In recent years, the Nigerian investment landscape has undergone a quiet revolution. Gone are the days when buying stocks meant physically visiting a stockbroker’s office, filling out forms, and waiting days for trade execution.

Today, thanks to technology and the growing appetite for financial inclusion, a new breed of mobile apps has put the Nigerian Exchange (NGX) and even global markets in the palm of your hand.

These stockbroking apps are not only changing how Nigerians invest but also who gets to invest.

With entry points as low as N1,000 or even $1, everyday Nigerians, from university students and young professionals to retirees, are building stock portfolios alongside traditional institutional investors.

They combine the regulatory backing of licensed brokers with the ease and accessibility of fintech, creating an environment where retail investors now account for a larger share of daily trading volumes on the NGX.

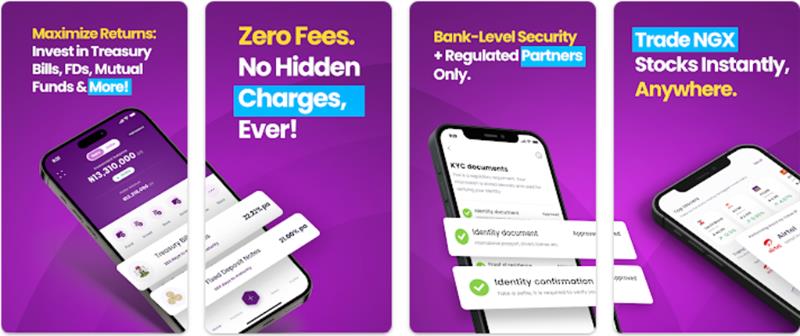

What makes them even more appealing is their versatility. Many of these apps now go beyond just buying and selling shares. They offer fractional investing, so you don’t need to buy a whole share, real-time price updates, curated investment plans, dollar-denominated portfolios, and even the ability to buy foreign stocks from the U.S., Europe, or Asia all without leaving your living room.

Whether you’re aiming to grow wealth through long-term investments, diversify with international assets, or take advantage of short-term market opportunities, there’s an app tailored to your needs.

But with so many options in the market, it can be overwhelming to decide where to start.

In this article, we have compiled a list of the top 5 stockbroking apps ranked based on their number of downloads on the Google Play Store and their user rating.

The Trove app allows Nigerians to invest in Nigerian stocks, U.S. equities, ETFs, mutual funds, and government bonds, all with fractional shares starting at N1,000 or $10 through its fractional investing.

For Nigerian stocks, Trove works through Sigma Securities, which is registered with both the SEC and NGX. For U.S. investments, they use Trove Investment Advisers, LLC, a company registered with the U.S. SEC. Additionally, your U.S. account is protected by SIPC insurance, which covers up to $500,000.

On Google Play Store, the app has been downloaded over 100,000 times, and it’s rated 4.5 out of 5 by users.

Bamboo is the best in this list. Once your account is activated, your CSCS and CHN are created. You have to be very careful of the others except maybe i-invest that’s registered with the SEC. But can’t say much since I haven’t used it.