CEOs of leading fintechs in Nigeria, including Flutterwave and Paga, have hailed Nigeria’s removal from the Financial Action Task Force (FATF) grey list, calling it a transformative moment for the country’s financial credibility and global investment outlook.

The FATF announced on Friday that Nigeria, alongside South Africa, Burkina Faso, and Mozambique, had been delisted following significant reforms to combat money laundering and terrorist financing.

The move ends nearly three years of increased scrutiny and signals renewed confidence in Nigeria’s financial governance.

Operational and economic impact

Reacting to the announcement, Olugbenga Agboola, CEO of Flutterwave, emphasized the operational and economic impact of the delisting:

“Nigeria’s exit from the FATF Grey List is a massive win for our economy. Flutterwave is Africa’s most licensed non-bank financial institution with 50+ licenses and a massive investment in keeping compliance at the highest standards. This grey listing made cross-border payments and settlements harder and more expensive.

“This delisting restores confidence, lowers remittance and cross-border costs, and unlocks faster, cheaper payments to and from Nigeria. Well done to the Central Bank of Nigeria, the Ministry of Finance, and everyone who made this happen. A strong signal that Nigeria is back on the path of trust, transparency, and financial leadership.”

Tayo Oviosu, CEO of Paga, echoed the sentiment, highlighting the broader economic implications:

“The best news, guys… Nigeria is off the FATF grey list! Congrats to everyone at NFIU, CBN, and the entire financial industry. We worked hard to get here.

This is a big deal because it opens up the country for FDI and engagement from the West, especially.”

Other stakeholders too

Beyond fintech, other stakeholders also expressed optimism. Olusegun Onigbinde, Co-founder of BudgIT, described the development as “very good news,” commending the efforts of the Nigerian Financial Intelligence Unit (NFIU) and civil society organizations.

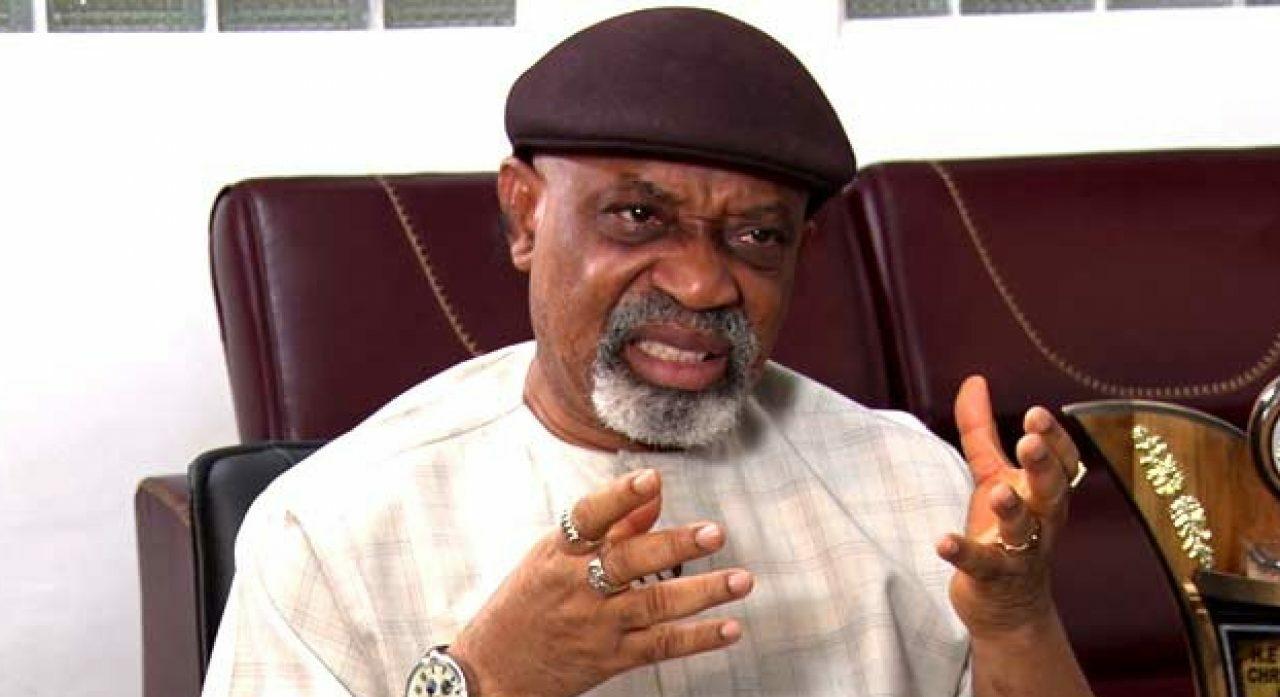

Government officials have also weighed in. Minister of Interior, Olubunmi Tunji-Ojo, stated:

“This significant development reinforces confidence in Nigeria’s economy and validates the effectiveness of the government’s monetary and financial reforms.

The delisting is expected to facilitate smoother cross-border transactions, enhance capital flows and foreign direct investment while laying a solid foundation for sustained economic growth and job creation.”

The FATF’s decision follows coordinated efforts by Nigerian institutions to strengthen compliance frameworks, improve transparency, and align with global standards. Analysts say the delisting will reduce compliance costs, improve access to international finance, and accelerate remittance flows—benefits that are especially critical for fintech platforms and startups operating across borders.

What you should know

South Africa and Nigeria were added to the grey list in February 2023, while Mozambique was added in October 2022, and Burkina Faso was originally designated in February 2021.

- Nigeria’s exit from the FATF grey list represents a confidence boost for its financial system and broader economy.

- Being on the list often increases the cost and complexity of cross-border transactions, as global financial institutions impose tighter scrutiny and compliance checks.

With its removal, Nigeria can expect smoother and cheaper international transactions, including remittance inflows that average around $20 billion annually.