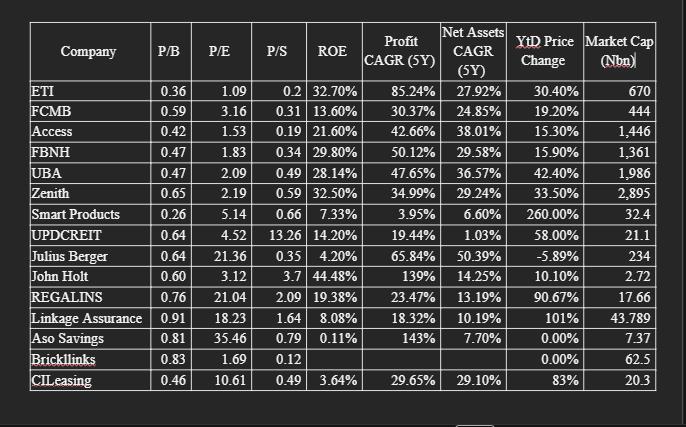

Fifteen Nigerian companies spanning banks, insurers, industrials, and real estate are currently trading below their book value, with an average P/B ratio of just 0.60.

These include Smart Products Nigeria, ETI, Access Holdings, UBA, FirstHoldCo, CI Leasing, FCMB, John Holt, UPDC REIT, Julius Berger, Zenith Bank, Regency Alliance Insurance, Aso Savings, Briclinks Africa Plc, and Linkage Assurance.

On paper, this means investors can buy their shares for less than the value of their net assets.

But does a discount always spell opportunity? For strong banks like Zenith, UBA, and Access, it may hint at undervaluation.

For struggling firms like Smart Products, Julius Berger, and Aso Savings, however, the market may simply be pricing in weakness.

The big question: are these low price-to-book ratio companies hidden bargains, or value traps in disguise?

Why Price-to-book (P/B) ratio matters

The price-to-book ratio compares a company’s market price to its book value (net assets). A ratio below 1.0 suggests investors are paying less than the asset value, which looks like a bargain.

But in reality, such discounts can just as easily signal deeper problems, from weak profitability to overstated assets. That makes P/B both a useful metric and a potential red flag.

Banking sector: Bargains over traps?

From the banking sector, six banks trade at an average P/B ratio of just 0.49x. Given their strong fundamentals and consistent earnings, they appear more like bargains than traps.

Over the past five years, these banks have delivered an average profit CAGR of 48%, net asset CAGR of 31%, and ROE of 26%.

Zenith Bank has been growing its profit steadily at about 35% every year (CAGR) over the past five years. Its net assets have also increased by 29%, showing that the bank is stronger financially.

The stock itself has done well, rising 33.5% this year, and analysts mostly recommend it as a BUY.

Despite this rally, it still trades at just 0.65 times its book value, meaning investors are paying only 65 kobo for every N1 of the bank’s net assets.

- FCMB Group Plc: Profit CAGR of 30% and asset growth of 25%. Analysts are overwhelmingly positive, and the share is up 19% YtD. A solid bargain.

- Ecobank Transnational Inc: The steepest discount (0.36x P/B) but also the fastest growth: 85% profit CAGR and ROE of 33%. Up 30% this year, it looks like a bargain hiding in plain sight.

- Access Holdings Plc: Profit CAGR of 43% and net assets up 38%. Modest YtD gains (15%), but the fundamentals suggest more upside.

- FirstHoldco Plc: Profit CAGR of 50% and ROE of nearly 30%. With only 16% YtD gains, it looks overlooked and still cheap at 0.47x book.

- United Bank for Africa: Profit CAGR of 48%, ROE of 28%, and the stock up 42% this year. Even after the rally, it still looks undervalued.

Non-Banks: More traps than Bargains

Outside banking, the picture is murkier. Many companies trade at discounts, but their fundamentals don’t back the low multiple.

- Smart Products Nigeria: share price is up 260% this year, yet profits and sales barely grew in five years. The rally looks speculative, making this a value trap.

- UPDC Real Estate Investment Trust: Price up 58% but assets hardly moved. Likely investors chasing yield, not real growth.

- Julius Berger Nigeria Plc: Strong asset growth but thin profits and a falling share price. Size doesn’t equal value.

- John Holt Plc: Huge profit growth and high ROE, but the market hasn’t noticed yet. One to watch.

- Regency Alliance Insurance & Linkage Assurance: Both surged in price this year, but profitability lags. Valuations look stretched, suggesting overheated trades rather than bargains.

- Aso Savings and Loans: Almost no real profit despite flashy “growth” numbers. The stock hasn’t moved this year. Clear trap.

- C&I Leasing Plc vs. Bricklinks Africa Plc: Both trade at discounts, but C&I Leasing plc stands out. With steady asset growth and an 83% rally this year, the market seems to be recognizing its turnaround story. Bricklinks Africa Plc, by contrast, has shown no growth and no price movement — nothing to cheer about.

Overall, cheap doesn’t always mean good. For Nigeria’s big banks, low valuations are an opportunity they’re delivering strong profits and growth yet still trade at a steep discount.

For most non-bank names, however, the discounts mask weak earnings and poor returns, making them more trap than treasure.