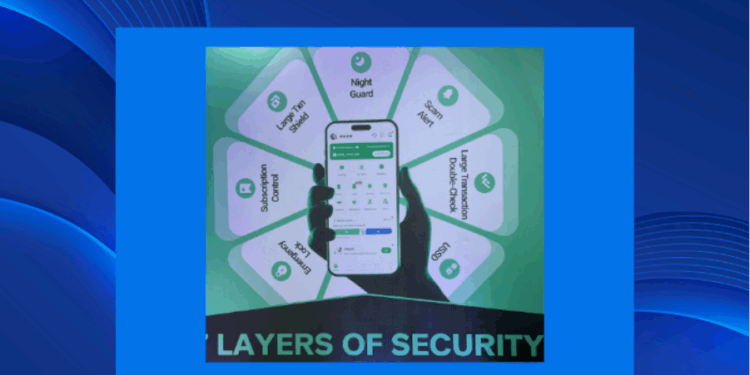

When OPay unveiled a new suite of seven security features last month, it promised to redefine how Nigerians manage digital transactions and protect their funds.

For years, customers of both traditional banks and fintech apps have complained about surprise deductions, fraudulent transfers, and the long delays involved in reversing mistakes.

The new features aim to tackle these challenges head-on. But do they live up to the promise, or are they simply incremental upgrades in an increasingly crowded fintech space?

About the service

The seven security features was launched as part of the #MyOPaySecurityVoteChallenge campaign, which started in August 2025.

These tools came with a clear message from OPay executives. They highlighted that every feature was built in response to real customer pain points, from accidental transfers to recurring online subscription charges.

“The entire process of building this product started with us interacting with the users first. It was about knowing what they wanted, what they needed, what would make their financial life a little easier.

Customers need immediate control over their accounts, whether their phone is lost, their card is compromised, or they face unexpected online deductions,” Elizabeth wang, chief commercial officer of Opay Nigeria, stated.

The features are as follows

USSD lock

USSD Lock is designed for urgent situations when a phone or card is lost or stolen. Users can instantly lock their account or card using a simple USSD code, preventing unauthorized access. Only the account owner can activate this lock, which means even if someone else has the device, they cannot access the funds. This feature gives users immediate control and peace of mind.

- Large transaction shield

This feature targets high-value transfers. Before processing significant payments, users are prompted to verify the transaction through Face ID, fingerprint, or security codes.

By adding this extra layer of protection, OPay ensures that large transactions are secure and that funds cannot be transferred without deliberate user confirmation.

- Emergency lock

Emergency Lock complements USSD Lock by allowing users to immediately freeze their accounts during suspicious activity or theft.

The feature is particularly useful for preventing fraudulent withdrawals or unauthorized transfers, giving users immediate control over their accounts and protecting funds while the issue is investigated.

- Subscription control

Surprise deductions from recurring payments have long frustrated customers. Subscription Control allows users to manage all online subscriptions linked to their cards. When a card is first linked to a platform, OPay notifies the user and gives the option to pause or stop recurring payments. Users can fully control which subscriptions continue and which are halted, eliminating unexpected charges from online merchants.

- Night guard

Night Guard adds extra protection for transactions conducted outside normal banking hours. Late-night transfers require Face ID verification, reducing the risk of unauthorized activity if an account is compromised during off-hours.

This feature targets a common vulnerability for both banks and fintech apps, where fraudulent activity often occurs during low-supervision hours.

- Scam alert

Scam Alert protects users from fraud in real time. OPay maintains a database of suspicious accounts and continuously updates it with new threats.

When a potentially fraudulent transaction is detected, the system can automatically block it or prompt the user with verification steps to confirm legitimacy.

- Large transaction double check

Large Transaction Double Check specifically addresses errors and accidental transfers. For transactions above certain thresholds, users must confirm recipient details, re-enter account information, or even type the recipient’s name to proceed.

If a mistake occurs, the system can immediately freeze the transferred funds and coordinate with the recipient bank to reverse the transaction where possible. This reduces losses from accidental transfers and reinforces user confidence in the platform.

OPay noted that it had to develop an in-house Face ID system tailored for Nigerian users. Unlike standard facial recognition systems that can be fooled with photos, this system requires live verification; users must move, nod, or perform gestures to confirm their identity.

These security features can be seen as a strategic upgrade to its existing financial services, particularly in response to past vulnerabilities.

Nairametrics reported that several OPay agents protested unauthorized withdrawals from their accounts, triggering panic withdrawals among users. Users reported significant unauthorized deductions, including transfers to unknown accounts and purchases made without their consent.

Competing products

OPay is increasingly undermining traditional banks by providing safe, reliable, fast payment services at times when bank apps and USSD platforms are failing. Nigeria’s fintech market is crowded and competitive. OPay also goes head-to-head with rivals like PalmPay, Moniepoint, Flutterwave and Paystack

For many Nigerians, banks have become unreliable with unending app crashes, USSD code failures and delays in transaction confirmations.

While these platforms offer robust payment and wallet services, none provides the same depth of user-controlled security features.

Traditional banks, which rely heavily on in-branch verification and slower dispute resolution, may feel pressure to modernize their systems. Fintech competitors could also face higher expectations from users for fraud prevention and real-time monitoring.

In essence, OPay’s focus on security could reshape customer expectations and push both banks and fintech companies toward more proactive protection measures, potentially disrupting segments of the digital payments and online financial services industry.

Expert opinion

Oluwaseun Oke, an engineering and product manager, fintech solutions architect, and mobile developer, noted that one of the biggest risks OPay faces is system reliability

“Key risks include system reliability, with databases and APIs struggling with sudden spikes.”

He also pointed out the risks tied to OPay’s reliance on third-party providers.

“They can’t own it all. From the third-party provider that helps them send OTPs for ID verification, they have to make sure these partners are capable of handling such growth. I believe they have systems in place to share and balance workload between multiple providers.”

Oluwasegun cautioned that bad actors are finding ways to misuse the companies scam alert feature.

“Some users are exploiting the scam alert feature for revenge. I believe a strict system should be put in place.”

“From what I see currently, they have one of the best systems in place, and all they need to do is scale it as they grow. Where they might have an issue is in talent retention, compliance, regulation or political interference. But for now, they have proved that they have what it takes,” he said

User experiences

To understand how OPay’s features perform in real-world settings, Nairametrics spoke with traders and regular users of the app. Mrs. Annastasia Njoku, a market trader, highlighted one challenge with the facial recognition feature.

“I always have to go on and on with this Face ID feature. They will tell you to turn your head right, left, and even say cheese. This is what I have to do while selling in the market most times,” she said.

Despite this, many users appreciate the security measures. Another user, Isreal Adebayo, noted that the

“The app’s security feature is really amazing. Whenever I want to send an amount that is not usually what I send, they enquire repeatedly and put me through more verification, like fingerprint, face ID and codes.

“They even tell you the network status of the bank you are sending money to, so you know if the bank’s system is down and whether the transaction will go through,” he said.

“Annastasia Ufio uses OPay as a backup for quick transactions, appreciating its reliability even though she remains cautious about app-based operators.

“I don’t fully trust app-based mobile operators because I worry about waking up to news of people losing money unexpectedly. That’s why I only keep a certain amount of funds on OPay, as a backup in case my bank falls short when I need to make a transaction. So far, I’ve never been stranded using OPay,” she said

She added that the verification steps can be frustrating, especially if you make mistakes when entering login details, but she prefers that over the risk of fraud.

“It feels reassuring knowing that if my password is compromised, the app locks me out for 24 hours,” she noted.

Olubukola Ozone shared his experience: “The Scam Alert feature, which warns you when you’re about to transfer money to a flagged account, is a lifesaver. Just last week, it prevented me from falling victim to a scam. Everything about the account looked legitimate, but OPay blocked the transaction. That single moment of caution saved me from losing money, and I’m genuinely grateful,” he said.

- For now, OPay’s new suite of security features represents a strong step toward addressing long-standing challenges in digital transactions. While the tools offer users greater control and protection, their long-term impact will depend on how smoothly they function in everyday use, and how well the company continues to refine them in response to evolving fraud tactics.

Nice reportage