The Federal Government has concluded implementation frameworks for a N4 trillion government-backed bond aimed at settling verified arrears owed to power Generation Companies (GenCos) and gas suppliers.

This was revealed by the Special Adviser to the President on Energy, Mrs. Olu Verheijen, in a statement shared on X (formerly Twitter) on Tuesday in Abuja.

According to the statement, the agreement was reached at a high-level meeting between federal government officials and senior executives of GenCos to review modalities for clearing the outstanding debts.

The statement said the meeting concluded with a consensus on the next steps, including bilateral negotiations to finalise comprehensive settlement agreements that balance fiscal realities with the financial challenges facing the GenCos.

The statement noted, “Approved by President Tinubu and endorsed by the Federal Executive Council (FEC) in August 2025, the plan authorizes the issuance of up to N4 trillion in government-backed bonds to settle verified arrears owed to generation companies and gas suppliers. This intervention, the largest in over a decade, addresses a legacy debt overhang that has constrained investment, weakened utility balance sheets, and hindered reliable power delivery across the country.”

GenCos commend Tinubu

The statement also quoted Generation Company (GenCo) owners commending President Tinubu’s intervention.

Tony Elumelu, Chairman of Heirs Holdings and Transcorp Power said:

“For the first time in years, we are seeing a credible and systematic effort by government to tackle the root liquidity challenges in the power sector. We commend President Tinubu and his economic team for this bold and transformative step.”

Also, Kola Adesina, Group Managing Director of Sahara Group, echoed this sentiment: “This initiative is significant in every respect. It gives us renewed confidence in the reform process and a clear signal that the government is serious about building a sustainable power sector.”

FG says intervention to help close metering gaps

The Special Adviser said that the step would also help in closing metering gaps, aligning tariffs with efficient costs, improving subsidy targeting to support the poor and vulnerable, and restoring regulatory trust.

“The sector is shifting from crisis response to sustained delivery and building the confidence needed to attract large-scale private capital,” she said.

Backstory

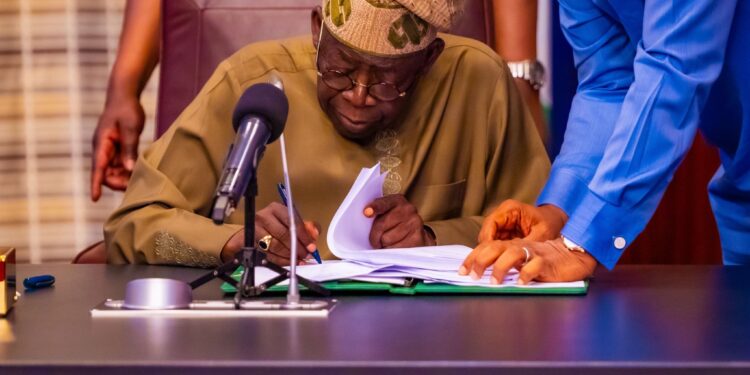

In July, President Bola Tinubu approved a N4 trillion bond initiative aimed at addressing the liquidity shortfall in Nigeria’s power sector.

This follows a meeting between President Tinubu and representatives of power generation companies (GenCos) at the Presidential Villa in Abuja.

President Tinubu reaffirmed his administration’s commitment to resolving the financial challenges bedeviling the sector.

He acknowledged the historical liabilities inherited from previous administrations and assured the GenCos that his government would approach the issue with transparency and fairness.

The Special Adviser to the President, Ms. Verheijen, attributed the liquidity crisis to “a combination of unfunded tariff shortfalls and market shortfalls” that has built up over a decade.

She stated that as of April 2025, the Federal Government is carrying a verified exposure of N4 trillion in debts to GENCOs, an accumulation dating back to 2015.

What you should know

In September, the Bureau of Public Enterprises (BPE) announced plans to list two electricity distribution companies (Discos) and one generation company (Genco) on the Nigerian Exchange (NGX).

The initiative is part of the Bureau’s broader strategy to support President Tinubu’s Renewed Hope Agenda — focused on unlocking value from public assets, driving private investment, and accelerating job creation.