prices

A comparative review of offerings from five leading HMO providers—Axa Mansard, Leadway Health, Hygeia HMO, Avon HMO, and HCI Healthcare—shows that insurers have widened their product tiers while recalibrating prices upward to maintain viability.

Axa Mansard

Axa Mansard now offers six tiers, with the entry-level Bronze plan priced at N86,500 and the elite Rhodium plan rising to N1.939 million. Other plans include:

- Silver – N127,725

- Gold – N253,192

- Platinum – N409,515

- Platinum+ – N685,371

Leadway Health

Leadway Health offers five retail plans:

- Strawberry – N104,997

- Cranberry – N147,790

- Blueberry – N254,826

- Blackberry – N585,975

- Raspberry – N954,720

Hygeia HMO

Hygeia focuses primarily on family packages:

- HyBasic (4 members) – N292,400

- HyBasic (6 members) – N333,930

- HyPrime (4 members) – N746,320

- HyPrime (6 members) – N916,710

Avon HMO

Avon targets middle- and upper-income earners:

- Life Plus – N307,516

- Premium Life – N485,660

- Boss Life – N978,267

HCI Healthcare

HCI offers some of the highest-end plans on the market:

- Titanium Compact – N227,500

- Klassic – N267,020

- Ultra – N338,000

- Deluxe – N794,300

- Titanium Royal – N3.160 million

Rising cost drivers across the healthcare supply chain

Industry insiders confirm that hospitals initiated much of the recent price adjustment, citing soaring costs of drugs, consumables, utilities, and staffing.

A senior staff member at a major Lagos HMO, identified only as Remi, told Nairametrics that the increases were unavoidable.

“The rise in the cost of drugs and other hospital supplies is one of the reasons private hospitals increased their subscription fees.

“The cost of running the business has gone up across the board, and hospitals have passed these costs to HMOs, which in turn had to adjust premiums,” she said.

According to her, essential drugs such as malaria treatments, previously priced between N1,500 and N1,800, now retail between N3,500 and N4,300. Similar spikes affect syringes, bandages, antibiotics, diagnostic consumables, and other everyday medical supplies.

Another HMO executive from emPLE Life Assurance Limited, who requested anonymity, shared similar concerns, noting that the higher costs of plans are driven by rising costs of drugs. He, however, noted that this has not stopped Nigerians from subscribing to HMO.

“Despite the higher costs, many people are still maintaining their subscription plans. When it comes to health, it’s not something you can joke about. In fact, some are upgrading their plans to get better coverage given the economic realities,” he said.

This growing willingness among some Nigerians to maintain or improve their plans coexists with widespread frustration over affordability.

Public concerns: ‘Healthcare Is becoming unaffordable’

The premium hikes have triggered public outcry, with many Nigerians expressing fears that quality healthcare may soon become unattainable for middle-income families.

Fola Famuyiwa, an employee whose organization subscribes to group HMO coverage, told Nairametrics:

“Our company’s HMO can no longer cover the premium package we used to enjoy. They downgraded us to a lower plan, which limits the range of treatments we can access. When my family needs care that isn’t covered, we pay out of pocket.”

A viral TikTok video posted by a Nigerian mother, Bonike, further amplified public sentiments. She lamented the discontinuation of affordable retail plans and the push toward premium-only offerings.

“HMO is ridiculously expensive, and many Nigerians not on corporate plans simply can’t afford it. Good hospitals now want patients to be on premium plans. I’m struggling to find an affordable option.”

Her message sparked significant online engagement, prompting commentary from health advocate and public figure Dr. Aproko Doctor, who called for national dialogue on healthcare affordability.

Impact of NHIA’s major tariff adjustments

A major contributor to the rising premiums is the 93% increase in capitation fees implemented by the National Health Insurance Authority (NHIA) in April 2025.

Capitation fees represent the fixed annual amount HMOs pay hospitals for every enrolled patient.

Under the new structure, capitation increased 93% compared to December 2023, while fee-for-service payments rose 378%, covering procedures and diagnostic services.

NHIA Director-General Dr. Kelechi Ohiri announced the sweeping reforms in February, describing them as the most significant adjustment to provider payments in more than a decade.

These changes pushed the average price of HMO plans from N346,000 in 2024 to approximately N668,000 in 2025.

While the NHIA argues that the reforms are necessary to strengthen provider sustainability and improve service quality, the impact on households—especially self-employed and informal-sector workers—remains substantial.