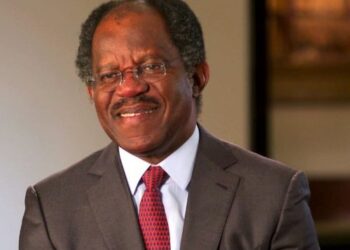

The Governor of Anambra State, Charles Soludo, has once again expressed his strong support for President Bola Tinubu’s bold economic reforms aimed at stabilising and reviving Nigeria’s economy, noting that his administration is taking the right steps.

This was made known by Governor Soludo while speaking to State House correspondents after meeting President Tinubu on Tuesday, August 12, 2025, at the Presidential Villa, Abuja.

Soludo, who was a former Governor of the Central Bank of Nigeria (CBN), emphasized on the urgency of structural reforms to accelerate national development.

He said his support for Tinubu is beyond party lines because the reforms aim to return Nigeria to a sustainable growth path.

I support the president

Soludo said, “The President is in high spirits, hale and hearty. It was a pleasure meeting him; indeed, it was quite a pleasant meeting. President Tinubu is my friend; we have been friends for 22 years, so you don’t deny your friend.

“I support him and commend his bold steps, especially in the economy and structural reforms. I have said severally we’re taking the right steps.”

Soludo also discussed his administration’s strategy to curb insecurity in Anambra.

“We are approaching insecurity comprehensively, using both kinetic and non-kinetic approaches. The kinetic involves guns and the usual. The non-kinetic focuses on youths, empowerment, and job creation,” he said.

Meanwhile, the presidency, in its reaction to the meeting between President Bola Tinubu and Governor Soludo at the Aso Villa, Abuja, said their discussions focused on deepening economic reforms, strengthening security through kinetic and non-kinetic approaches, and expanding opportunities for social and human capital development.

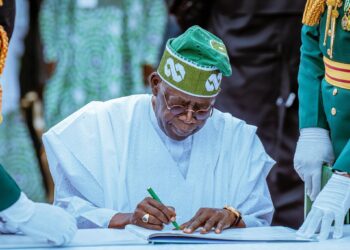

The President reaffirmed his commitment to partner with all states that demonstrate seriousness in driving human, social, and economic transformation, noting that Nigeria’s progress is best achieved through unity of purpose and shared responsibility.

President Tinubu, in a statement on his official X account, said, ‘’It was a pleasure to welcome my friend of over two decades and the Governor of Anambra State, Governor Charles Soludo, to the Aso Villa yesterday.

‘’We share a firm belief that all who profess progressivism must work together to deepen our democracy, strengthen security, and transform our economy.

‘’We discussed the bold reforms underway, the need to stay the course, and the importance of tackling insecurity through both decisive action and inclusive opportunities for our teeming youth.

‘’Our administration will continue to partner with every state that is serious about human, social, and economic development because Nigeria’s progress is strongest when we work together.

‘’We will continue to take a bet on our dear country, Nigeria, to ensure sustainable and shared prosperity for the future.’’

What you should know

Recall that earlier in May 2025, President Tinubu visited Anambra State to commission some projects executed by the state governor, Charles Soludo.

The projects commissioned by Mr Tinubu included the new Anambra State Government House, Solution Fun City, and the new Governor’s Lodge.

That was the first time Mr Tinubu would be visiting Anambra State since he was sworn in as Nigeria’s President on 29 May 2023.