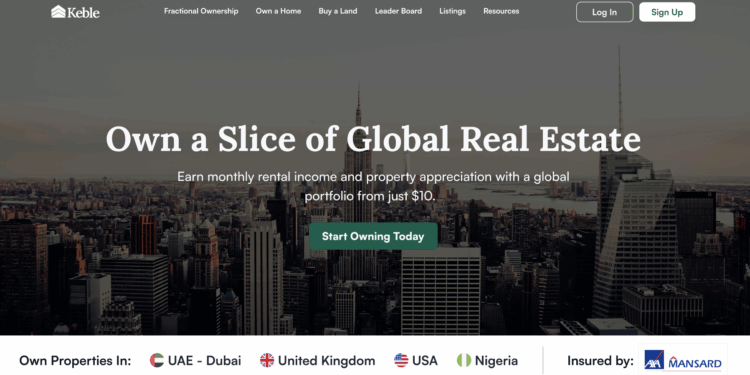

- Keble enables Nigerians and the diaspora to co-own premium properties globally from as little as $10 through fractional ownership, making real estate investment more accessible and scalable.

- The platform has facilitated over 300,000 fractional sales across 70+ properties, delivering up to 30% capital appreciation and rental income, with trusted partners like Mixta Africa and insurance from AXA Mansard.

- Investors can participate in vetted projects across Nigeria, Dubai, the UK, and the U.S., turning remittances into income-generating assets with flexible payment options via the Keble app.

Real estate has long been the preserve of the wealthy, but a Lagos-based proptech startup, Keble, is changing that.

Backed by Techstars and Asset & Resource Management Holding Company (ARM), the company allows Nigerians at home or abroad to co-own properties in Nigeria, London, Dubai, and the U.S. with as little as $10 (N10,000).

The model is simple: fractional ownership. Fractional ownership means you buy a portion or “share” of a property rather than the whole thing. Much like trading apps give everyday investors access to global equities, Keble opens the doors to premium real estate. You co-own with other investors and earn a share of rental income and property appreciation.

Fractional real estate allows you to own premium properties without the high upfront cost, with professional due diligence ensuring the quality and credibility of developers.

Since launch, Keble has onboarded over 30,000 users and facilitated more than 300,000 fractional sales across 70+ properties.

Turning Funds into Income-Generating Assets

Every year, Africans abroad send nearly $100 billion in remittances, with Nigeria alone receiving about $20 billion. While much of this is spent on short-term needs like food, rent, and school fees, research suggests that around 30% of remittances are directed toward property investment — building or buying houses — across Africa.

Experts estimate that up to 70% of real estate investment in Nigeria originates from the diaspora, highlighting their influence in the market.

Whether you live in Nigeria or abroad, Keble makes property investment accessible, transparent, and scalable. Investors can start small, benefit from professionally vetted projects, and grow their wealth through real estate — all without the traditional high entry barriers.

Below are some examples of how investors can participate in real estate through Keble:

- Nigeria: A home worth N120 million may seem out of reach, but with Keble, you can own a piece of it from as little as N100,000. Your stake grows in value as the property appreciates, while also generating rental income.

- Dubai: Properties priced at $300,000+ are split into affordable fractions. With monthly commitments starting from under $500, you can co-own prime Dubai real estate and share in the rental returns.

- UK: Projects like Westminster Point III in Liverpool were opened to fractional investors starting at just $20 per share. Within a year, these fractions delivered an 8% return — proof that you don’t need to own the whole property to start building wealth.

Why Property Belongs in a Portfolio

Globally, real estate is a proven wealth builder. Jeff Bezos owns mansions in Beverly Hills and Manhattan, Bill Gates holds farmland and commercial assets through Cascade Investment, while Larry Ellison famously purchased almost the entire Hawaiian island of Lanai.

Wealth advisors typically recommend 20–30% of a portfolio in real estate for stability, income, and diversification. Yet in Africa, high entry costs have kept most people out. Keble’s $10 minimum reframes property as a realistic choice for ordinary investors at home and abroad.

Flagship Properties Across Africa and Beyond

Keble’s portfolio spans residential, rental, and luxury developments:

- Ibudo Wura, Lagos: A Mixta Africa–developed residential community offering structured rental income.

- Buckingham Apartments, Yaba: A N202 million two-bedroom property co-owned by multiple investors.

- Nove Vacation Rental, Ibadan: A short-let asset in a city where prices have risen 20% in the past year.

- Sky Views, Dubai: A soon-to-launch tower opening up one of the world’s most lucrative markets at accessible entry levels.

In 2024 alone, Keble says its projects delivered 20–30% capital appreciation, in addition to rental income.

Building Trust Into Property Deals

Trust is key when investing in real estate. Keble carefully vets every property and developer, partners with Mixta Africa and other credible developers with strong track records, and provides insurance coverage from AXA Mansard. This ensures all investors, both local or abroad, can grow their wealth with confidence.

“We’re not just selling property; we’re building futures,” says Adebisi Borokinni, Keble’s Co-founder and Head of Operations.

How to Get Started

Investing through Keble is designed to be straightforward:

- Download the Keble app (iOS & Android).

- Fund your wallet in naira, dollars, or pounds.

- Browse co-ownership opportunities across Nigeria, London, Dubai, and the U.S.

- Invest from $10/N10,000 via flexible monthly or lump-sum payments.

Support is available via +234 702 615 0110, hello@keble.co, or www.keble.co.

By lowering the entry point to $10 and embedding safeguards like developer vetting and insurance, Keble is positioning itself as a gateway to global property ownership. If it succeeds, the platform could make investing in real estate as easy as buying a stock and, in doing so, turn Africa’s diaspora remittances into lasting wealth.