Although Nigeria’s drinking culture has long been dominated by beer and spirits, wine is steadily gaining ground as an upscale, healthier, and more sophisticated alternative.

A recent survey found that 7% of respondents consumed wine more frequently than any other alcoholic beverage in the week preceding the study.

This growing acceptance is reflected in an annual market size of about 28,000 metric tons, with most supply imported from France, the United States, Spain, South Africa, and Italy.

Domestic production remains minimal, particularly for grape-based wine, but interest is rising in regions like Jos and Benue, where climatic conditions are more favorable. Locally made fruit wines—derived from mango, pineapple, palm sap, and plantain—remain popular among low-income communities and are often featured at ceremonies.

Traditionally, Nigerian wine consumers have been concentrated in urban centers such as Lagos, Abuja, and Port Harcourt, typically within higher-income groups with strong exposure to global wine trends. However, this profile is shifting as importers expand the market with broader selections at varied price points and alcohol levels. Survey results show that 71% of wine lovers hold at least a university degree, 84% are in the middle- to high-income bracket, and 75% fall between the ages of 20 and 40—reflecting an increasingly young, aspirational consumer base.

Pricing and Spending Patterns

Wine prices in Nigeria vary widely. A standard bottle may cost as little as N4,000, while premium labels can equal a year’s rent in parts of Lagos. This reflects wine’s dual identity as both a luxury beverage and, increasingly, a mass-market option.

To broaden appeal, importers have introduced affordable, low- or alcohol-free variants that resonate with wider audiences. Brands such as Eva and Veleta, priced around N4,000, have successfully attracted cost-conscious consumers seeking alternatives to spirits or beer.

Expenditure on wine also exceeds other alcohol categories. On average, Nigerians spent N11,207 per week on wine in Q1 2024, compared to N7,614 on spirits and N4,123 on beer. Spending patterns vary by demographics: consumers with university degrees spend three times more than average, and females spend about 25% more than males.

Brand Preferences and Loyalty

Nigerians exhibit a strong preference for low-alcohol wines, with brands such as Eva, Pure Heaven, and Veleta commanding significant market share. The Four Cousins label emerged as the market leader in the survey, reflecting its blend of affordability, accessibility, and taste appeal.

Taste is the dominant driver of brand selection, accounting for 60% of consumer choices, followed by perceived health benefits from fruit ingredients, flavor variety (8%), and brand reputation (6%).

Brand loyalty is notable: 60% of surveyed wine consumers regularly purchase the same brand, citing consistent taste and familiarity. Nonetheless, a sizable minority (22%) prefer to experiment with new labels, signaling opportunities for emerging brands to capture market share through innovation in flavor, packaging, and marketing.

Distribution Channels

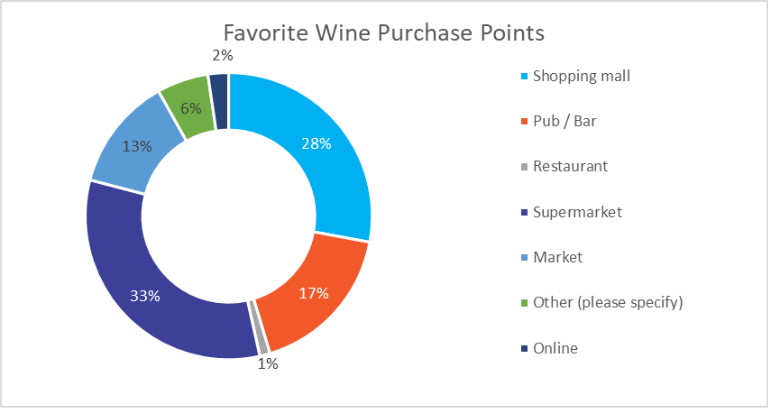

Wine purchases in Nigeria are dominated by off-trade channels, with supermarkets, shopping malls, and specialized wine shops serving as the primary outlets. This reflects changing consumer habits as urbanization and retail modernization expand. For new entrants to the market, establishing strong relationships with modern retail distributors is critical for visibility and sustained sales.

Figure 1: Favourite Wine Purchase Points in Nigeria

Market Outlook

Despite rising popularity, wine consumption in Nigeria is vulnerable to economic fluctuations. Inflation, currency depreciation, and tighter monetary policy have reduced disposable incomes, potentially curbing short- to medium-term growth. For many consumers, wine remains a discretionary luxury rather than a staple.

However, these challenges also present opportunities. Domestic producers who can leverage local raw materials and manage production costs may be able to provide more affordable alternatives to imports. At the same time, high-income consumers are likely to maintain demand for premium and imported labels, creating a dual market structure with space for both low-cost local wines and established global brands.

For investors, success in Nigeria’s wine market depends on timing market entry carefully, targeting the right consumer segments, and aligning offerings with evolving preferences. A well-structured distribution network and clear brand positioning—whether as an affordable lifestyle beverage or a premium luxury product—will be critical in capturing value in this expanding but competitive space.

About Firmus Advisory Limited

Firmus Advisory provides actionable market research that empowers businesses to understand markets, customers, and brands—supporting informed decisions and sustainable growth. From customer insights to market trends, Firmus Advisory turns research into growth strategies that help your business compete and thrive.

If you found this analysis insightful, you may also enjoy exploring our other Firmus Advisory deep-dive market reports:

- The Wine Market in Nigeria uncovers consumer trends and growth opportunities in the country’s expanding wine sector.

- The Spirit Market in Nigeria to get a closer look at demand drivers and competitive dynamics shaping this industry.

- The Beer Market in Nigeria to understand market shifts, local preferences, and new openings for investors.

- The Energy Drink Market in Nigeria to explore how lifestyle changes and youth culture are fueling rapid growth.

- The Soft Drink Market in Nigeria to see what’s behind the steady demand and evolving product innovations.

Each report offers data-driven insights to help you make smarter business and investment decisions in Nigeria’s beverage sector.

About Firmus Advisory Nigeria LimitedFirmus Advisory Nigeria offers a comprehensive range of market research services, including market and sector insights as well as customer satisfaction studies. Employing the full set of market research tools (depending on a business’ particular needs), we unearth insights that will help you understand a business situation and make insightful and profitable decisions. Over the years, we have provided research services to several local and international companies and have obtained optimal experiences in the areas of customer experience surveys, market insights, and brand tracking studies across multiple sectors.

Email: info@firmusnigeria.com to speak with our market research team or visit www.firmusnigeria.com to learn more about what we do.