- Youth drive demand with 71% of consumers aged 30 or younger, using energy drinks for studying, sports, parties, and casual refreshment.

- Fearless leads the market due to affordability, taste, and brand recognition, capturing 44% of consumer preference.

- Health perception and innovation present growth opportunities, as many consumers view energy drinks as healthy despite high sugar content.

Energy drinks are among the fastest-growing soft drink segments in Africa, with Nigeria leading growth at a projected CAGR of 14.1%, well above the continental average.

Traditional energy drinks dominate but are increasingly boosted by health and wellness trends tied to functional beverages.

Despite their high sugar content, many Nigerians still perceive them as healthy—20% of consumers cite this belief when choosing brands.

Youth as the Core Market

Young Nigerians remain the mainstay of energy drink consumption. Survey findings indicate that the majority of regular consumers are below 50 years old, with 71% aged 30 or younger.

Their motivations vary: 43.5% consume energy drinks for alertness when studying, 19.2% for enhanced sports performance, and 16.4% at parties. Another 35% drink them casually, simply treating energy drinks as a soft drink alternative. This diversity of use cases underscores the broad appeal of the product among Nigeria’s youthful, energetic population.

Pricing and Consumer Spending

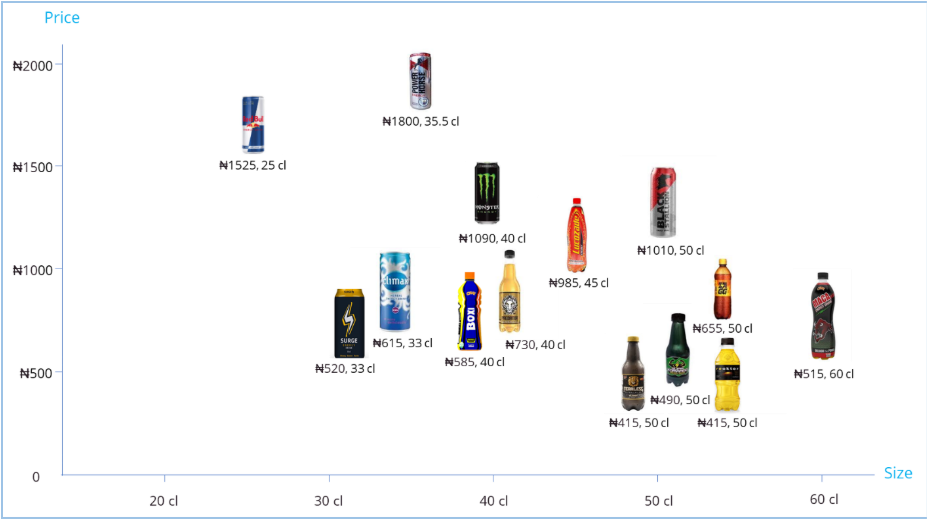

Energy drink prices in Nigeria vary significantly by brand and packaging size, ranging from N415 to N1,800 per bottle or can. The leading brand, Fearless, sits at the lower end of the spectrum, retailing at N415.

Its competitive pricing has been a central strategy for maintaining dominance despite a crowded market. Many new entrants adopt a “more for less” approach, offering larger volumes of 50cl to 60cl at around N500 or less.

Figure 1: Prices of Energy Drinks in Nigeria

On average, Nigerians spend N3,009 on energy drinks—equivalent to six lower-priced bottles or two premium options.

Demographic patterns reveal that parents tend to spend more than non-parents, perhaps reflecting the added demands of family life. Females also spend slightly more than males, further illustrating subtle gendered differences in consumption.

Market Leaders and Brand Preferences

Fearless continues to lead Nigeria’s energy drink market, supported by brand longevity, affordability, popularity, and what many consumers describe as a “great taste.” Despite stiff competition from newer brands such as Predator, Fearless remains the top choice, with 44% of surveyed consumers purchasing it in the week before the study.

Predator follows at 29%, while Power Horse and Bullet register smaller shares of 5.8% and 5.2%, respectively. Collectively, the top 10 energy drink brands account for over 97% of consumer preference, signaling a highly concentrated market where only a few players dominate.

Consumer Loyalty

Brand loyalty is notable but not absolute. Half of energy drink consumers report strong loyalty to a preferred brand, while 26% remain open to experimenting with new options. Product functionality is the strongest driver of loyalty, with 35% citing energy-boosting performance as their top requirement.

Taste follows closely at 25%, while a smaller segment (4%) prioritizes added health benefits such as immunity support. This suggests opportunities for innovation—brands that combine effective energy boosts with health-related claims may capture untapped demand.

Distribution Channels

Energy drinks are widely available across multiple sales outlets, reflecting their positioning as an on-the-go beverage. Supermarkets account for the largest share of purchases (34%), followed by open markets (24%).

Street hawkers play a notable role at 17%, highlighting convenience as a major factor in consumer access. Restaurants and online channels account for smaller shares but represent areas for future growth as retail channels modernize.

Market Outlook

Nigeria’s energy drink market is poised for continued expansion, but future growth will be shaped by evolving consumer expectations. Many buyers already associate energy drinks with health, yet most products in the market do not offer clear functional benefits beyond stimulation.

This gap represents an opportunity for innovation. Brands that introduce natural or organic ingredients, or that fortify products with vitamins, proteins, or immunity boosters, could align more closely with consumer perceptions and aspirations.

As demand rises, both local and international players are expected to broaden offerings—whether through new flavors, healthier formulations, or competitive packaging sizes. For investors, Nigeria’s youthful population, rising urbanization, and growing appetite for functional beverages provide a strong foundation for long-term market opportunities. However, competition is intensifying, making differentiation through price, taste, and added health benefits critical for sustained success.

If you found this analysis insightful, you may also enjoy exploring our other Firmus Advisory deep-dive market reports:

- The Wine Market in Nigeria uncovers consumer trends and growth opportunities in the country’s expanding wine sector.

- The Spirit Market in Nigeria to get a closer look at demand drivers and competitive dynamics shaping this industry.

- The Beer Market in Nigeria to understand market shifts, local preferences, and new openings for investors.

- The Energy Drink Market in Nigeria to explore how lifestyle changes and youth culture are fueling rapid growth.

- The Soft Drink Market in Nigeria to see what’s behind the steady demand and evolving product innovations.

Each report offers data-driven insights to help you make smarter business and investment decisions in Nigeria’s beverage sector.

About Firmus Advisory Nigeria Limited

Firmus Advisory Nigeria offers a comprehensive range of market research services, including market and sector insights as well as customer satisfaction studies. Employing the full set of market research tools (depending on a business’ particular need), we unearth insights that will help you understand a business situation and make insightful and profitable decisions.

Over the years, we have provided research services to several local and international companies and have obtained optimal experiences in the areas of customer experience surveys, market insights and brand tracking studies across multiple sectors.

Email: info@firmusnigeria.com to speak with our market research team or visit www.firmusnigeria.com to learn more about what we do.